Retirement Planning is the most complex chapter in this book, incorporating all of the prior topics, several very complex additional topics, and linking closely to estate planning.

Let’s explore income generation from investing first. A gradual change in portfolio composition—your risk-return profile—along with a specific component that matches guaranteed-to-pay-out expenses to guaranteed income (pension, Social Security, and annuities) is crucial. Let’s start with how non-guaranteed income sources can fail.

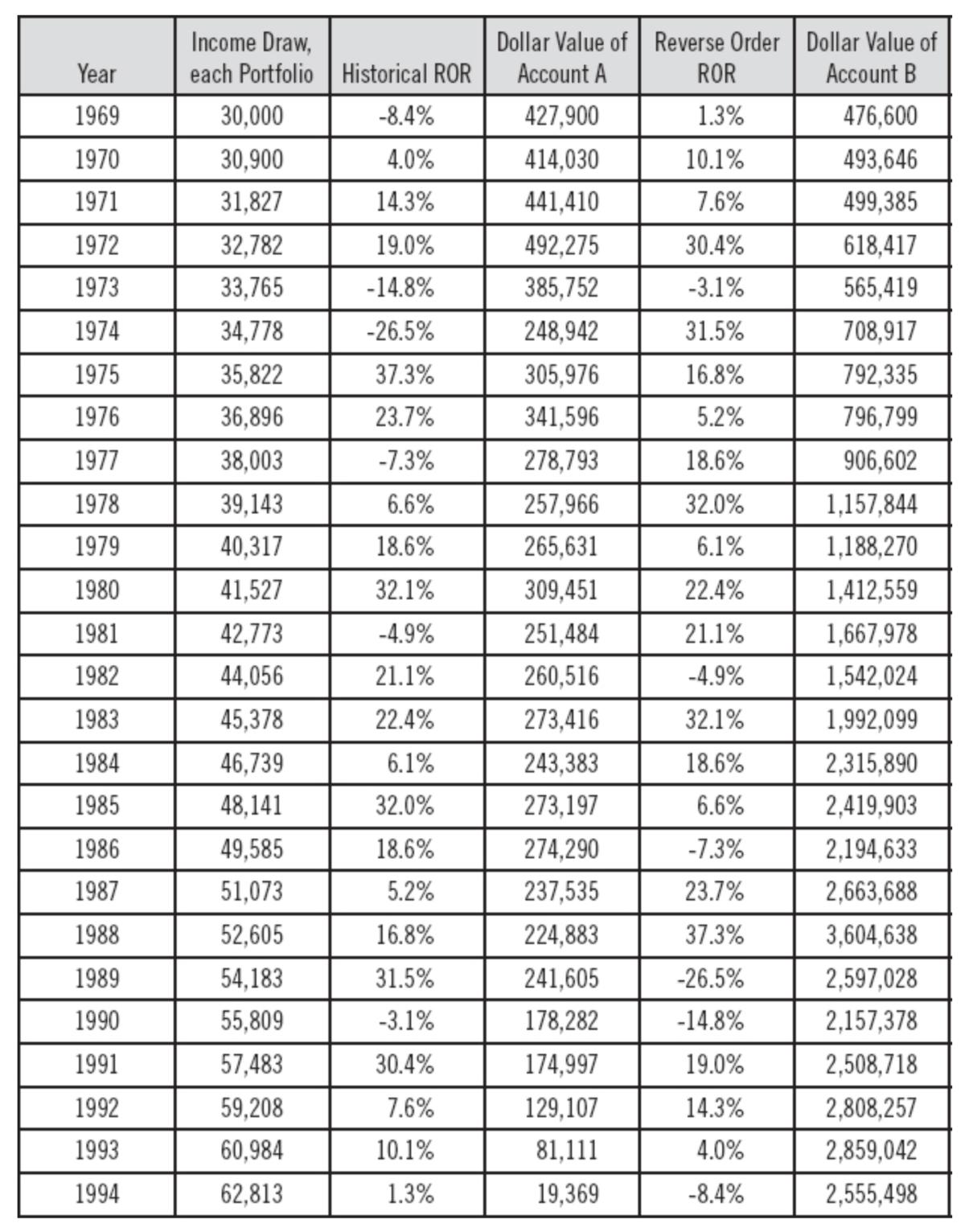

The Order of Returns and Losses

Most people assume that some conservatively estimated rate of return for a portfolio, coupled with a conservatively set withdrawal rate, will result in success in the same way a long- term stock portfolio (e.g., the S&P 500 index) is successful. They assume the portfolio cannot be exhausted with a low withdrawal rate and a high average rate of return. But this is far from true. The chronological order of losses and gains (returns) makes a dramatic difference in success. The following table shows two hypothetical $500,000 portfolios. Each has an identical average rate of return at 11.3% and runs twenty-six years. The income draw is identical, starting at 6% of portfolio value and inflating 3% annually. The only difference between the two is that B has the sequence of returns reversed. While this illustration can work with any time frame and set of returns (hypothetical or real), I picked the starting year of 1969 in order to show a modest loss in the first year and to avoid the anomalous gains and losses of the last quarter century.

By 1994, Portfolio A cannot support the income draw and Portfolio B has almost 132 times the remaining balance, even though the average rate of return is 11.3% for each and the draw is the same! Now, consider that a big withdrawal early in retirement can have the same effect as an early market loss insofar as value is lost (shares are sold off, etc.) when a big withdrawal for that dream vacation (or whatever imprudent treat) is made. So, the lesson is this: In your planning, avoid professionals whose models are not based upon modern portfolio theory (i.e., no Monte Carlo simulations, the recommended portfolios are not on the efficient frontier, and quarterly rebalancing is not done to keep them there).

This leads to an investment maxim credited to Warren Buffett: “Rule No. 1: never lose money; rule No. 2: don’t forget rule No. 1.”