Commentary

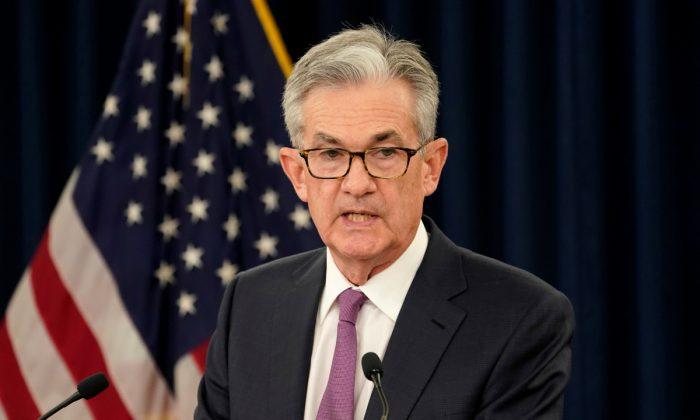

Chairman Jerome Powell’s

keynote speech on Aug. 23 at the Federal Reserve’s Jackson Hole Economic Policy Symposium will be heavily influenced by rising China turmoil.

The elite Jackson Hole Economic Symposium is the world’s premier economic forum with

attendance limited to 120 participants, including about 25 top Federal Reserve officers, 45 central bankers, 8 commercial bank CEOs, 5 national leaders, 25 academics and 12 media CEOs gathering to discuss the US reserve currency’s global economic impact.

A series of commissioned academic papers will be presented regarding issues such as inflation, labor markets and international trade. But the most important discussion at this year’s get-together will be if the United States versus China Trade War marks the type “Global Pivot” seen 30 years ago this month when Hungarians, Austrians and East Germans gathered for a pan-European

picnic in the Hungarian border town of Sopron.

Despite heavily armed sentries actively patrolling electrified fences, hundreds of East Germans took the opportunity to flee across the border to the West as the once-feared Hungarian communist guards failed to intervene. Soviet hegemony over Eastern Europe quickly evaporated, and in January 1992 the Soviet Union itself imploded.

In 1989 Chinese protesters in Tiananmen Square had challenged the Communist Party by erecting their own version of the Statue of Liberty, in hopes that establishing a market economy could lead to democracy. Beijing sent tanks that were famously blocked by an unidentified man. But three years after clearing the Square, the China Communist Party chose to grant urban protestors limited private economic activity to avoid the same fate as the Soviet Union,

according to Geopolitical Futures.

Harvard Professor Paul Kennedy’s 1987 book “

The Rise and Fall of the Great Powers” predicted Japan’s economy would overtake the United States, but China powered by the cheapest labor force in Asia soon replaced Japan as the supposed “Factory of the World.”

When newly elected President Donald Trump launched the trade war that he promised in his 2016 election campaign, many grim-faced economists

warned that the United States as a post-industrialized nation was at risk of an economic depression.

The Federal Reserve expressed apprehensions about cost-push wage inflation, raised interest rates

8 times after Trump was elected. But U.S. inflation has fallen during the Trump administration and stronger economic growth drove unemployment to its lowest level since

1969.

With the Federal Reserve convening its third Jackson Hole Symposium since the start of the trade war, there is growing concern that China instead of a growth engine for the world, may pivot into the type of international economic crisis that broke-out 30 years ago.

With Hong Kong protests even more robust than three decades ago in Tiananmen Square, The Epoch Times

reported China’s capital flight has increased from $22 billion last year to a $139.2 billion annual rate this year; the People’s Bank of China (PBoC) seized insolvent Baoshang Bank and Bank of Jinzhou citing “serious” credit risks in July, and China’s ‘Total Social Financing’ credit growth plunged by -55.3 percent last month.

The International Monetary Fund released its annual China review on Aug. 9 that stressed the “urgent need” for greater foreign exchange intervention transparency and disclosures. The IMF cautioned that the People’s Bank of China’s using its state-owned banks to trade huge amounts of

forex swap derivatives may entail “systemic risk.”

Moody’s Credit Rating Service issued a sector comment calling a move by the People’s Bank of China to slash the prime lending rate from 4.25 percent to floating rate of about 3.25 percent was “

Credit Negative for Chinese Banks’ Profitability.” Moody’s cautioned:

“We expect that the banks’ narrowing margins on traditional loans will prompt some banks to increase their risk appetite, potentially weakening asset quality.”

Chriss Street is an expert in macroeconomics, technology, and national security. He has served as CEO of several companies and is an active writer with more than 1,500 publications. He also regularly provides strategy lectures to graduate students at top Southern California universities.