Chinese authorities admitted on March 19 that outbreaks of new COVID-19 cases occurred in “multiple cities at the same time.” Although the Chinese Center for Disease Control and Prevention (China CDC) still claims that “Dynamic Zero-COVID” strategy suits the situation in China, analysts believe that this policy will make the already difficult local finances even more strained.

Liang Wannian, head of the expert panel for China’s pandemic response, clarified that the new “dynamic Zero-COVID” policy can have two meanings. One, is the ideal situation of absolutely no patients, and the other, is that as soon as there is a new outbreak, patients are “quickly identified” so that the outbreak can be “nipped in the bud.”

While touting China’s Zero-COVID policy, Liang denigrated the concept of “Coexisting with the virus” in the West as “lying flat,” meaning, a passive do-nothing approach.

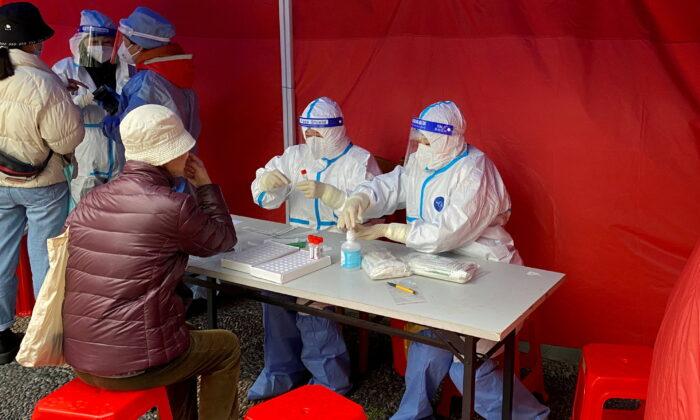

He also stressed that “quick identification” requires that antigen tests and PCR tests should complement each other. Regardless of the test method, the funding for mass testing is a pressing burden for local governments.

Taking Zhengzhou as an example, from Jan. 3 to Jan. 11, the city’s entire 12 million population went through four rounds of PCR tests, and the most suspect individuals went through six rounds of tests. The cost was 24 to 48 yuan (about $3.80-$7.70) per test per person, and the total sum was certainly a considerable amount.

Albert Song, a financial analyst with 27 years of experience in China’s financial industry, told The Epoch Times on March 21 that China’s local finances are already under great pressure, and the CCP’s “zero-COVID” policy has exacerbated the conflict between the central and local finance departments.

“The conflict is increasingly intensified and is becoming increasingly obvious,” Song said.

Conflicts of Central and Local Financial Departments

The financial distress of local governments can be seen from the scale of new loans issued and the degree of dependence local governments have on the central government.Chinese authorities usually determine the scale of new debt after the Two Sessions each year, and the money is gradually distributed from central government to provincial level, then to city level and county level in May and June.

However, due to financial constraints in recent years, the debt scale was announced in mid-December last year, when 1.788 trillion yuan (about $281 billion) of new debt was added. About 70 percent of it has been issued so far.

Moreover, Chinese Premier Li Keqiang’s recently released 2022 Government Work Report stated that “transfer payments” from the central government to local governments reached nearly 9.8 trillion yuan (about $1.6 trillion) this year, an increase of 1.5 trillion yuan (about $240 billion) from last year.

“Transfer payments” are funds returned from central government to local governments after the former collects tax revenues from the latter. Due to corruption, many local governments have been running at a loss for a long time.

Song explained that it is through “transfer payments” that the central government controls local governments.

“The central government’s centralization in recent years is characterized by ‘financial power is in the hands of the upper level while administrative power is transferred to lower levels.’ That is to say, the central government has seized financial power, and the control ratio has reached 70 percent, but the power to handle administrative affairs has been released,” Song said. “Local governments receive less money, but have more jobs to do. They have to rely on the ‘transfer payments’ from the central government. This has become the focus of the conflict between the two.”

Moreover, local governments are seeing drastically reduced revenues as their income from land sales has dropped significantly, amid tightened regulation by the central authorities. According to Song, local officials have a lot of complaints in this regard.

“Now China’s economy is declining, tax revenue is limited, and the real estate market has cooled down. Both the central government and local government are facing serious pressures. At present, the conflict between central and local finance is getting more and more intensified,” Song said.

Shanghai Has Changed Its Pandemic Measures

Wu Fan, an expert in the Shanghai Pandemic Prevention and Control Expert Group, said on March 18 that Shanghai’s pandemic control practice will be changed.Wu said that Shanghai, a mega city with a population of nearly 30 million, would not be locked down or suspended for pandemic control. “In a sense, we are forced to take this approach, because Shanghai is not just a city of the people of Shanghai. It is a city of all the Chinese people,” she said. “Its importance to China’s economic and social development is irreplaceable, and local economic activities will even affect the overall situation of the international economy.”

Wu Fan said that if Shanghai’s container ports are suspended, many international trade shipments will be implicated. During a 10-day lockdown, migrant workers have to stop working, and all kinds of losses would be too great to bear, Wu added.

Regarding the severity of the epidemic in Shanghai, Wu said, “The previous number of cases reported was only the tip of the iceberg … The staff at Shanghai’s CDC and grassroots pandemic control teams are already exhausted.”