New Canadians and temporary foreign workers who send money to family members back in their home countries are being charged exorbitant transfer service fees, says a national non-profit that represents low- and moderate-income families.

Pascal Apuwa, a spokesperson for ACORN Canada, says fees levied on remittance payments—the money immigrants send to family members in their country of origin—by money transfer organizations such as Western Union are as high as 20–25 percent.

“For every dollar I send, Western Union gets 20 cents,” Apuwa says, regarding his own experience in sending money to family in a rural village in Kenya.

“Western Union is in the small towns and rural areas, but banks are only found in the big cities. My mom is not in the city, she is in a rural area, so that’s why I have to use Western Union.”

In addition, transfer service companies sometimes charge hidden fees and fail to pay full value for exchange rates to poverty-stricken relatives collecting the funds, says Apuwa, a Canadian citizen.

“It’s a very sad situation.”

ACORN Canada has been calling on the federal government to cap the fees placed on remittance payments at 5 percent, a figure cited by the World Bank and the International Monetary Fund as sustainable for both users and the money transfer industry.

ACORN International, with which Acorn Canada is affiliated, launched its “Remittance Justice” campaign in December 2010 with a report detailing the need for government oversight in the massive remittance market.

The report said the high fees charged by money transfer organizations were “predatory” and that no one is taking the plight of the remitting migrant worker seriously.

The global remittance market is set to reach a whopping $440 billion this year, according to the World Bank. ACORN estimates that when informal remittance flows are taken into account, however, values worldwide could be as high as $770 billion.

Remittances from the United States, the most popular “sending country,” amount to over 10 percent of all remittances globally. Statistics Canada reports that about 41 percent of foreign-born residents living in Canada send money home.

That money, notes Apuwa, can go a long way in countries such as Kenya, where many live on less than a dollar a day.

“Ten dollars here is so small, you can’t even count it. But if I send it back home—10 times 93 gives you about 930 Kenyan schillings—if I send that to my mom in a rural area, that’s enough to buy her groceries for two weeks,” he says.

“Right now there are a lot of people dying in Kenya, there’s a lot of drought. With this in mind we know we are helping people in need. A dollar can save someone’s life you know, or at least prolong somebody’s life. Maybe they get that money, they can buy medicine.”

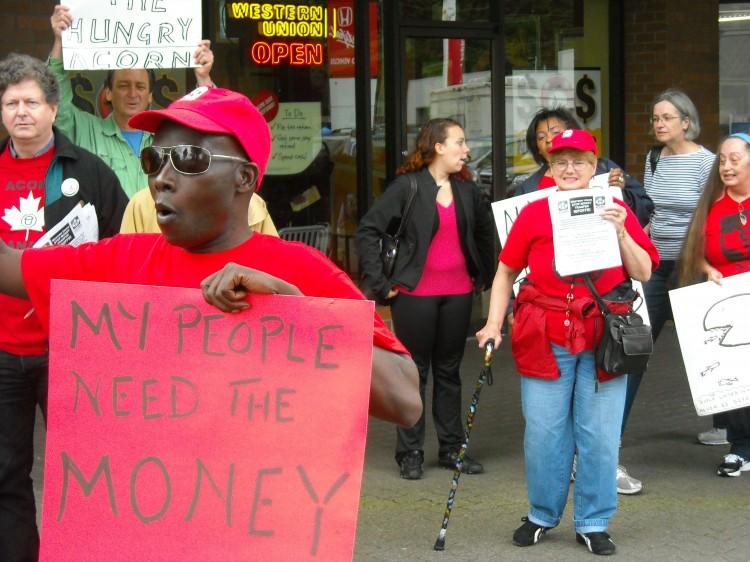

The group recently held a protest at a Money Mart location in Burnaby, B.C., which acts as an agent for Western Union, where they called for lower fees and government oversight on the remittance market.

Pascal Apuwa, a spokesperson for ACORN Canada, says fees levied on remittance payments—the money immigrants send to family members in their country of origin—by money transfer organizations such as Western Union are as high as 20–25 percent.

“For every dollar I send, Western Union gets 20 cents,” Apuwa says, regarding his own experience in sending money to family in a rural village in Kenya.

“Western Union is in the small towns and rural areas, but banks are only found in the big cities. My mom is not in the city, she is in a rural area, so that’s why I have to use Western Union.”

In addition, transfer service companies sometimes charge hidden fees and fail to pay full value for exchange rates to poverty-stricken relatives collecting the funds, says Apuwa, a Canadian citizen.

“It’s a very sad situation.”

ACORN Canada has been calling on the federal government to cap the fees placed on remittance payments at 5 percent, a figure cited by the World Bank and the International Monetary Fund as sustainable for both users and the money transfer industry.

ACORN International, with which Acorn Canada is affiliated, launched its “Remittance Justice” campaign in December 2010 with a report detailing the need for government oversight in the massive remittance market.

The report said the high fees charged by money transfer organizations were “predatory” and that no one is taking the plight of the remitting migrant worker seriously.

The global remittance market is set to reach a whopping $440 billion this year, according to the World Bank. ACORN estimates that when informal remittance flows are taken into account, however, values worldwide could be as high as $770 billion.

Remittances from the United States, the most popular “sending country,” amount to over 10 percent of all remittances globally. Statistics Canada reports that about 41 percent of foreign-born residents living in Canada send money home.

That money, notes Apuwa, can go a long way in countries such as Kenya, where many live on less than a dollar a day.

“Ten dollars here is so small, you can’t even count it. But if I send it back home—10 times 93 gives you about 930 Kenyan schillings—if I send that to my mom in a rural area, that’s enough to buy her groceries for two weeks,” he says.

“Right now there are a lot of people dying in Kenya, there’s a lot of drought. With this in mind we know we are helping people in need. A dollar can save someone’s life you know, or at least prolong somebody’s life. Maybe they get that money, they can buy medicine.”

The group recently held a protest at a Money Mart location in Burnaby, B.C., which acts as an agent for Western Union, where they called for lower fees and government oversight on the remittance market.