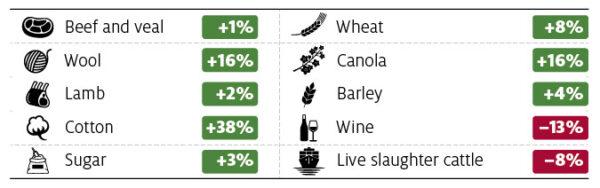

Australian agricultural producers are expecting a record-breaking harvest this season due to a perfect combination of price increases and higher production volumes.

It will be the first time Australia’s gross agriculture value surpassed $70 billion if realised.

Agriculture Minister David Littleproud said he was confident that the sector would be able to hit the $70 billion mark at the very least.

ABARES notes that the sector will greatly benefit from a “remarkable combination of events” of favourable domestic seasonal conditions and unfavourable overseas conditions.

Domestically, Australian farmers have enjoyed widespread favourable growing weather conditions leading to near-record high harvest volumes. Meanwhile, key international competitors have suffered from poor growing seasons that have led to higher grain prices.

However, the wine industry will continue to struggle from Chinese tariffs, with its export value expected to drop 13 percent.

Challenges Still Remain

ABARES noted that the sector faced three main challenges to realising a record year, including ongoing labour shortages, the threat of mice populations, and commodity price risks.Labour shortages will particularly affect horticulture, meaning Australians are likely to see higher fruit and vegetable prices. Littleproud called it the biggest constraint to the growth of the sector.

To help farmers with this issue, the government announced an agriculture visa on Aug. 23, aimed at Pacific Islanders and Southeast Asian workers, including a pathway to permanent residency.

While the mice plague still is expected to cause serious problems in the affected areas of Australia, ABARES said it would not significantly affect national production.

ABARES also said that current high international freight costs will particularly affect exporters of cotton, pulse, and horticulture goods.

The possibility of further deteriorating trade relationships with economic partners was also noted.

“While agricultural exporters are proving adept at diversifying into new markets or taking advantages of changes in trade flows, this does come with transition costs and lower prices as has been seen for barley,” ABARES said.

However, the agriculture minister said this was a year to be proud of as the agriculture sector navigated through the uncertainty of a pandemic.

“Australians backed our farmers during the tough years of drought; we are now seeing those very farmers help the Australian community and Australian economy through and beyond the pandemic,” Littleproud said.