U.S. manufacturing is experiencing a revitalization. After years of anemic growth due to companies outsourcing their operations and exporting employment opportunities to foreign markets, manufacturing across different sectors is entering a boom period. Since the coronavirus pandemic, when the global public health crisis resulted in a worldwide supply chain disaster, many developments have supported this resuscitation within the United States. Companies have adopted reshoring initiatives and started waving goodbye to China, buoyed by public policy encouraging this trend, and the Chinese market no longer serving as an advantage amid geopolitical tensions and rising labor costs.

But is this a short-term boost or a long-term push?

“This boom is real,” said Scott Paul, president of the advocacy group Alliance for American Manufacturing, in an interview with American Essence. “The trend is clear. The data shows that manufacturing is definitely for the U.S. market and is definitely headed out of China.”

In addition to the current administration’s massive investments to attract domestic manufacturing in critical sectors like chipmaking, state governments are aggressively employing their own incentives, from workforce training and community college partners to tax incentives and infrastructure investment for companies that set up manufacturing locally, Paul noted.

Rosemary Coates, executive director at the Reshoring Institute, which conducts research and advises companies looking to reshore, told American Essence that the country’s manufacturing sector could be creating as many as 200,000 jobs annually in the coming years. She also alluded to an analysis of S&P 500 companies’ earnings call transcripts that found mentions of “reshoring” went up 128 percent in the first quarter of 2023 compared to the same period a year ago. “It’s a very popular idea and an awful lot of [companies are] attempting to reevaluate their global strategy,” said Coates.

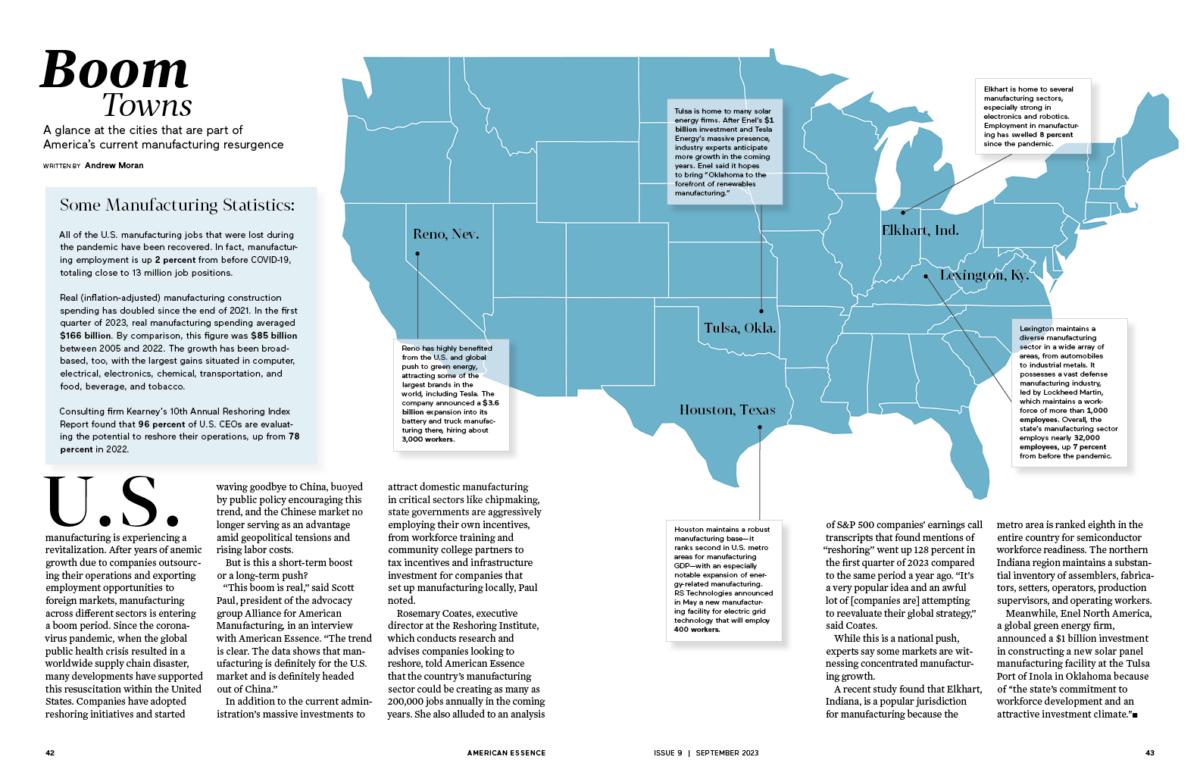

While this is a national push, experts say some markets are witnessing concentrated manufacturing growth.

A recent study found that Elkhart, Indiana, is a popular jurisdiction for manufacturing because the metro area is ranked eighth in the entire country for semiconductor workforce readiness. The northern Indiana region maintains a substantial inventory of assemblers, fabricators, setters, operators, production supervisors, and operating workers.

Meanwhile, Enel North America, a global green energy firm, announced a $1 billion investment in constructing a new solar panel manufacturing facility at the Tulsa Port of Inola in Oklahoma because of “the state’s commitment to workforce development and an attractive investment climate.”

Overall, these types of investments being made by federal, state, and local governments are “game changers,” said Paul, which is why it is happening across the country.

Elkhart, Ind.

Elkhart is home to several manufacturing sectors, especially strong in electronics and robotics. Employment in manufacturing has swelled 8 percent since the pandemic.

Houston, Texas

Houston maintains a robust manufacturing base—it ranks second in U.S. metro areas for manufacturing GDP—with an especially notable expansion of energy-related manufacturing. RS Technologies announced in May a new manufacturing facility for electric grid technology that will employ 400 workers.