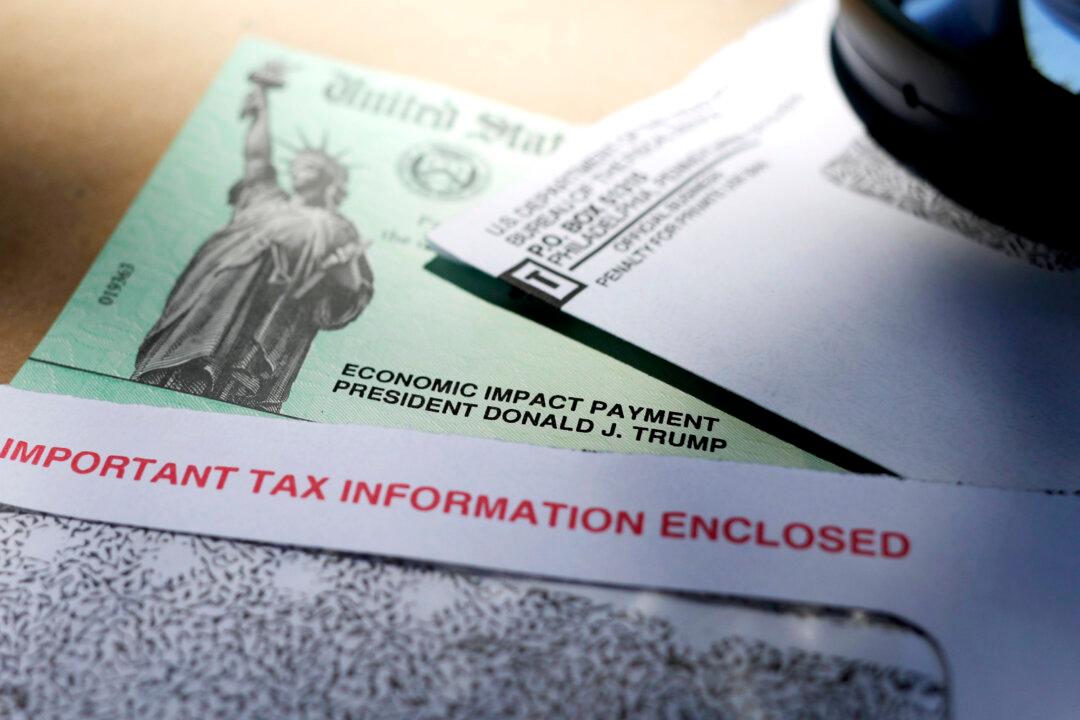

The final stimulus checks in California are currently being sent out. Distributing the money started in October when it was sent via direct deposit. The program is called the Middle Class Tax Refunds (MCTR), and recipients will receive between $200 and $1,050.

The reason for the California state stimulus checks is to help residents cope with high inflation occurring across the nation. It is a one-time payment, and they should all be made between October 2022 and January 2023, says the California Franchise Tax Board (FTB)—the agency responsible for distributing the money.