Revoking an Existing Trust

When we say revocable, we usually mean changeable. But revoke also means revoke. If your circumstances change and there are simpler ways to leave your estate free of probate as described in chapter 2, your trust can be revoked so you can use the alternate methods. Or it might be that there has been a divorce or disagreement between the owners of a joint trust and it has to be revoked. How do you do that? Unless your trust has been filed with a probate court, you do not need to sign any special form to revoke it. I know there are lawyers out there who will prepare such a form, but is it not necessary.

The simplest way is to remove all the assets from the trust name and put them back in your own name. If there are unrecorded deeds you signed to transfer your real estate to the trust, merely destroy them and the property stays in its original ownership. If the deed to the trust has been recorded, make a new deed from the trust back to you or in an ownership type as described in chapter 2 (How to Avoid Probate by Using Deeds: The Ladybird Deed).

Beneficiary designations can be changed so that the trust is not the beneficiary; the same with TOD and POD accounts. Titles to vehicles and boats can be returned to your name. The personal property assignment form can be destroyed as well, and a will can be made that automatically rescinds the pour-over will.

The goal is “repeal and replace.” Be sure no assets are left in the trust name and that none will flow to the trust at your death. If the trust owns nothing now or in the future, it is a non-entity. You must then set up your non-trust probate-avoiding plan by way of deeds, beneficiary designations, joint ownership, or TOD and POD designations.

Understanding the Trust

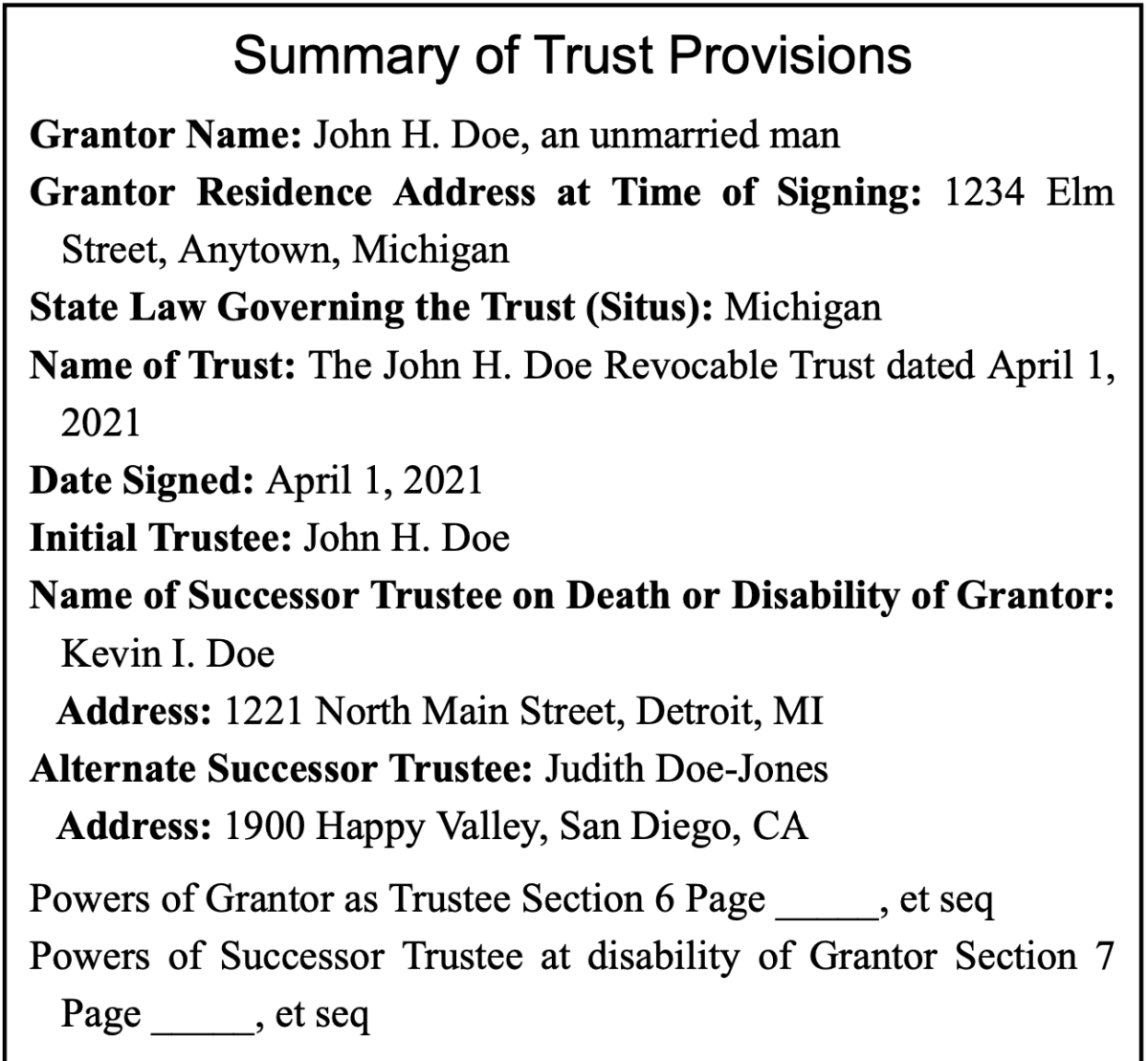

A properly written trust can be lengthy, and depending upon the intentions of the grantors and the composition of their assets, it may seem complicated to a non-lawyer. However, by structuring it much like a book, it can be much easier to understand. Searching for important provisions is also easier if it is properly set up. I like the textbook approach with a table of contents. This should be the very first page of the trust, so that frequently asked questions are easily answered. You can use this format and fill it out yourself if your attorney doesn’t do it this way.

Here is a sample for the John H. Doe Trust.