Industrials

Latest news about industrials and economic policies.

Industrials | LATEST STORIES

IMF Says China’s State-Led Growth Model Is Hurting Other Economies, Calls For Subsidy Cuts

The IMF says China’s export-driven growth and state support are widening trade imbalances and increasing pressure on global partners.

|

Rare Earths Climb Above US Price Floor Given to MP Materials

Shares of MP Materials rose by almost 2 percent at the end of the Feb. 18 trading session.

|

US Factory Output Jumps, Core Capital Goods Orders Signal Solid Business Investment

Stronger manufacturing production and rising equipment orders point to a tentative rebound in U.S. industrial activity.

|

Freight Data Indicate Early US Industrial Rebound as Midwest Truck Volumes Jump

Analysts say freight activity tends to turn ahead of broader industrial indicators, as manufacturers move inputs and finished goods before investment and hiring

|

Rio Tinto, Glencore Abandon Merger Talks for 3rd Time

Both firms maintain offices in the United States and are actively involved with American businesses.

|

Google to Double Capital Expenditure, Highlighting Broader US Investment Surge

Alphabet said it expects capital spending to surge this year to between $175 billion and $185 billion, more than double its 2025 outlays.

|

Small Water Systems Vulnerable to Cyberattacks, Operators and Experts Warn

A U.S. Senate panel was told that rural districts can’t reliably thwart sophisticated electronic sabotage—and that ‘bad actors’ know it.

|

Rubio Hosts Critical Minerals Summit as US Pushes to Secure Commodities Outside of China

The push follows Trump’s launch of a strategic minerals stockpile aimed at insulating U.S. manufacturers from geopolitical supply shocks.

|

Top Diplomats to Head to Washington for Critical Minerals Summit

Ministers head to the inaugural Critical Minerals Ministerial as allies seek to counter China’s dominance in rare earths and strategic metals.

|

US Factory Output Rises to Near 4-Year High as Manufacturing Rebounds

Two manufacturing surveys point to improving business conditions and stronger factory activity at the start of 2026.

|

Electric Vehicles Outsell Gasoline Autos in EU for First Time

Chinese company BYD saw a 229 percent rise in vehicle registrations in December 2025, while U.S.-based Tesla fell by 20 percent.

|

Century Aluminum to Construct 1st US Aluminum Plant in More Than 40 Years

The project is expected to create 5,000 direct and construction jobs.

|

House Votes to Overturn Minnesota Mining Ban, Sending Bill to Senate

Reversing the ban will protect jobs and strengthen national security, Rep. Pete Stauber (R-Minn.) said.

|

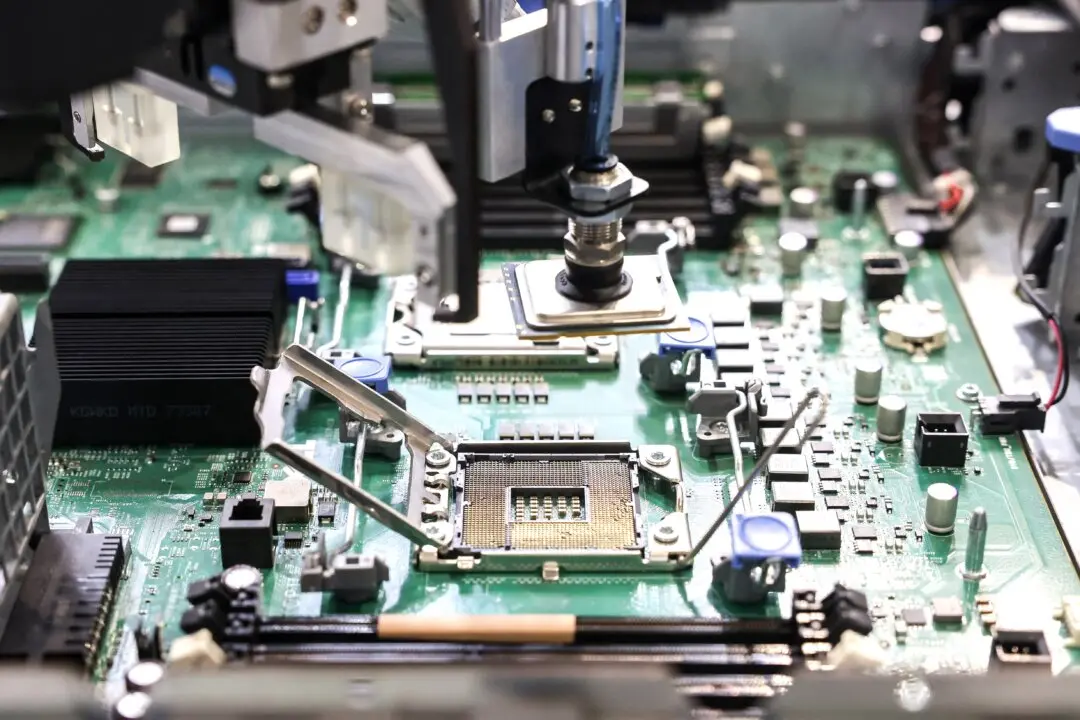

Bessent Warns Taiwan Chip Reliance Risks ‘Economic Apocalypse’

The Treasury secretary said Washington is racing to reshore semiconductors and critical minerals to counteract China’s leverage over key supply chains.

|

US Annual Average Gas Prices Expected to Be Lowest in 5 Years: GasBuddy

Motorists are estimated to be spending $11 billion less on gasoline this year compared with 2025.

|

Trump Admin’s Offshore Wind Suspension Faces Legal Challenge From Orsted

The company has asked a federal judge to block a 90-day construction halt imposed by the Trump administration that cited national security risks.

|

Nvidia Strikes Tech-and-Talent Deal With AI Startup Groq to Run AI at Scale

Chip giant Nvidia will license Groq’s AI technology and hire founder Jonathan Ross and key engineers in a deal short of a full acquisition.

|

How China’s Rare Earth Stranglehold Is Unleashing American Innovation

U.S. innovation could finally start to blunt Beijing’s control over critical minerals.

|

Trump Orders Federal Spectrum Shift to Secure US Lead in Global 6G Race

Analysts say early control over the spectrum could determine which countries shape the future digital economy and security environment.

|

US Manufacturers More Optimistic Despite Trade Uncertainties, Health Care Costs: Survey

More than 80 percent of survey respondents reported paying tariffs on imported manufacturing inputs since the beginning of 2025.

|

IMF Says China’s State-Led Growth Model Is Hurting Other Economies, Calls For Subsidy Cuts

The IMF says China’s export-driven growth and state support are widening trade imbalances and increasing pressure on global partners.

|

Rare Earths Climb Above US Price Floor Given to MP Materials

Shares of MP Materials rose by almost 2 percent at the end of the Feb. 18 trading session.

|

US Factory Output Jumps, Core Capital Goods Orders Signal Solid Business Investment

Stronger manufacturing production and rising equipment orders point to a tentative rebound in U.S. industrial activity.

|

Freight Data Indicate Early US Industrial Rebound as Midwest Truck Volumes Jump

Analysts say freight activity tends to turn ahead of broader industrial indicators, as manufacturers move inputs and finished goods before investment and hiring

|

Rio Tinto, Glencore Abandon Merger Talks for 3rd Time

Both firms maintain offices in the United States and are actively involved with American businesses.

|

Google to Double Capital Expenditure, Highlighting Broader US Investment Surge

Alphabet said it expects capital spending to surge this year to between $175 billion and $185 billion, more than double its 2025 outlays.

|

Small Water Systems Vulnerable to Cyberattacks, Operators and Experts Warn

A U.S. Senate panel was told that rural districts can’t reliably thwart sophisticated electronic sabotage—and that ‘bad actors’ know it.

|

Rubio Hosts Critical Minerals Summit as US Pushes to Secure Commodities Outside of China

The push follows Trump’s launch of a strategic minerals stockpile aimed at insulating U.S. manufacturers from geopolitical supply shocks.

|

Top Diplomats to Head to Washington for Critical Minerals Summit

Ministers head to the inaugural Critical Minerals Ministerial as allies seek to counter China’s dominance in rare earths and strategic metals.

|

US Factory Output Rises to Near 4-Year High as Manufacturing Rebounds

Two manufacturing surveys point to improving business conditions and stronger factory activity at the start of 2026.

|

Electric Vehicles Outsell Gasoline Autos in EU for First Time

Chinese company BYD saw a 229 percent rise in vehicle registrations in December 2025, while U.S.-based Tesla fell by 20 percent.

|

Century Aluminum to Construct 1st US Aluminum Plant in More Than 40 Years

The project is expected to create 5,000 direct and construction jobs.

|

House Votes to Overturn Minnesota Mining Ban, Sending Bill to Senate

Reversing the ban will protect jobs and strengthen national security, Rep. Pete Stauber (R-Minn.) said.

|

Bessent Warns Taiwan Chip Reliance Risks ‘Economic Apocalypse’

The Treasury secretary said Washington is racing to reshore semiconductors and critical minerals to counteract China’s leverage over key supply chains.

|

US Annual Average Gas Prices Expected to Be Lowest in 5 Years: GasBuddy

Motorists are estimated to be spending $11 billion less on gasoline this year compared with 2025.

|

Trump Admin’s Offshore Wind Suspension Faces Legal Challenge From Orsted

The company has asked a federal judge to block a 90-day construction halt imposed by the Trump administration that cited national security risks.

|

Nvidia Strikes Tech-and-Talent Deal With AI Startup Groq to Run AI at Scale

Chip giant Nvidia will license Groq’s AI technology and hire founder Jonathan Ross and key engineers in a deal short of a full acquisition.

|

How China’s Rare Earth Stranglehold Is Unleashing American Innovation

U.S. innovation could finally start to blunt Beijing’s control over critical minerals.

|

Trump Orders Federal Spectrum Shift to Secure US Lead in Global 6G Race

Analysts say early control over the spectrum could determine which countries shape the future digital economy and security environment.

|

US Manufacturers More Optimistic Despite Trade Uncertainties, Health Care Costs: Survey

More than 80 percent of survey respondents reported paying tariffs on imported manufacturing inputs since the beginning of 2025.

|