SPECIAL COVERAGE

Read More

Read More

Arizona Senate Approves Repeal of Near-Total Abortion Ban

Gov. Katie Hobbs has vowed to sign the bill.

Arizona Senate Approves Repeal of Near-Total Abortion Ban

Gov. Katie Hobbs has vowed to sign the bill.

Top Premium Reads

Top Stories

Most Read

House Passes Anti-Semitism Bill Amid Campus Unrest

The bill will establish ‘that if you are engaged in rhetoric and behavior that is anti-semitic, there’s going to be consequences,’ says GOP Rep. Mike Lawler.

Blinken Meets With Netanyahu Amid Gaza Ceasefire Push, Deliberations on Israeli Offensive in Rafah

“We are determined to get a ceasefire that brings the hostages home and to get it now, and the only reason that that wouldn’t be achieved is because of Hamas.”

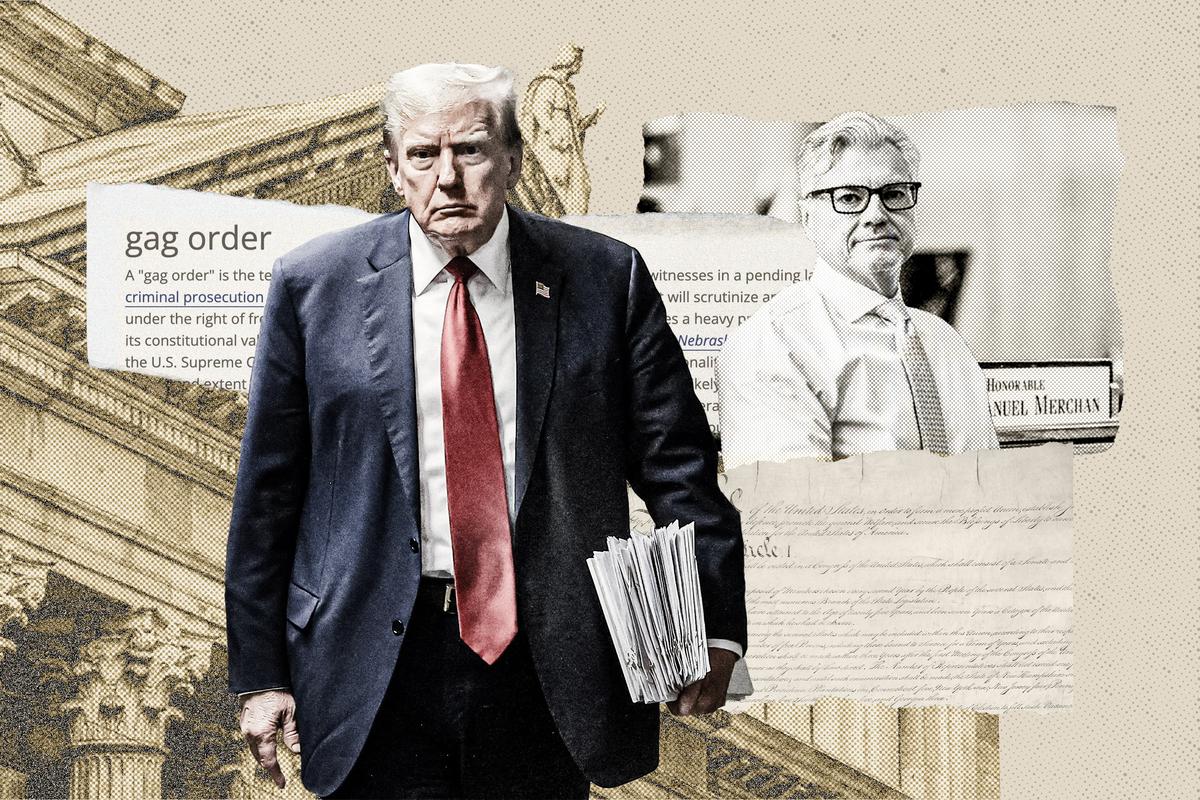

House GOP Probes Links Between Biden DOJ and Top Bragg Prosecutor in Trump Trial

‘A former senior Biden Justice Department official is now leading the prosecution of President Biden’s chief political rival,’ Jim Jordan wrote.

Border Patrol Braces for Illegal Immigrant Surge as Cargo Train Travels Through Mexico

‘They have created a conveyor belt into the United States.’

Pentagon Says Hamas May Attack US Troops Building Gaza Pier

Concerns of U.S. troops getting caught up in the Israel-Hamas war comes days after an alleged mortar attack caused damage to the maritime dock.

Fed Leaves Interest Rates Unchanged as ‘Inflation Risks’ Persist

Fed Chair Powell says his confidence in inflation moving back down is lower than before.

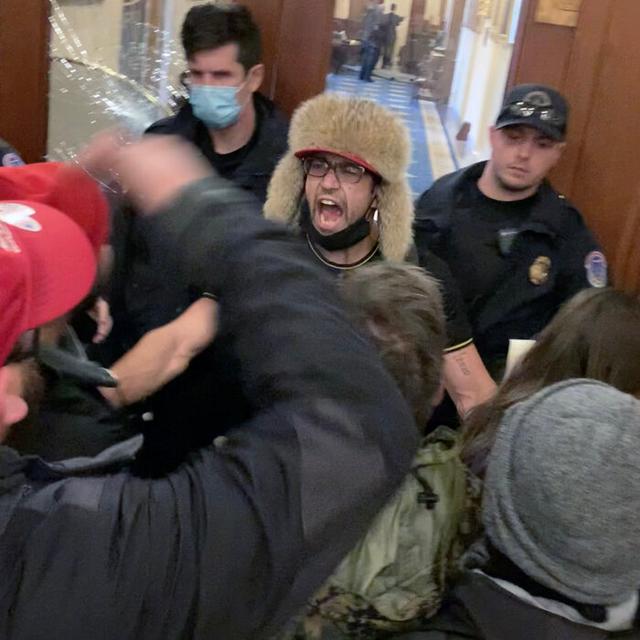

Violent Clash Breaks Out Between Pro-Palestinian Activists and Counter-Demonstrators on UCLA Campus

At around 2 a.m. local time, the LAPD announced its officers had arrived to assist campus police in dealing with the fighting.

Police, College Officials Say Campus Clashes Stoked by ‘Outside Agitators’

Counter-demonstrators battle pro-Palestinian protesters at UCLA as police evict groups from buildings and encampments in New York, Wisconsin, and Arizona.

NYC Mayor Eric Adams Says Outsiders Led Escalation in Protests at Columbia University

‘Young people are being influenced by those who are professionals at radicalizing our children,’ Mr. Adams said.

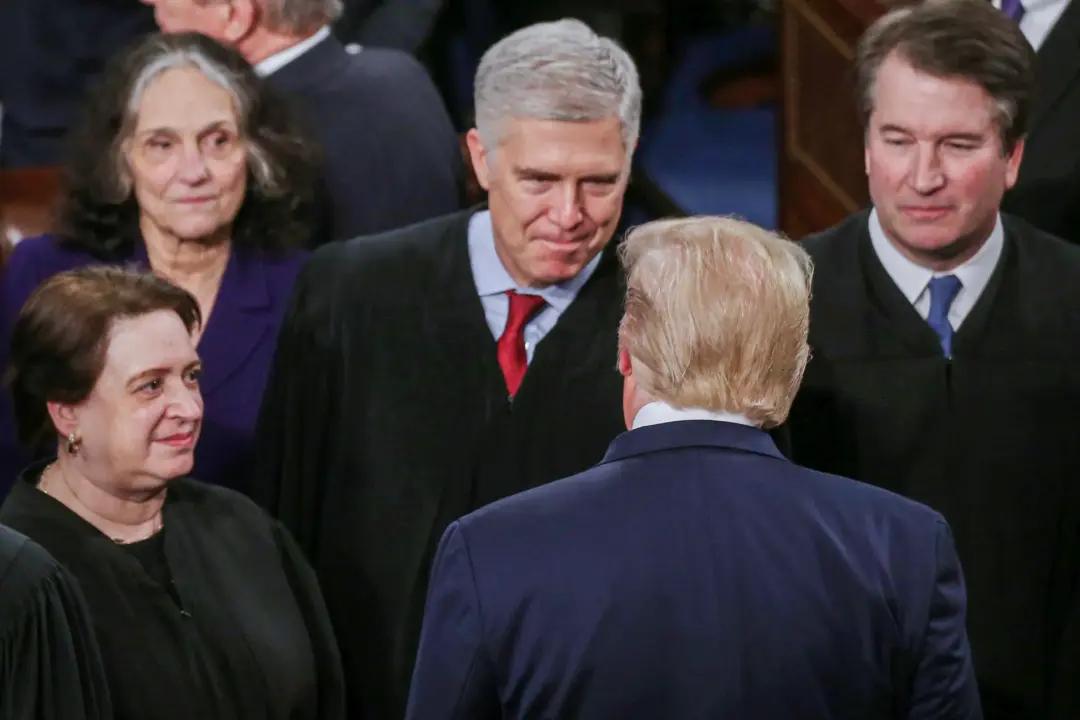

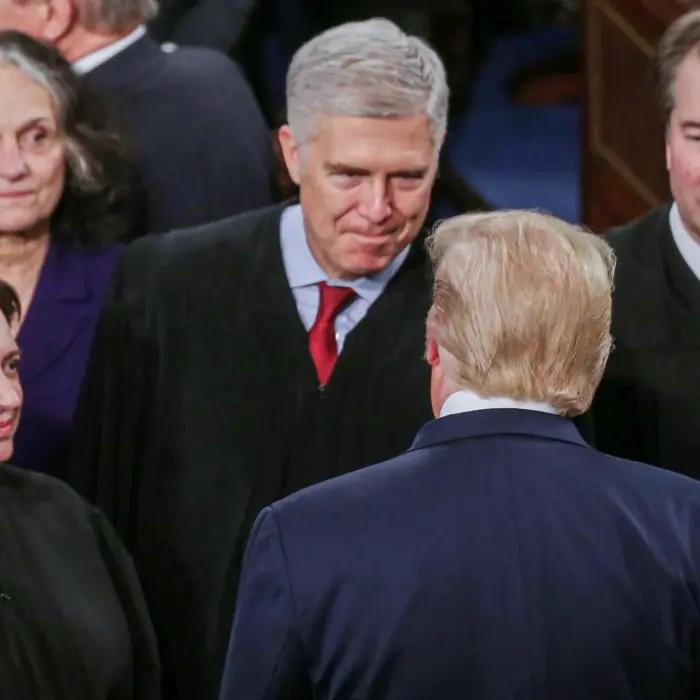

Supreme Court Justice Gorsuch Issues Caution During Trump Hearing

‘We’re writing a rule for the ages,’ he cautioned last week.

Pipeline Maker Sues Midwest Carbon Capture Developer Over Order Cancellation

Welspun Tubular accuses Summit Carbon Solutions of breach of contract over a $182.5 million purchase agreement for more than 4.1 million feet of pipe.

Trump Lays Out Plan for Second Term in TIME Interview

President Trump said on day one of his second term he would take aggressive action over illegal immigration.

Republican Committee Chairs Vow Congressional Response to College Protests

‘We will not stop until we get answers, until Jewish students can feel safe, and until these universities are held accountable,’ Rep. Jason Smith said.

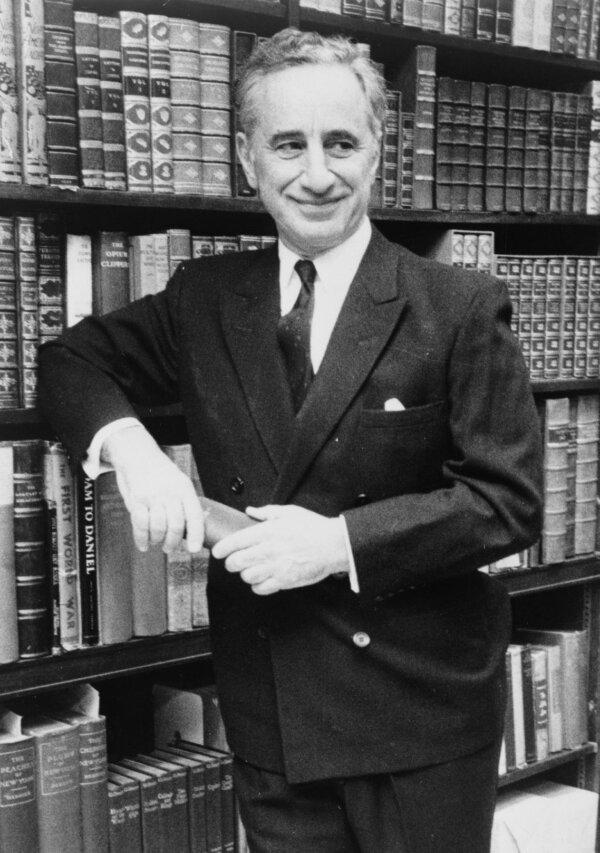

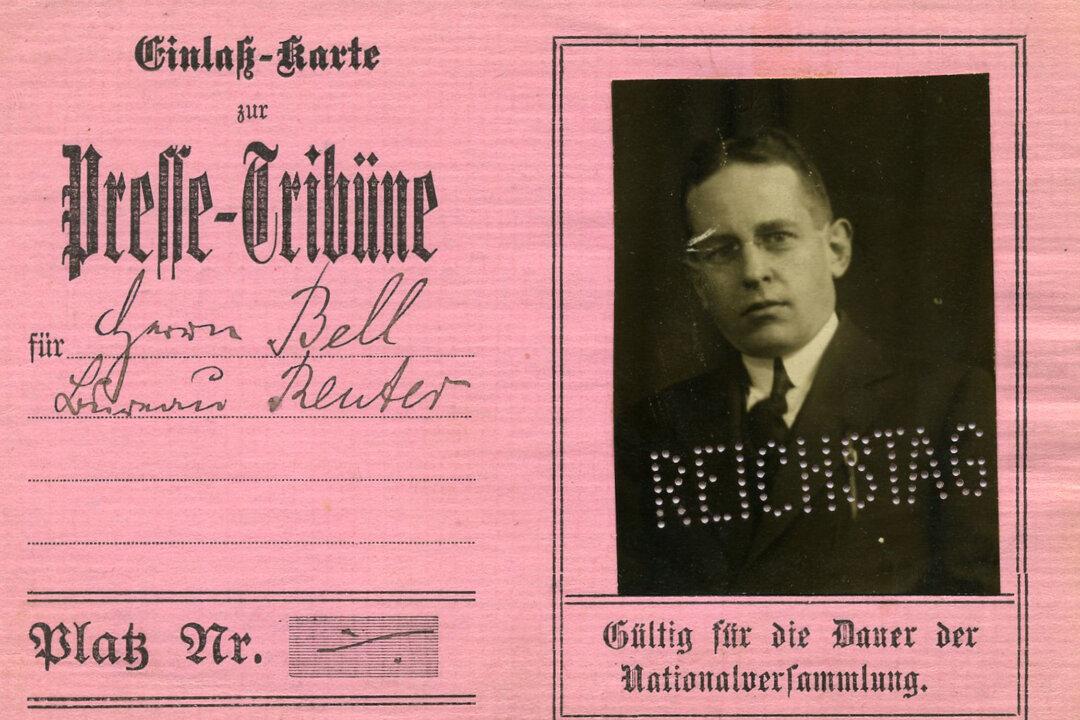

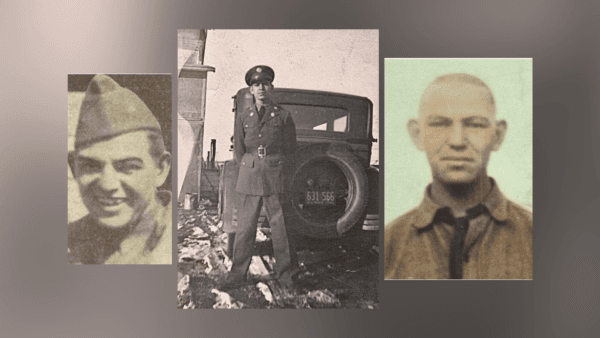

Why an Unknown Spy May Have Been History’s Greatest

A young Canadian philosopher turned British spy infiltrates post-WWI Berlin with astounding results in ‘Cracking the Nazi Code.’

Why an Unknown Spy May Have Been History’s Greatest

A young Canadian philosopher turned British spy infiltrates post-WWI Berlin with astounding results in ‘Cracking the Nazi Code.’

Epoch Readers’ Stories

A History Of The American Nation

A patriotic poem by Ted Schneider

Of Cars and Kids

Why should our kids have to settle for a Trabant, or a Pyonghwa, education when they could have a BMW?

A Nation Divided

Poem by an American Patriot

What Is Going on Here?

There are two major things plants need to survive and continue generating our life saving oxygen. The first is CO2, and the second is sunshine.

Inspired Stories

Empower the World with Your Story: Share Love, Inspiration, and Hope with Millions

Special Coverage

Special Coverage

The Asian Fascination With Cherry Blossoms, Explained

These delicate, ephemeral blossoms symbolize profound values.

‘Bartleby the Scrivener’ and Ingratitude

The essence of a progression toward deeper ingratitude is Bartleby’s characteristic words: “I prefer not to.”

Veterans Find Healing and Renewed Purpose Through Program That Teaches Them To Become Farmers

Archi’s Institute for Sustainable Agriculture in California teaches all aspects of how to farm and build a successful business.

‘Jim Thorpe, All-American’: An Olympic Athlete and More

Burt Lancaster gives a strong performance in a finely crafted production about a great American hero.

The Asian Fascination With Cherry Blossoms, Explained

These delicate, ephemeral blossoms symbolize profound values.

Wine-Food Pairing

Fewer restaurants are giving diners the guidance they need—leaving diners to do the research themselves.

Surprises Await Off Washington’s Major Highways

The first people of the land named it, “the shimmering heat waves which dance and play above the prairie when the summer sun shines hot.”

Universal Unwraps Some Details for 2 Epic Universe Hotels

Two resorts by Universal Orlando are scheduled to open in 2025.

San Diego County Museums Worth a Trip

Learn about surfing, artwork, music, and more at various museums in San Diego county.

Surprises Await Off Washington’s Major Highways

The first people of the land named it, “the shimmering heat waves which dance and play above the prairie when the summer sun shines hot.”

![[PREMIERING MAY 9, 8:30PM ET] Weapons of Mass Migration | NEW Documentary](/_next/image?url=https%3A%2F%2Fimg.theepochtimes.com%2Fassets%2Fuploads%2F2024%2F04%2F30%2Fid5640415-1920x1080-no-epochtv.jpg&w=1200&q=75)

![[PREMIERING MAY 9, 8:30PM ET] Weapons of Mass Migration | NEW Documentary](/_next/image?url=https%3A%2F%2Fimg.theepochtimes.com%2Fassets%2Fuploads%2F2024%2F04%2F30%2Fid5640415-1920x1080-no-epochtv-1080x720.jpg&w=1200&q=75)

![[PREMIERING MAY 9, 8:30PM ET] Weapons of Mass Migration | NEW Documentary](/_next/image?url=https%3A%2F%2Fimg.theepochtimes.com%2Fassets%2Fuploads%2F2024%2F04%2F30%2Fid5640471-900x1350-600x900.jpg&w=1200&q=75)

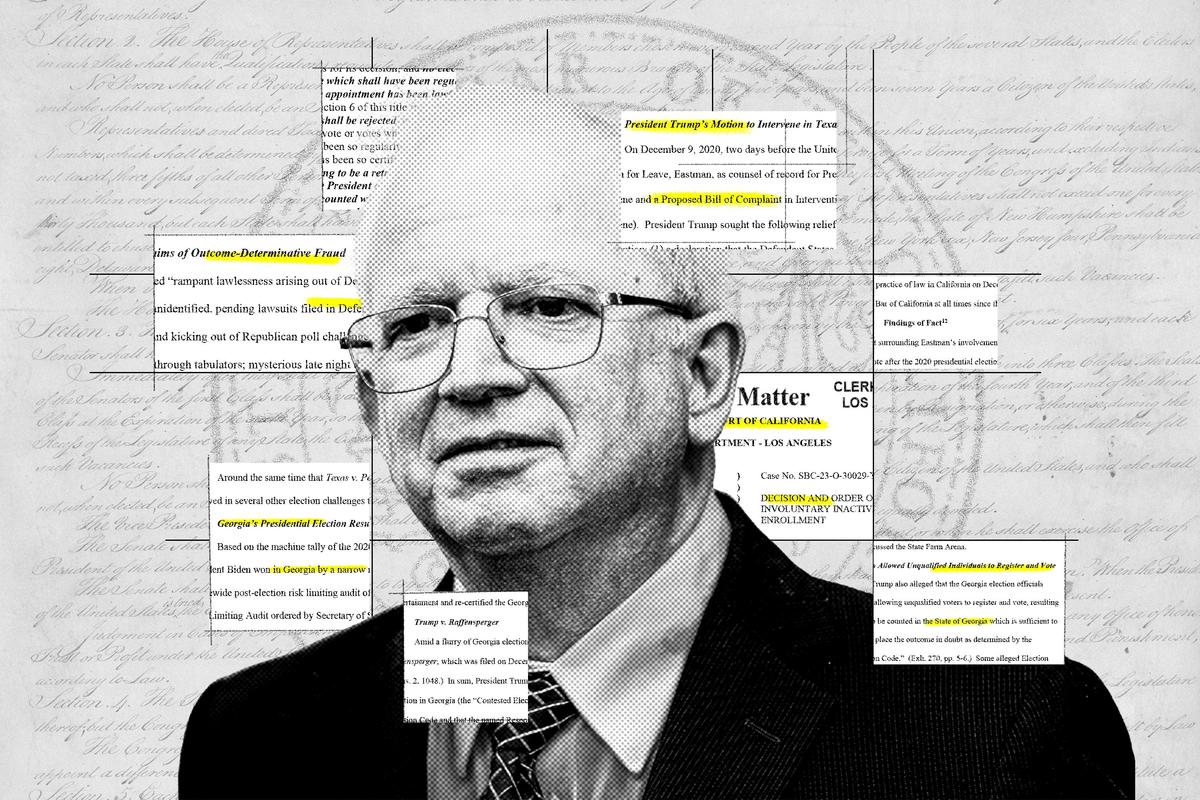

![[LIVE Q&A 05/02 at 10:30AM ET] New Group of Dueling Electors Indicted by Biden Admin, Termed ‘Fake Electors’](/_next/image?url=https%3A%2F%2Fimg.theepochtimes.com%2Fassets%2Fuploads%2F2024%2F05%2F01%2Fid5641589-CR-TN_REC_0502-600x338.jpg&w=1200&q=75)