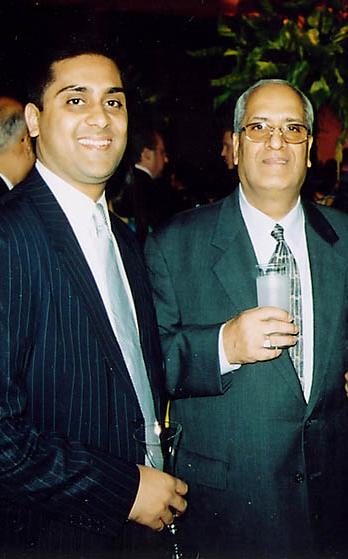

Indian and Himalayan arts are close to Suneet Kapoor’s heart. He is the latest generation of Kapoors to specialize in museum-quality Indian miniature paintings and Himalayan statuary.

Kapoor Galleries is a family business founded in 1975 by Ramesh and Urmil Kapoor. After studying Indian art at the School of Oriental and African Studies, Suneet is carrying on the family tradition.

Below, he offers his insights to investors and those new to Asian art.

How would a new investor get started?

Visit galleries, museums, and talk to experts in their respective fields. As with anything, one should invest time and energy before taking the plunge and beginning collecting of any sort.

Luckily, there will be many experts in various fields of Asian art on hand during Asia Week New York, as well as the breadth of expertise available at the numerous highly renowned cultural institutions in the area.

What is an example of a piece of art and a price you would recommend?

I would recommend a lovely Indian miniature from the Pahari Hills, created in the 18th century, as these are becoming harder to find and exemplify the zenith of Indian miniature painting. Price of course depends on the quality, condition, and rarity of the work; that is, is it from a rare loose-leaf manuscript or from a series of paintings which were widely dispersed in the art market?

We focus on the classical and ancient arts of India, Nepal, and Tibet. The overwhelming majority of works from our specialty are done by anonymous artists.