On March 7, the Atlantic Council, an American think tank, published a report on Hong Kong’s business environment titled “Fractured foundations: Assessing risks to Hong Kong’s business environment,” criticizing the “National Security Law (NSL)” for changing Hong Kong’s political and legal landscape and increasing the risk to foreign capital in doing business in Hong Kong. It recommended that companies should weigh between business opportunities and risks and formulate contingency plans.

The report pointed out that the most fundamental change in Hong Kong in the past three years has been the shift from a legal system based on the Basic Law and English common law to a system governed primarily by political norms enhanced by the NSL. The new law establishes another system of powers running parallel to Hong Kong’s traditional institutions, allowing interference in those jurisdictions on matters of national security and potentially conflicting provisions of the Basic Law.

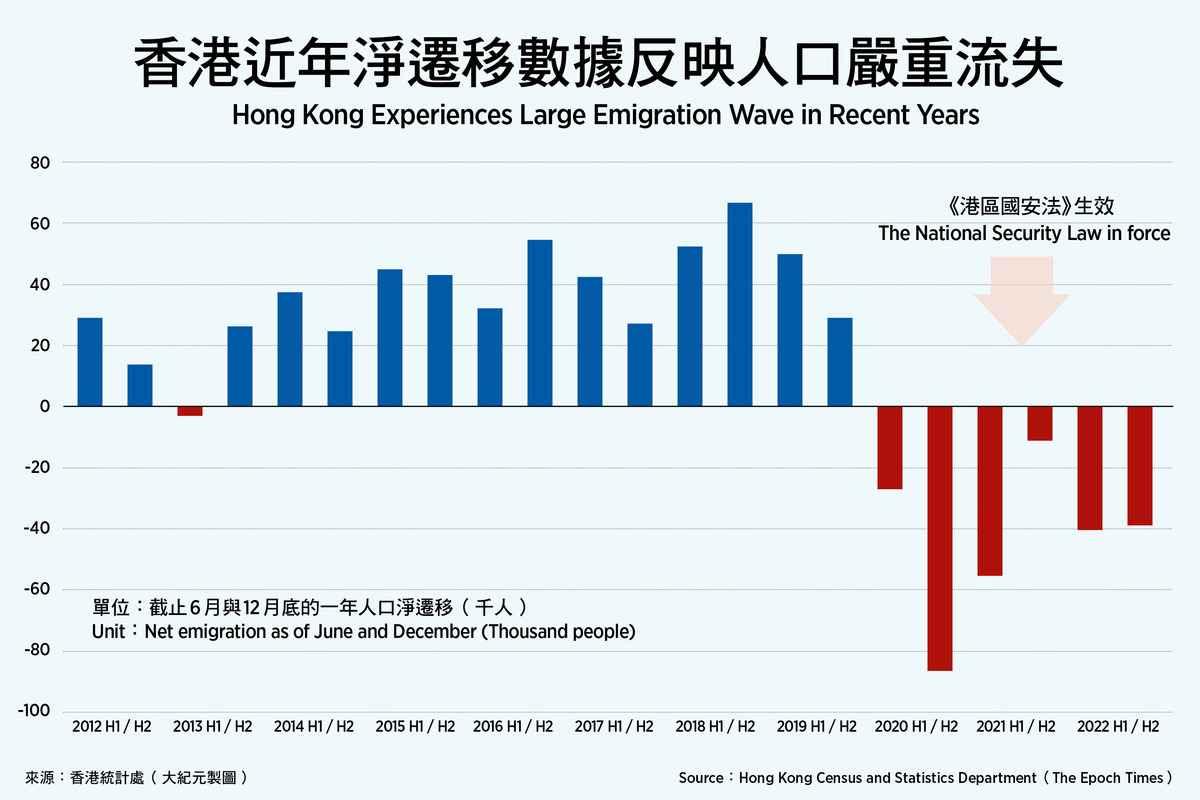

Furthermore, since the implementation of the NSL and the large-scale restrictions imposed by COVID-19, there has been a population outflow never seen before in Hong Kong’s history. Hong Kong’s population has shrunk by 2.9 percent since the summer of 2019. During that time, the UK government started offering a five-year “Leave to Stay” visa to eventual British citizenship status for Hong Kong holders of British Overseas National (BNO) passports in 2021. According to the announcement of the British Home Office on Feb. 1, more than 144,000 Hong Kong residents have emigrated to the UK.

Hong Kong’s Business Environment Faces Five Major Risks

The report also analyzes the risks faced by Hong Kong’s business environment since the implementation of the NSL.First, changes in Hong Kong’s institutional structure have brought new risks to the future of Hong Kong’s independent currency, the Hong Kong dollar, and its peg to the U.S. dollar through the linked exchange rate mechanism. Until today, the Hong Kong Monetary Authority (HKMA) still maintains openly that the system remains unchanged. But the think tank pointed out that the risk to the stability of the Hong Kong dollar comes not from Hong Kong but from the market regarding the uncertainty of Beijing’s intentions.

If at some point in the future, Beijing makes public comments on the future of the Hong Kong dollar, those comments could carry more weight in global markets than any HKMA statement. The benefits of Hong Kong’s status to Beijing are that Hong Kong allows capital to flow in and out of mainland China, and its legal and institutional system is more attractive and understandable to foreign investors and financial institutions. But if these outflows accelerate, they could also endanger China’s own financial stability.

The most likely alternative to pegging the Hong Kong dollar to the U.S. counterpart is not to let it float freely and allow the market to price it in but to re-peg the Hong Kong dollar to the Renminbi. This means that Hong Kong will import China’s monetary policy, and the Hong Kong dollar will essentially become a form of offshore Renminbi. If there is a significant difference in interest rates between Beijing and Hong Kong, funds will quickly flow to areas with higher yields. Such a change would require Beijing to impose stricter capital controls between China and Hong Kong or between Hong Kong and the rest of the world.

The think tank argues that Hong Kong needs free and open capital flows to maintain its status as a global financial center. Any change in its currency’s peg to the U.S. dollar inevitably raises new questions. And no matter how one assesses the likelihood of a change in Beijing’s preferences, it remains a major new risk that any company or financial institution operating in Hong Kong must carefully consider and manage.

Risk 2. The report points out that financial institutions headquartered in Hong Kong are facing new compliance risks related to the sanction imposed on either side between China and the United States. There are reasons to worry that both sides may intensify the use of sanctions-related controls in the future and may seek to prevent the execution of conflicting directives in Hong Kong. Global financial institutions may be asked to work harder to balance business and compliance risks with rising political risks associated with their decisions. In addition, the “National Security Law” stipulates that anyone who “engages in activities such as asking for instructions from foreign countries, colluding, and accepting instructions” is illegal. As a result, foreign financial institutions may incur legal risks in Hong Kong simply by complying with U.S. sanctions policies.

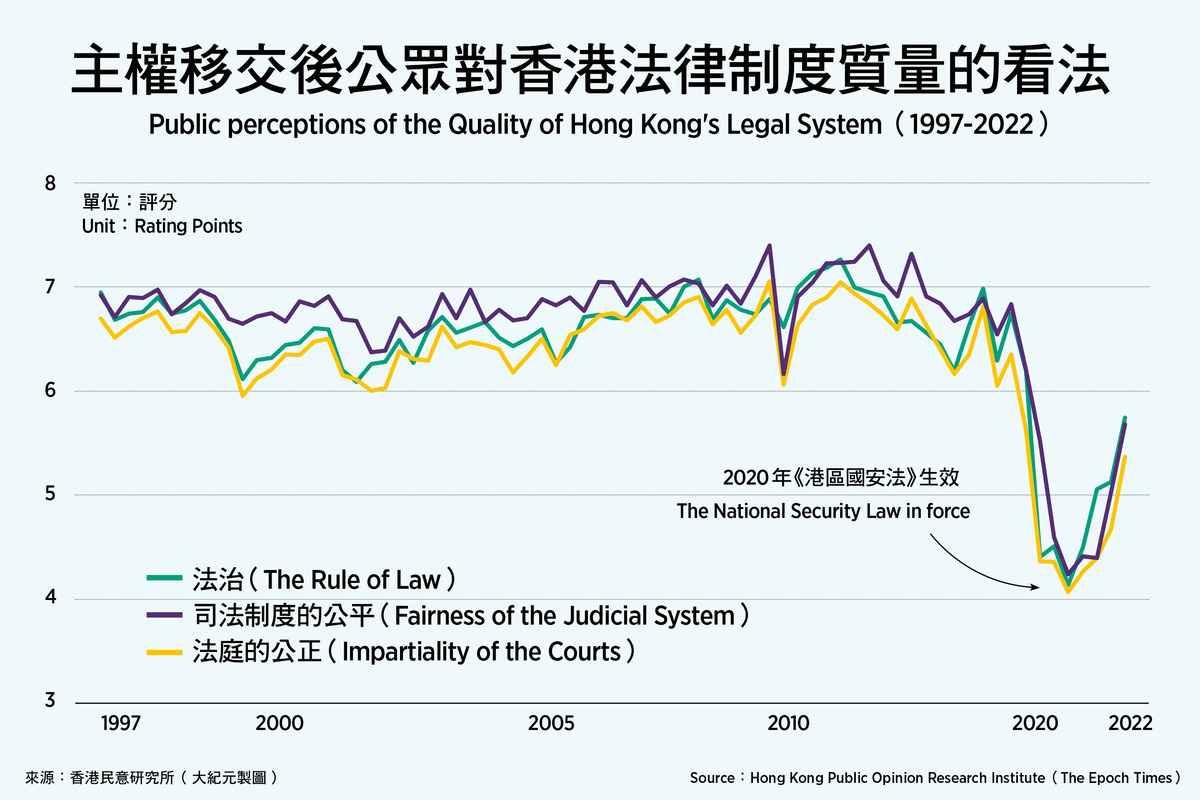

The third risk is that the changes to Hong Kong’s legal and institutional framework brought about by the NSL have brought considerable uncertainty to the continued operation of the rule of law and the independence of Hong Kong’s judiciary. The new power system makes the jurisdiction of Hong Kong courts unclear in several matters related to commercial and financial transactions. While the NSL deals explicitly with criminal cases, it remains unclear how it will apply to future civil cases related to commercial and financial institutions. In such civil proceedings, the line where Hong Kong courts’ jurisdiction ends and the National Security Council’s power begins is determined by Beijing’s political norms, not legal limits determined by Hong Kong.

Public opinion of the quality of Hong Kong’s legal system and its independence and fairness has plummeted since the 2019 protests and the passage of the NSL, according to poll results from the Hong Kong Public Opinion Research Institute (PORI).

Risk 4: The risks of press freedom, free exchange of ideas and information in Hong Kong are on the rise. Success of business and finance depends to a large extent on reliable and trusted information. Before the implementation of the NSL, the overall media environment in Hong Kong was very relaxed by global standards. Bloomberg recently reported that, out of concern about the fuzzy lines of the national security law, financial analysts have exercised high levels of self-censorship, even for their own internal reporting. Analysts in Hong Kong are now concerned about similar treatment, which will reduce the free flow of financial information.

The media environment in Hong Kong has been tightened, and in the future transparency required in reporting necessary for business or financial market will be carried out by fewer outlets and journalists. Beyond journalism, the transparency and accessibility in the broader flow of information needed to run the modern economic and financial system is increasingly at risk, including economic data and the underlying reporting of companies’ financial performance.

How to Respond to Changes in the Legal Structure of Hong Kong?

The think tank pointed out that the obstacle to further changes in Hong Kong’s environment will be the underlying political factors. In this respect, collective lobbying and public relations execution by the business and financial circles can influence the political calculations of Hong Kong and Beijing. Wherever possible, the business community should take advantage of every available opportunity to directly communicate the consequences of uncertainty about Hong Kong’s status. Additionally, a focus on US-China political dynamics and expectations for Hong Kong is helpful in understanding when compliance and business-related risks may intensify. It is key to focus on data from national security cases and outcomes, Hong Kong’s foreigner population and their engagement, and outcomes within the legal system.Furthermore, the report highlights the importance of independent media to Hong Kong’s future. In the process of lobbying and opposing the reform of Hong Kong’s legal structure under the National Security Law, the fate of independent media organizations is of great significance. It should be emphasized that implementation of the “fake news” laws or further crackdowns on media outlets jeopardize the flow of information necessary for proper commercial and financial transactions and create new barriers for companies to adequately respond to defamation and disinformation.

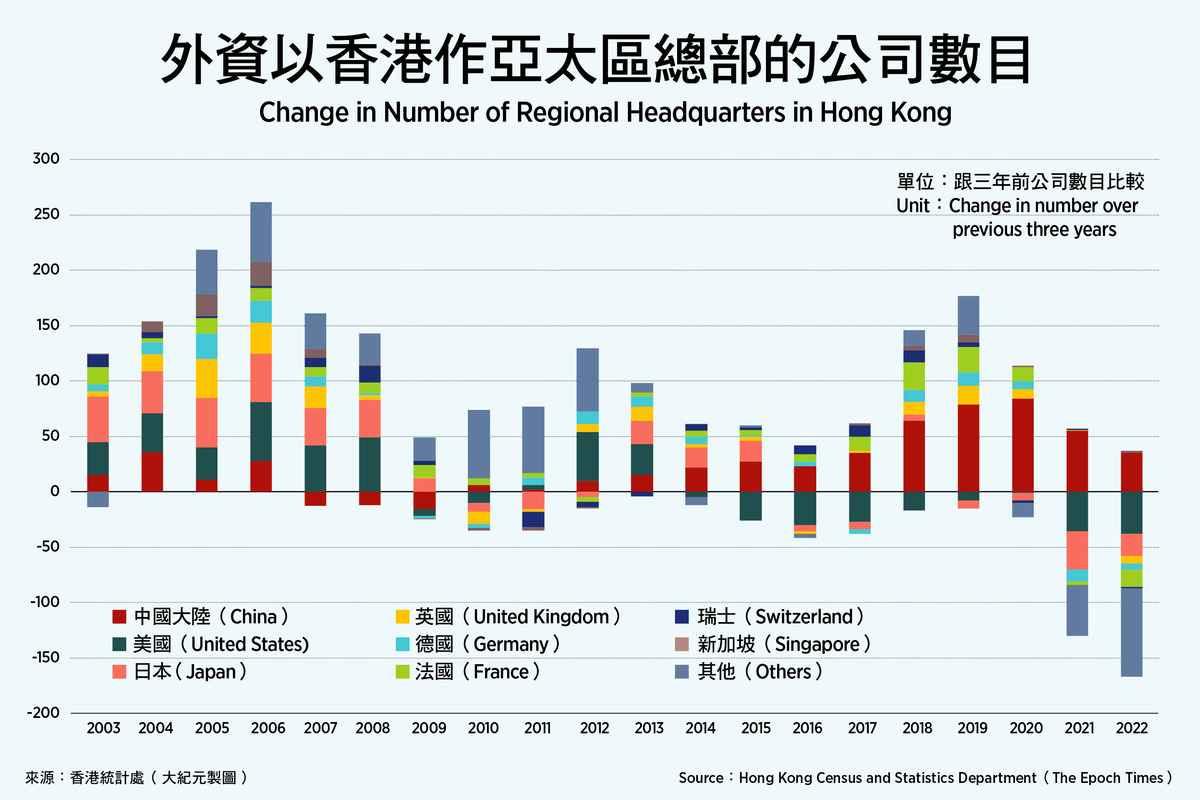

Commentary: Leading to More Foreign Capital Outflow from Hong Kong

Dr. Frank Xie Tian, Chair Professor of the Aiken School in Business at the University of South Carolina in the United States, was interviewed by the Epoch Times on March 8. He said the analysis report just reiterated what was already known and what is happening. For example, the deterioration of the foundation of the rule of law in Hong Kong will lead to more foreign-funded enterprises leaving Hong Kong. He pointed out that before the report was published, many foreign-funded enterprises had already withdrawn from Hong Kong, for instance a lot of financial institutions had moved to the United Kingdom and Singapore. At the same time, capital, foreign-funded enterprises, and supply chains from the West have begun to withdraw from mainland China on a large scale. Lots of such cases in the manufacturing industry are seen leaving the Pearl River, and the Yangtze River Delta, all because the CCP is showing increasing hostility toward private businesses.Although the “National Security Law” has been in place for some time, he believes there are some foreign investors still having illusions about the CCP, and this report will help encourage those companies to leave.