Amazon MGM Studios’ highly anticipated television drama series “Fallout,” based on the popular video game franchise of the same name, debuted exclusively on Prime Video on April 10. Set in a post-apocalyptic Los Angeles, the first season was largely filmed in New York, and a second season is already in the works. However, production for the forthcoming series is relocating to California after Amazon nabbed $25 million in tax credits from the state.

California Gov. Gavin Newsom revealed the show is 1 of 12 television productions to secure tax credits through the state’s Film and Television Tax Credit Program, totaling $152 million, per an April 8 press release.

Mr. Newsom indicated the projects will help bolster California’s economy—garnering more than $1.1 billion and providing 4,500 new jobs, in addition to employing 50,000 background performers, or extras.

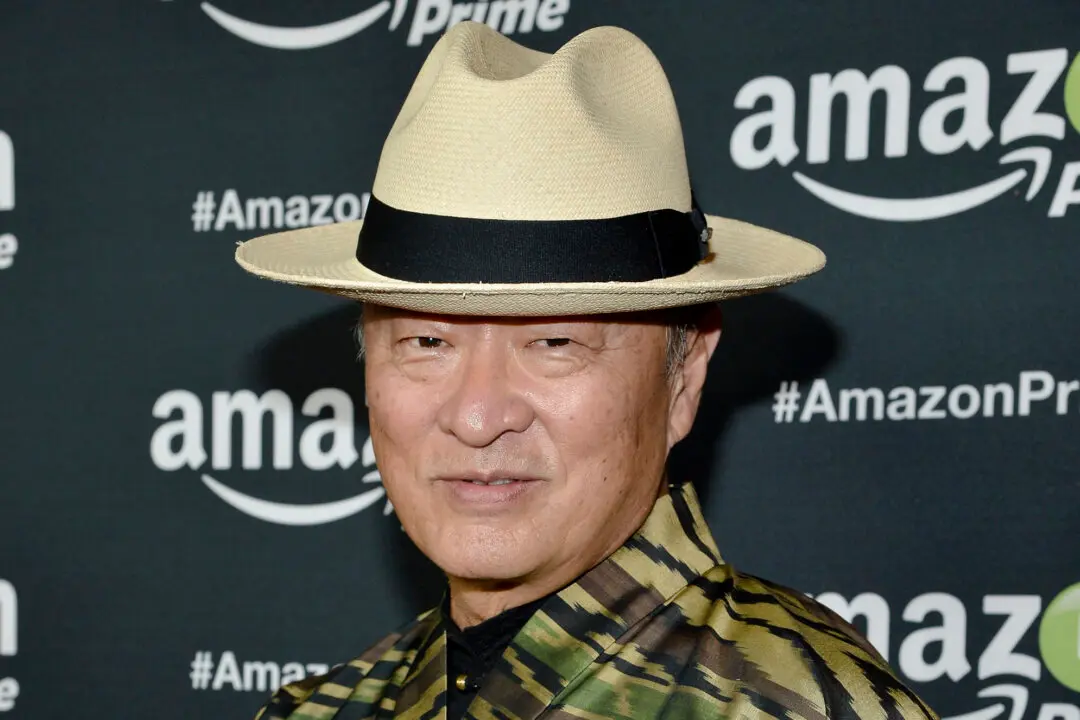

Production for the second season of “Fallout” is expected to contribute $153 million in qualified expenditures alone. Amazon is also projected to employ roughly 170 cast and crew members for the upcoming series adaptation, which stars Ella Purnell “Yellowjackets” and Walton Goggins “Sons of Anarchy,” among others.

“Our tax credit program is delivering precisely as intended: attracting and keeping productions filming in California, creating new job opportunities for our workforce, and bolstering our local economies,” Colleen Bell, executive director of the California Film Commission, said in a statement.

“Additionally, we are thrilled to bring Fallout back to its California roots. We take pride in productions choosing to pack up and relocate to our great state from other jurisdictions,” she added.

In addition to “Fallout,” eight new television series secured tax credits, including 20th Television’s “Dr. Odyssey” and “Grotesquerie,” CBS Studios’ “NCIS: Origins,” Warner Bros. Discovery’s “Latitude” and “The Pitt,” Faith Media Distribution’s “Blood Ties” and “Runaway Girl,” and Amazon MGM Studios’ “Untitled Task Force Series.”

“We’ve had the immense privilege to create stories with the talented crews and individuals in California for years,” the executive producers for “NCIS: Origins,” Mark Harmon, Sean Harmon, Gina Lucita Monreal, and David J. North, shared in a joint statement.

“With the support of the California Film Commission, we are thrilled to film ‘NCIS: Origins’ in Los Angeles, utilizing all of the fantastic resources, locations and most importantly, the talented people in this city we love and call home,” they concluded.

California’s Film and Television Tax Credits

Launched in 2009, California’s Film and Television Tax Credit Program is administered by the California Film Commission, which oversees other production-related duties, such as issuing permits for projects filmed at state-owned properties, according to its website.The current iteration of the $1.55 billion initiative, originally set to expire on June 30, 2025, was extended another five years via Senate Bill 132, signed into law by Mr. Newsom in July of last year. The incentive program provides tax credits for production costs and other qualified expenses on projects produced within California.

Approximately $150 million is available in television tax credits during the next application window, slated for early June, while roughly $80 million is on the table for film tax credits during the next application period, which becomes available via application in late July.

In February, the California Film Commission announced that 15 film productions had secured tax credits totaling a little over $61 million, per a press release.

Tax Credit Programs

California is one of 38 states to offer tax breaks for film and television projects, per Wrapbook. Other states include Georgia, New Jersey, and New York, the lattermost of which recently came under fire earlier this year for failing to give taxpayers a good return on investment.The report, commissioned by New York’s Department of Taxation and Finance and conducted by PFM Group Consulting, also found that many of the film and television projects that claimed the tax breaks would likely have decided to film in New York regardless due to the state’s “prominence in U.S. culture.”

A total of 12 states do not currently offer tax incentive programs for the entertainment industry, including Alaska, Florida, Idaho, Iowa, Kansas, Michigan, New Hampshire, North Dakota, South Dakota, Vermont, Wisconsin, and Wyoming.