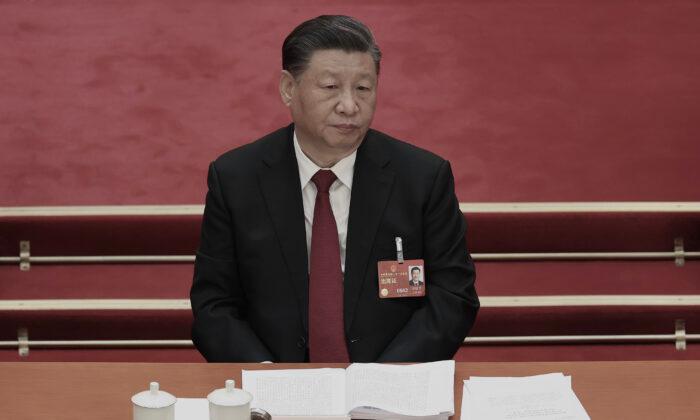

China featured large in a recent article carried by the prestigious The Atlantic magazine. In those pages, China experts from the American Enterprise Institute, Dan Blumenthal and Derek Scissors, dissected the change Xi Jinping has wrought in the country’s economic objectives since he took office in 2013.

All his predecessors, from Deng Xiaoping to Hu Jintao, had straightforward aims: promoting growth to develop China’s economy at every level, elevating China’s stature globally, and securing domestic tranquility by improving the lot of the Chinese people.

Xi, in contrast, has more particular and militant goals. According to this analysis, he aims to minimize China’s dependence on other nations and maximize its ability to coerce other nations. His plans are not working smoothly at all. It is not apparent that they ever could.

Xi’s plan, according to these two analysts, rests on his assertion that the “powerful gravitational field” of China’s state-controlled market will reshape supply chains in Beijing’s favor. To exercise such overwhelming control, Xi has tried to dominate global production in a number of critical areas. China already produces most of the world’s electric vehicles and lithium batteries. The same could be said of windmills and solar panels. It also plays a significant role in producing inputs to many of the world’s pharmaceuticals. China also controls the flow of rare earth elements necessary for producing many of these products.

Xi’s program also looks to bring China global dominance in low-end computer chips. The aim is to create an oversupply that will drive foreign competition out of business. Further steps in Xi’s plan involve Chinese dominance in high-end technologies, some through organic development but mostly using trade to force transfers from the West and Japan and also by outright theft. The amount of control required by these efforts has impelled Xi to become less and less tolerant of private Chinese business largely because of its insistence on following profits instead of Beijing’s directions.

These plans have clearly come up against difficulties. For one, Beijing’s more assertive behavior has induced pushback from Washington, Tokyo, and to a lesser extent, Europe. The United States now has legislation to thwart Beijing’s plan to add semiconductors to the list of essential products over which China has control. Washington now subsidizes semiconductor production in the United States and further forbids the sale of advanced chips and chipmaking equipment to China. Japan and the Netherlands have joined Washington in these bans. Meanwhile, Tokyo has made efforts to get the G-7 countries to acquire assets around the world and so block China from getting a stranglehold on rare earth elements.

Perhaps more significant than these government moves is the clear tendency of Western and Japanese producers to invest away from China. Apple, for example, has decided to move the assembly of its iPads from China to Vietnam. Samsung is making similar decisions regarding its production in China. Recent research reveals that 95 percent of multinationals are concerned about the risk of doing business in China, up from 62 percent only two years ago. To a large extent, it is the sharp rise in Chinese wages that is driving away this foreign investment, but it is also concerns about the reliability of Chinese production that stem from Beijing’s increasingly aggressive practices on trade as well as the demands for technology transfers.

Xi’s approach has even begun to lose him domestic support. His critical rhetoric of private businesses’ lack of patriotism and unwillingness to support party policies has chafed and, not surprisingly, undermined business confidence in the future. Private Chinese firms have accordingly held back on their investments, which have grown a mere 0.6 percent in the past year. Xi is aware of the economic burdens this behavior has caused and, of late, has set out to woo private businesses with softer rhetoric, so far to little effect.

Xi may yet make headway on his plans. After all, China’s domestic market has grown so large that the West and Japan can hardly ignore it. But otherwise, it seems as though Beijing has overplayed its hand. Had China’s government resisted pulling every power lever, it might have delayed the day when Washington, Tokyo, Europe, and foreign business awakened to Beijing’s open hostility. Now that damage is done. In one important sense, the fundamental inconsistency of Xi’s plans gives ample reason to doubt their ultimate success, even if Beijing had played a better game with the rest of the developed world.

A nation cannot be independent of the world and dominate its trade simultaneously. To dominate trade, it must engage in it, making it vulnerable to buyers and sellers. That fact alone might defeat Xi however determined he is.