Iron ore prices have flourished again despite a downward dive following Beijing’s promise to curb the mineral’s unabated market growth.

Spot prices launched to an unprecedented, all-time high of US$230 per tonne earlier in May, followed by a sharp decline by 20 percent to US$183 two weeks later. However, values once again surpassed US$200 at the beginning of June and currently sit close to US$208.

However, prices proceeded to plummet after crackdowns by the Chinese Communist Party (CCP), which accused the domestic industry sector of hoarding, monopolisation, price gouging, and other corrupt market practices.

This included targeting businesses that were “reaching agreements to implement monopoly, spreading false information, driving up prices, hoarding and other illegal activities.”

The communist regime’s efforts to threaten the booming iron ore market succeeded only temporarily, with prices recovering rapidly within days.

“As long as demand globally remains strong (including China) and markets are tight, we think it is unlikely China’s authorities will be able to push prices down on a sustained basis,” Bank of America said in a note.

However, in an article for the Australian Strategic Policy Institute (ASPI), Strategist David Uren said that the CCP holds less power than it believes with regards to sufficiently influencing iron ore prices.

“It must be galling to Chinese authorities that, notwithstanding their determination to punish Australia for its many perceived sins, their annual imports from Australia are running at near-record levels.”

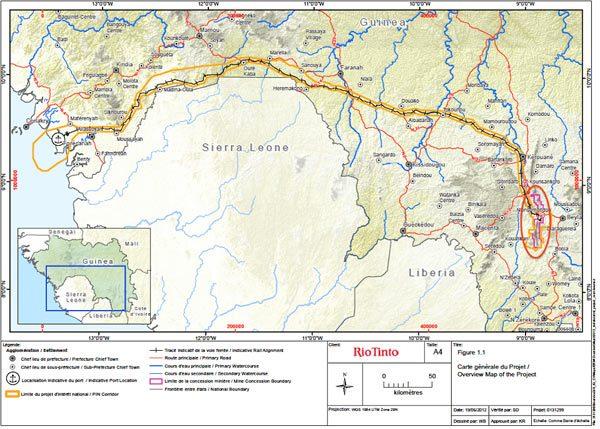

Uren also noted that the plan to improve domestic and international supply was unlikely to impact demand from Australia significantly. In particular, he said that one of the largest mine projects in Africa, Guinea’s Simandou project, was fraught with failure.

“Astronomical iron ore prices reflect the inefficiency of China’s own iron ore mines rather than any alleged monopolistic behaviour by the major Australian mining companies.”

“The [Simandou] project, which has been stalled for more than a decade amid corruption claims and conflicts between the government and partners, would take several years to complete, and production in the initial phase is expected to be in the region of 100 million tonnes a year.”