Since the 2008–2009 Great Recession, the world has endured financial crises, geopolitical tensions, natural disasters, a pandemic, and so much more. But there has been one factor that has been remarkably persistent: The stock market, from the United States to the UK, has soared to record highs.

As 2021 comes to a close, the leading U.S. benchmark indexes will have enjoyed a tremendous year, filled with multiple fresh highs.

The Dow Jones Industrial Average is poised for a 15 percent gain. The Nasdaq Composite Index is on track for a 19 percent rally. The S&P 500 Index will finish the year up 24 percent.

Other segments of the financial markets will also record solid gains. The U.S. Dollar Index (DXY), which gauges the greenback against a basket of currencies, will likely complete the year with a 7 percent surge. The benchmark 10-year Treasury yield is flirting with 1.5 percent.

This is not only confined to the United States. Many markets worldwide have enjoyed exceptional earnings this year. The London FTSE 100 Index has climbed 13 percent in 2021. The Shanghai Composite Index rose more than 4 percent. The German DAX advanced roughly 12 percent.

But aside from a few bumps in the road, this has been the norm for more than a decade.

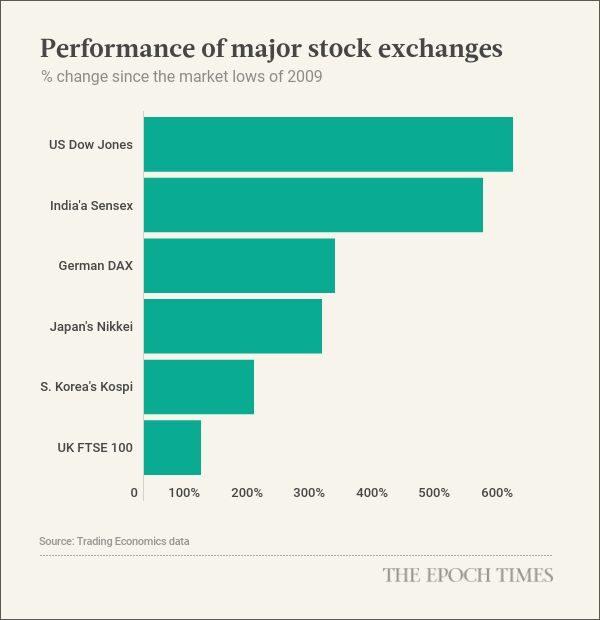

Since 2009, India’s stock market index has soared 543 percent, while the United States has spiked 590 percent. Japan rose 285 percent, while South Korea climbed more than 170 percent. The German DAX surged 306 percent, while the FTSE 100 added 92 percent.

Meanwhile, the U.S. financial markets have also witnessed other notable trends in the past 12 months.

In the background, however, conditions are facing an entirely different scenario.

The U.S. annual inflation rate is at a near four-decade high. There are still 4 million to 6 million fewer jobs than before the coronavirus pandemic. Public and private debt has swelled considerably since the early days of the pandemic. Many jurisdictions throughout the country have reintroduced public health restrictions in response to the Delta and Omicron variants.

What has supported the historic rally in equities?

Central Banks Fire Off the Big Guns

Economists and market analysts point to the same policy action that has been universal over the last 13 years, especially during the COVID-19 public health crisis: Monetary policy expansion by central banks.Over the past 20 months, the Federal Reserve has created one-third of all U.S. dollars ever produced in the nation’s history. Canada’s money supply swelled close to 10 percent over the last year. Since the beginning of the pandemic, the UK’s money supply advanced 14.61 percent.

Suffice it to say, money-printing has fueled this enormous growth in the stock market. A key component of the stock market’s performance is monetary liquidity, and the U.S. central bank has produced approximately $6 trillion to cushion the economic blows from the fallout of the virus. In total, the United States, Japan, and Europe have gone on a $10 trillion spending spree through their COVID-related quantitative easing efforts, raising their combined assets to approximately $25 trillion.

Central banks injected the economy with liquidity, much of which ended up as bank deposits. This gave lenders the capital to pump through the economy, with companies borrowing at high levels amid low-interest rates. The corporate debt boom prompted the Federal Reserve to warn about elevated “vulnerabilities arising from business debt.”

Some prominent figures believe this could trigger a different type of economic crisis.

Will Tapering Trigger a Correction?

But now that the Federal Reserve and its partners in the central banking community are beginning to ease monetary policy to fight inflation, will stock markets sustain comparable monster gains or suffer a sharp correction?Goldman’s chief U.S. equity strategist David Kostin forecasts a 12 percent gain in the S&P 500 by the end of 2022. Credit Suisse hiked its 2022 S&P 500 price target to 5,200. DWS Group is targeting 5,000.

But Morgan Stanley projects a drop of more than six percent, sending the S&P 500 down to 4,400 by next year.

“As we think about our forecasts for the year ahead, our key message centers around multiple contraction amid a continued mid-cycle de-rating, higher bond yields, and greater economic and earnings uncertainty,” Mike Wilson, Morgan Stanley chief U.S. equity strategist, said in a note. “While earnings for the overall index remain durable, there will be greater dispersion of winners and losers and growth rates will slow materially.”

JPMorgan Chase strategist Marko Kolanovic thinks something is happening underneath the surface because the average U.S. stock is down about one-quarter from its highs.

“Such a divergence is unknown to us, and indicates a historically unprecedented overshoot in selling smaller, more volatile, typically value and cyclical stocks in the last four weeks,” Kolanavic stated. “The narrative for the selloff is related to Omicron and the Fed, while actual selling comes largely from de-risking and shorting from equity and macro hedge funds.”

Despite the Federal Reserve accelerating its tapering plans and potentially raising interest rates as many as three times in 2022, market analysts are still bullish on the new year.

“Rising rates alone aren’t bad for stocks,” Bank of America strategist Savita Subramanian said in a note.

“It is interesting to note that even with a 24% price increase since the end of last year (December 31, 2020), analysts are more optimistic on S&P 500 stocks today compared to December 31, 2020, based on the percentages of Buy ratings,” noted FactSet senior earnings analyst John Butters.

Critics have said that central banks adopted a new mandate of not letting the stock market crash, placing price pressures on low- and middle-income families. But proponents of the unprecedented monetary expansion assert that the public health crisis would have created tremendous financial harm without these mechanisms.