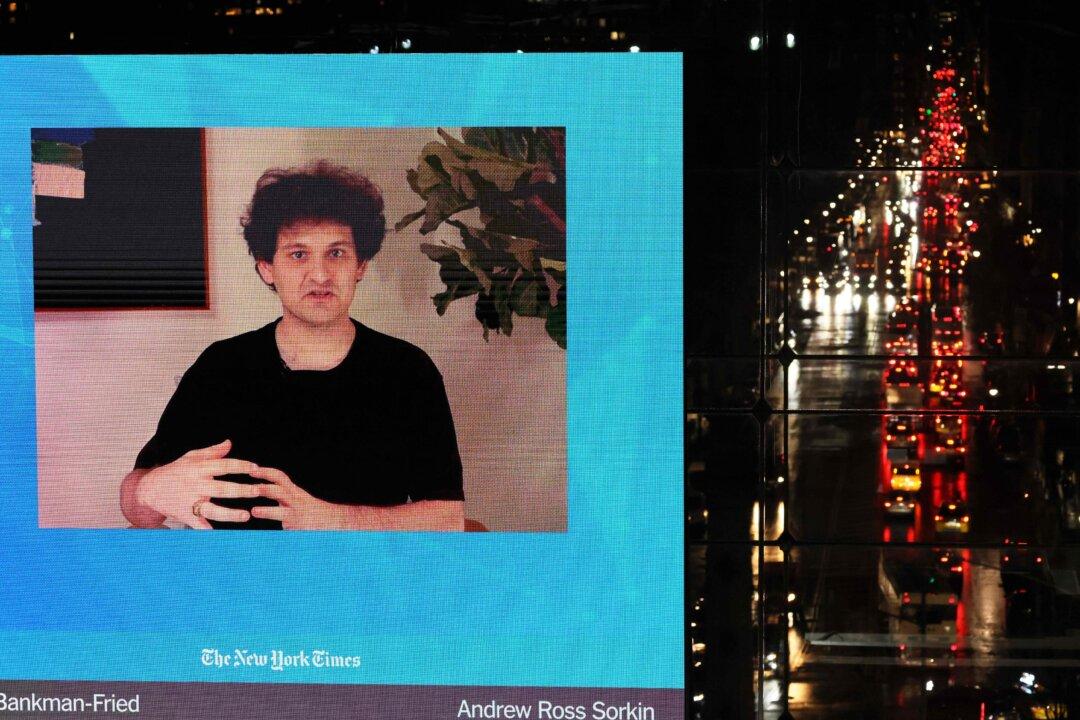

After weeks of speculation as to whether former billionaire, now hapless participant, Sam Bankman-Fried would be arrested for fraud surrounding FTX, the cryptocurrency exchange he ran into the ground, the mystery is over. The crypto exchange founder surrendered to Bahamian custody last week and is now awaiting extradition to the United States.

Following a grand jury indictment, Bankman-Fried was charged by the Southern District of New York, the Securities and Exchange Commission (SEC), and the Commodities and Futures Trading Commission (CFTC) on a variety of charges related to wire fraud, commodities fraud, securities fraud, money laundering, material misrepresentations, conspiracy to defraud the Federal Election Commission and to commit campaign finance violations.