By Lisa Gerstner

From Kiplinger’s Personal Finance

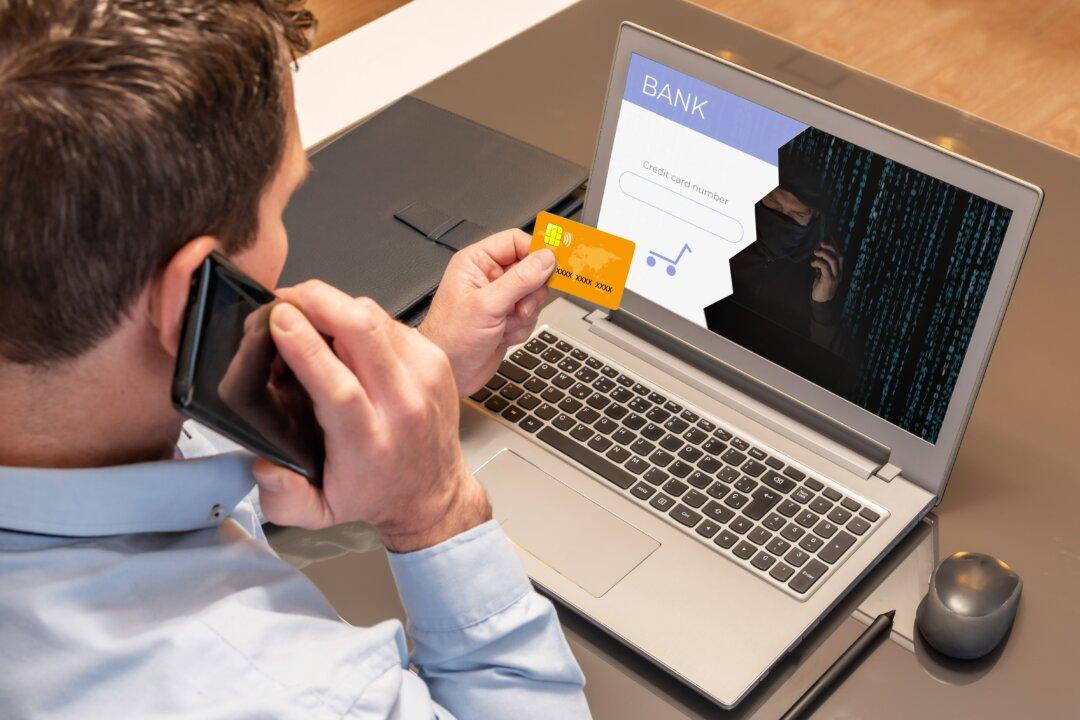

The number of publicly reported data compromises in the United States surged last year, reaching 3,205, according to the Identity Theft Resource Center’s 2023 Data Breach Report. That’s a 78 percent increase from 2022 and a 72 percent rise from the previous all-time high, of 1,860, in 2021.