R | 1h 50m | Documentary, Crime | 2005

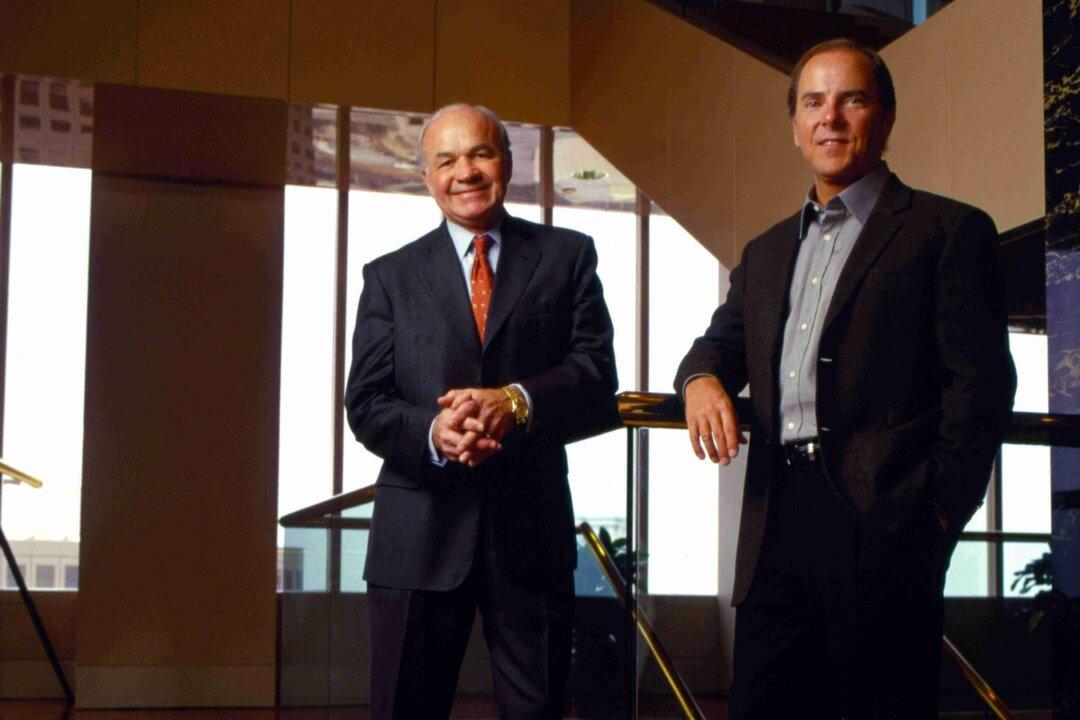

Written for the screen by director Alex Gibney, “Enron: the Smartest Guys in the Room” is based on the bestselling book of the same name by then Fortune magazine contributors Bethany McLean and Peter Elkind.

Written for the screen by director Alex Gibney, “Enron: the Smartest Guys in the Room” is based on the bestselling book of the same name by then Fortune magazine contributors Bethany McLean and Peter Elkind.