Privatisation of four state-owned energy companies is meeting with heavy opposition from the public despite the government having announced its intention before the 2011 elections.

People will be disenfranchised twice under the Government’s move to privatise the industry, says Molly Melhuish, an independent energy analyst for consumer and environmental groups.

Firstly by the Electricity Authority’s interpretation of the law during the regulatory process and secondly by the government’s claim to have a mandate when it enjoyed “a majority of one (seat) in an election in which the voter turnout was the lowest since 1887,” she says.

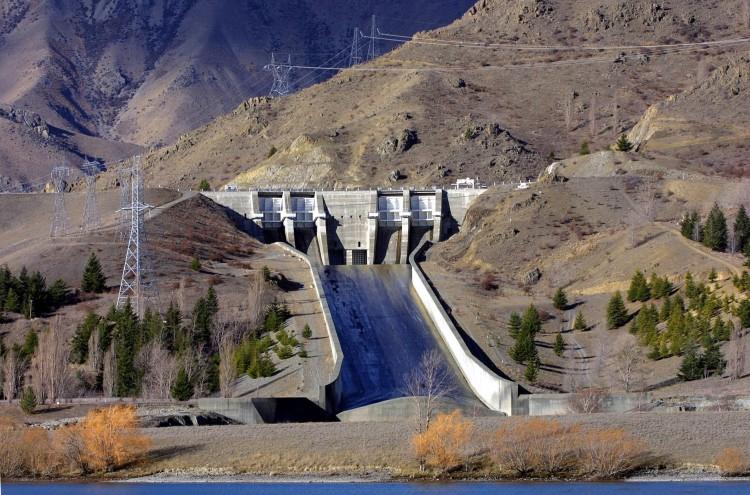

Under the government’s proposal 49 percent of the shareholdings of four state-owned energy companies (SOEs)—Genesis Power, Meridian Energy, Mighty River Power and Solid Energy—will be sold. The power suppliers would then operate under a mixed ownership model.

Submissions to the Mixed Model Ownership Bill, allowing the partial privatisation of the SOEs closed last Friday.

The proceeds from the sale would be used to invest in future assets and reduce the need for further borrowing, says the government.

However, privatising essential infrastructure assets is seen by many people as benefitting only the power suppliers and industrial consumers.

Molly Melhuish works with Greypower, one of New Zealand’s largest non-government organisations that lobbies on behalf of senior citizens. Greypower’s submission opposes the government’s Mixed Ownership Model bill in its entirety.

The new regulation will lock in the existing regulatory system, says Ms. Melhuish.“[It] specifically protects investors and specifically refuses to distinguish between domestic and industrial consumers.”