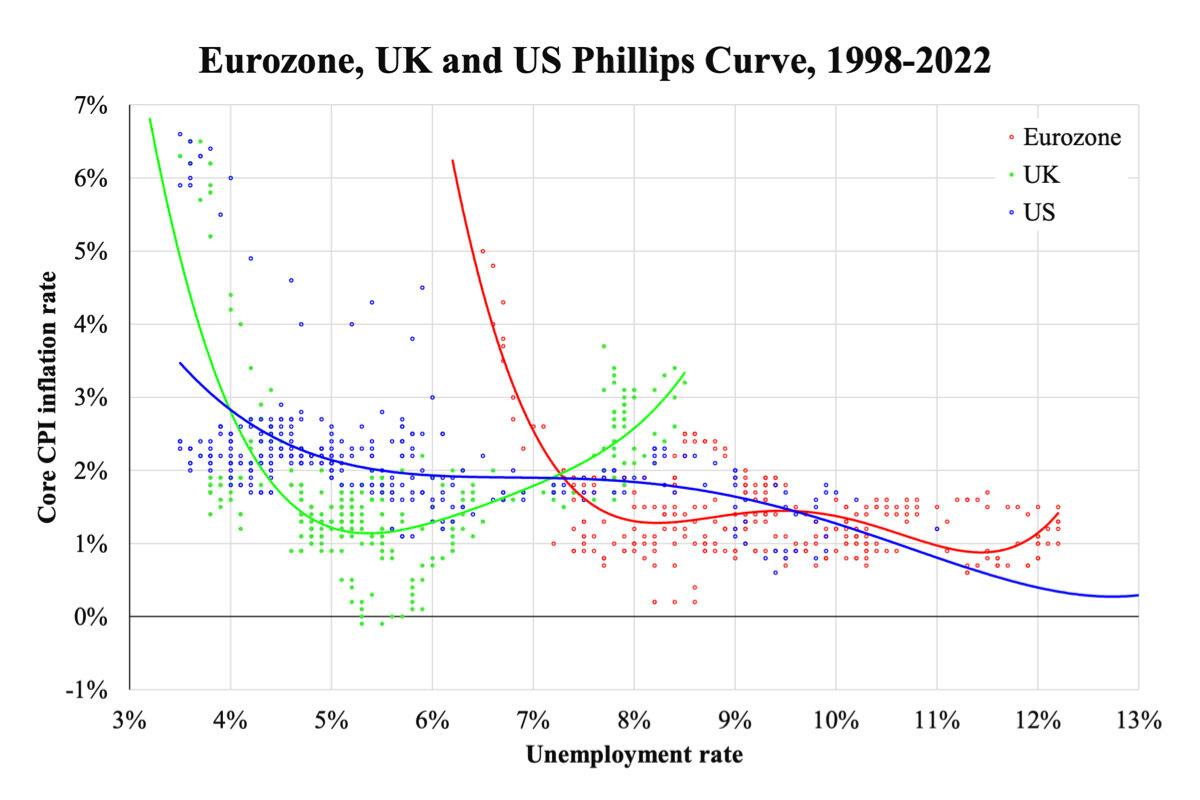

Before discussing the results, first, note the curves are far from the theoretical shapes taught in textbooks. They are neither linear nor convex but are highly nonlinear. The Phillips curve has not generally applied to the U.S. unemployment rates and inflation rates over the past decade. However, in the last two years, the correlation has been good, especially during the period of high inflation, as shown in the graph. The fitted U.S. Phillips curve (in blue) does not show a sharp rise towards the left end. Although, the stray dots do. In fact, a similar scattering of dots is observed for all three regions during the low inflation eras, but they are more pronounced for the UK and Eurozone. The sharp difference is observed to the right of the curve when inflation gets high.

The Eurozone’s curve shift to the right might simply demonstrate the difference between the natural unemployment rates of the three regions. The natural rate in the Eurozone is higher because of the many economically poor member countries. If only the United States and the UK are compared, both show similar natural rates as they bottom out at 3.x percent unemployment. The UK is more prone to high inflation when the unemployment rate is above seven percent, while the United States has comparatively high inflation when the unemployment rate is below seven percent. At other times, the behaviours are similar.

If the Eurozone curve (in red) is shifted to the left by three percent, the three curves will, in effect, be positionally similar. This suggests the same theory applies to all three places, probably with similar parameters, the trade-off between the pros and cons of monetary easing will be more or less similar in each place. Knowing this is important because we can conclude, with the same reasoning for high inflation over the past year, as we can predict similarly that all inflation rates will be coming down, that the United States is only leading while the Eurozone and the UK are lagging.

Indeed, the market is sharing the same view: While the United States is expected to stop hiking rates by May or June, the Eurozone and the UK are expected to stop by July or September. The cyclical behaviour of Europe is similar to that of the United States, and the only difference is, one is ahead of the other in timing.