In an upbeat final note, last week’s World Economic Forum concluded with top economic policymakers and business leaders making optimistic forecasts for global economic growth in 2020.

Reece tracks an array of economic indicators and issues U.S. business cycle reports that help investors seize opportunities and mitigate risk. He told The Epoch Times in an exclusive interview that his methodology shows that the probability of the United States entering a recession has dropped significantly between November 2019 and January 2020.

“While a few pictures still look concerning, there are enough recession disconfirmations to make me more positive than negative,” Reece said. “My base-case view is that we are in the process of coming out of a mid-cycle—or perhaps late-cycle—slowdown, and that we will see further evidence of cycle extension.”

While acknowledging risk, Reece said his view continues to be “economic expansion until further notice.” He estimates recession probability over the next six months to be around 10-25 percent, markedly lower than the numbers he cited when he was interviewed by Real Vision in November.

“In my view, there’s a lot of mixed data. I'd say that recession risk is real, it’s elevated, it has not yet become my best-case scenario, but I’ve estimated it to be between 30-45 percent chance of going into recession over the next six months.”

The same set of economic indicators Reece tracks and that he referenced in November are now flagging a lower risk of a U.S. recession.

“Based on my checklist approach, the U.S. business cycle picture near-term is overall more positive than negative. On balance, based on the data and frameworks presented (which inevitably may not capture all possible risk factors in real-time), it seems more likely than not that the expansion continues in the coming several months. The longer-term outlook remains neutral/negative as we are likely in the later part of this cycle,” he said.

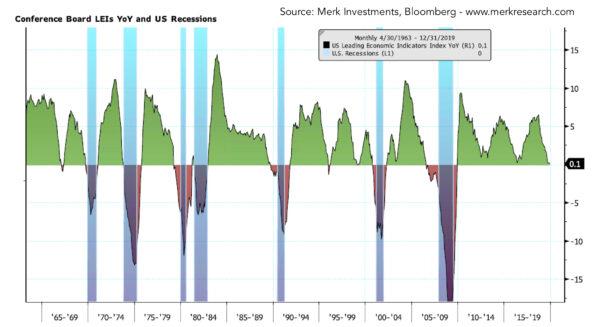

Leading Economic Indicator Index

Reece said the leading economic indicator index (LEI), published by the Conference Board, stayed above zero in mid-January, with a year-over-year reading of 0.1.“Those pretty much always go negative year-over-year going into a recession and we’re not quite there,” he explained.

“This picture keeps me generally positive on the outlook for the U.S. economy,” Reece said, adding, “I’d get incrementally negative on the business cycle outlook if the LEI YoY went negative.”

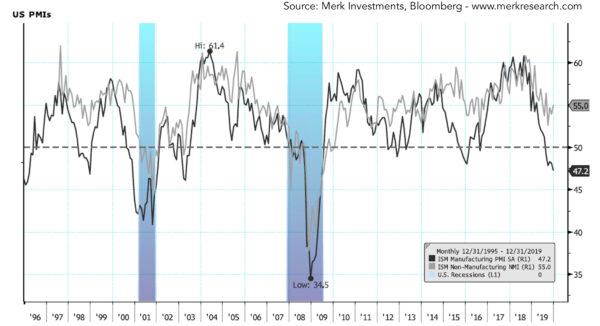

Factory Numbers

The Institute for Supply Management (ISM) publishes a Report on Business that includes a key measure called the Purchasing Managers’ Index (PMI), which tracks manufacturing activity. If the PMI print reads above 50, the sector is expanding, while a figure below 50 means it’s in contraction territory.“The manufacturing PMI’s look very weak. This has been a manufacturing-led slowdown,” Reece said. “Although services have held up really well.”

The services numbers, also called NMI, show a reading of 55 in the chart Reece provided, while manufacturing PMI sits at a lackluster 47.2.

A similar measure to the ISM PMI is the Markit PMI, which tracks both manufacturing and services.

Both the composite index and the services index grew, while one of the manufacturing components of the Markit PMI stayed flat and the other dropped to a 3-month low.

“The underlying data highlights a manufacturing sector that is not out of the woods yet, with goods producers seeing only modest gains in output and new orders,” Jones said.

“The U.S. economy is increasingly a service-based economy and less manufacturing centric,” said Greg McBride, Senior Vice President and Chief Financial Analyst at Bankrate, in a statement to The Epoch Times, explaining that a weaker factory print can be offset by strength in services.

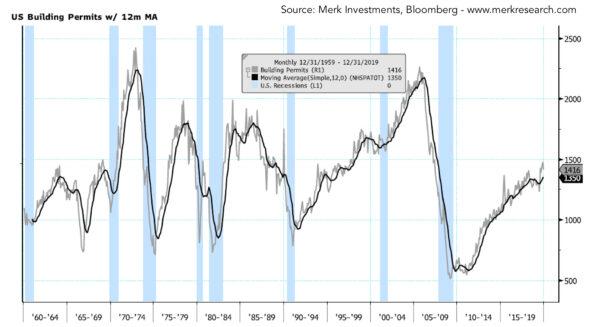

Housing Starts

Reece also noted the presence of a number of “disconfirming indicators” that support an optimistic outlook for the U.S. economy. One of these is new housing starts.“We’re at a cycle high for housing starts in the U.S.,” he said, explaining that building permits are a long leading indicator.

“If you get a building permit to build a house then that’s going to turn into construction activity, which is going to turn into buying household durable goods like refrigerators,” Reece said. “You normally don’t see an economy going into an imminent recession with building permits on a cycle high.”

Commenting on the figures, he said the absence of warning signs in the data makes a strong argument for continued economic expansion.

A report from the National Association of Realtors followed on the heels of government data last week showing home-building raced to a 13-year high in December, prompting President Donald Trump to laud the spike in new home construction.

Tight Credit Spreads

Reece said another disconfirming recession signal were high-yield credit spreads, which go up when investors are spooked by troubling economic conditions and demand a risk premium to lend to higher-risk borrowers like CCC-rated companies.“The high yield credit spread has continued to come down and remains below what I consider the warning level,” Reece said, adding that he would become “incrementally negative on the business cycle outlook if the spread moves above 5.”

The chart he provided shows the high-yield credit spread sitting at 3.34 in mid-January.

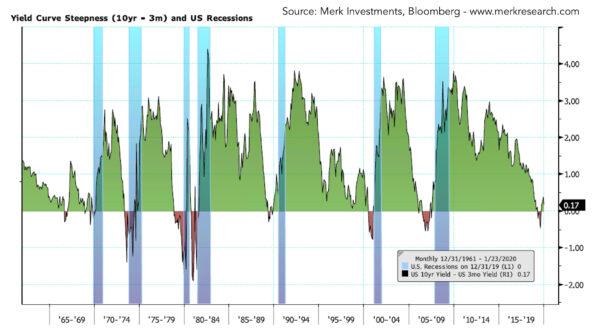

Conflicting Yield-curve Signals

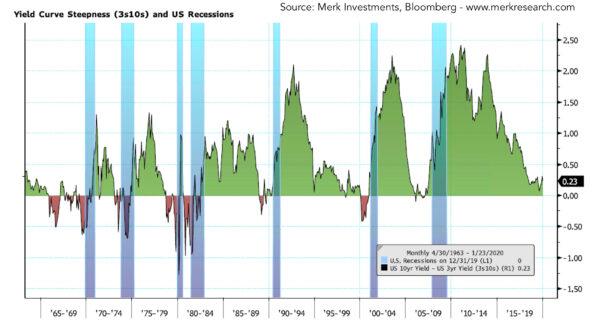

Yield-curve inversions on various U.S. Treasury-issued securities are an oft-cited predictor of recession, which Reece said have sent mixed signals this time around.The 10-year/3-month yield curve was inverted from May to October 2019, meaning the 3-month yield was higher than the 10-year yield.

“Historically, that’s a 1-year to 2-year leading indicator,” Reece said of the inverted 10-year/3-month curve, adding, “meaning there’s a good chance you’re going to be in recession a year later or two years later.”

He added as a caveat that the yield-curve indicator only goes back to the 1950s or 1960s, providing a relatively small sample size from which to infer future trends.

“We usually are working with seven cycles, so seven recessions, which is a small sample size, and that’s something to keep in mind,” he explained.

“However, we did not have inversion on the 10-year/3-year,” Reece said of another yield-curve measure. “So that’s a bit of a conflicting signal because the 10-year/3-year has historically been a very good predictor of recessions.”

“That’s why I say that the yield curve is sending me a conflicting signal,” he added.

“My base-case scenario is that we’re probably going to see the data start to improve,” Reece said. “Some of the data that’s been weak like the manufacturing PMIs maybe most importantly, to see those improve in the coming months, and then we’re going to get this kind of cycle extension, which could last for a few more years.”

Reece said he updates the forecast every month and revises his predictions in whatever direction the data points to.

“It’s important to say we’re not really out of the woods yet,” Reece added. “I still really want to see some of these key indicators improve over the next two or three months in order to get confirmation of that base-case scenario that we’re going to be coming out of the slowdown and extending the cycle.”