Blocking certain tax benefits, the measures could create a bigger hole in U.S. companies’ financial statements and hurt investors’ pocketbooks.

“I’m announcing a set of proposals to crack down on illegal overseas tax evasion, close loopholes, and make it more profitable for companies to create jobs here in the United States,” Obama said at a news conference. “For years, we’ve talked about ending tax breaks for companies that ship jobs overseas and giving tax breaks to companies that create jobs here in America.”

The standards attempts to close a tax loophole from the Clinton administration called “check the box,” in which companies could shift profits from overseas operations into low-tax regions, lowering the amount of taxes U.S. companies must pay on foreign operations.

The regulations also restrict the amount of foreign tax credits and deferred taxes on foreign operations corporations could deduct.

Congress Tentative

Already, fellow Democrats in Congress are expressing skepticism over the proposals, which could further deflate corporate earnings and hurt the bottom lines of businesses during a time that businesses could least afford to do so. Some analysts believe the new measures could raise corporate taxes by as much as 10 percent, amounting to billions of dollars per year.

Natalie Ravitz, a spokeswoman for California Senator Barbara Boxer, said that any tax overhaul provisions should not lead to “unintended consequences,” according to a Bloomberg News report.

Rep. Joseph Crowley, a member of the House Ways and Means Committee, reportedly said that he would not welcome any tax law changes that would further hurt Citigroup Inc., a major employer in his district in New York.

Some believe that such drastic measures may be too much, too soon.

“The middle ground would be to sit back, take a careful look at the tax code in its entirety, and try to put together a tax code that will raise federal revenues while at the same time promoting economic growth and job growth,” Dr. Marty Regalia, an economist at the U.S. Chamber of Commerce, in an interview on Fox News this week.

“Unfortunately, that can’t be done with campaign rhetoric. It’s going to take a reasoned, thorough look. And I don’t think this administration really has an appetite for that,” he added.

Businesses, Foreign Nations Weigh In

The proposed tax overhaul would not only dampen corporate profits on Wall Street, but could derail foreign investment into countries with low corporate income taxes. What’s most unnerving to foreign governments, U.S. corporations could be forced to create jobs at home rather than abroad to avoid tax penalties.

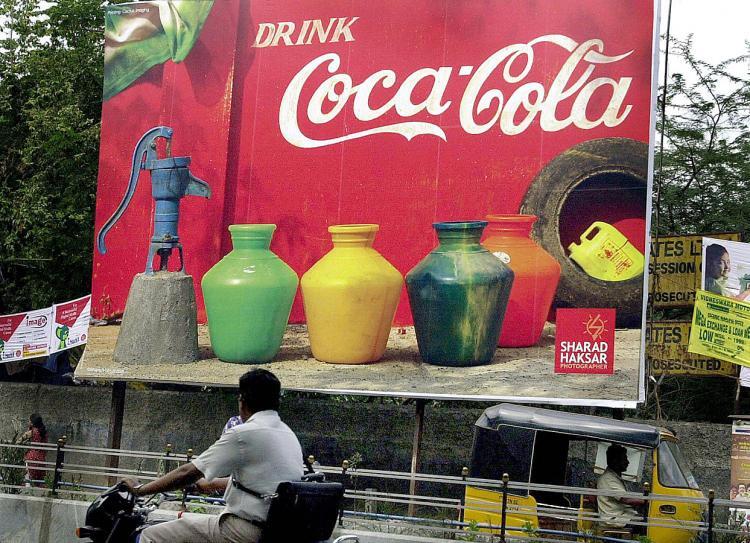

Outsourcing haven India, for one, isn’t thrilled with President Obama’s plans. The country depends heavily on foreign multinational corporations shifting call center, sales, and back-office functions to its technology parks.

“Obama’s new policy is not going to benefit anyone, neither the outsourcing companies nor the country the job is outsourced to,” IT professional Padma Nair said in a Times of India report. “The cost saved in outsourcing is higher than that saved by tax exemption,” Nair said.”

Most corporations are also up in arms about the proposal—over 200 businesses wrote letters to Congress this week in opposition to the tax plan.

“President Obama’s plan today to increase taxes on American corporations is the wrong idea at the wrong time for the wrong reasons,” said John J. Castellani, President of Business Roundtable, in a statement. “This plan will reduce the ability of U.S. companies to compete in foreign markets, which will not only reduce jobs, but will also cripple economic growth here in the United States.”

The tax measures would decrease competitiveness of U.S. companies. Business Roundtable is an association of chief executive officers of leading U.S. companies.

“[We support] the closing of tax loopholes, but given what a fundamental change this represents to our tax system—far beyond targeting so-called loopholes—to say nothing of the dramatic, negative economic impact it will have, President Obama’s proposals should only be considered in the context of broader tax reform that is designed to increase the competitiveness of U.S. companies,” he continued.

“It couldn’t come at a worse time,” Castellani said.