The Chinese Communist Party’s (CCP) strict controls on foreign exchange have led to a proliferation of underground banks. Shanghai police recently cracked the first case of an underground bank selling game time cards (GTC) as a cover for illegal currency exchange. In six years, the underground bank has transferred $3.75 billion.

According to Chinese media reports, the underground bank used the GTCs as a medium to form a multi-link currency exchange chain in China, helping domestic and foreign customers exchange currencies. Over 20 people have been arrested and 3 online exchange platforms have been shut down.

According to the report, the suspects liked the international liquidity and price stability of online GTCs. Through a self-fixed exchange rate, the cards are used as the medium to connect the domestic and foreign exchange transactions, so that it looks legitimate. The suspects recruited several domestic GTC dealers to facilitate the illegal exchange of foreign currency.

SAFE Reported 10 Cases of Illegal Foreign Exchange

On the same day the state media revealed the first case of illegal currency exchange via game point cards, the CCP’s State Administration of Foreign Exchange (SAFE) reported 10 cases of illegal currency exchange by “underground banks.” The 10 cases involved two enterprises and eight individuals punished by the SAFE from 2020 to 2021.Among them, the biggest penalty was for illegal trading of foreign exchange by a person outside China named Zeng. From November 2018 to January 2020, Zeng illegally traded 32 foreign exchange transactions through underground banks, totaling $7.472 million, and was fined $841,750.

The two companies were Anshan Dingtai Earthwork Engineering Co., LTD. and Nanjing Jin’ao Real Estate Co., LTD. In December 2019, Anshan Dingtai was fined about $105,510 for three illegal transactions of foreign exchange through underground banks, totaling $812,000. From May to June 2020, Nanjing Jin'ao illegally traded three foreign exchange transactions through underground banks, totaling $635,000, and was fined about $70,340.

CCP Tightens Foreign Exchange Controls

Xia Yeliang, a former professor at Peking University’s School of Economics and a visiting fellow at the Cato Institute, told The Epoch Times that the CCP relaxed foreign exchange controls in the 1990s, hoping to eventually make RMB freely convertible and make it an international means of payment and storage. But when Xi Jinping came to power in 2012, changes occurred and the CCP began to tighten foreign exchange controls.Underground Banks Persist in China Despite Repeated Prohibition

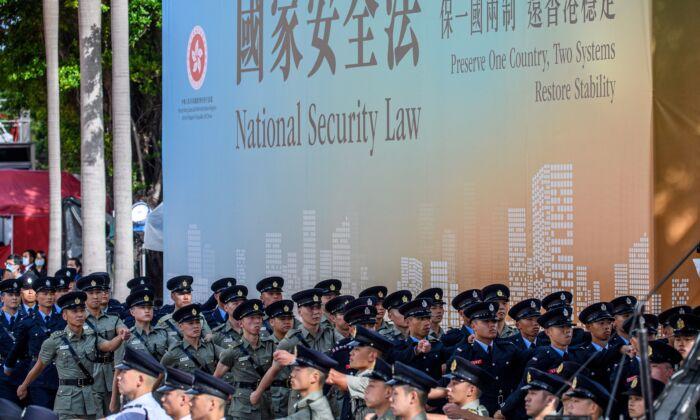

Xia said he knew the rules when he taught at Peking University. People were transferring money to Hong Kong and then to the rest of the world. But large sums of money are hard to carry, and so underground banks emerged. Now that Hong Kong is controlled by the CCP, it’s hard to transfer through Hong Kong.Xia said underground banks face the highest risks because they have to trust each other without formal written contracts. Meanwhile, the commission is high, with the minimum being 3 percent.

Danny Lau Tat-pong, a Hong Kong business leader with factories in China, told The Epoch Times, “There are also many underground banks that don’t charge a handling fee and pocket the difference [instead]. For example, if 100 Hong Kong dollars (about $13) is exchanged for 82 yuan ($12.82), he may give you 80 yuan ($12.50), and pockets the difference. It’s easier to make more money from pocketing the difference.”

Lau is the honorary chairman of the Hong Kong Small and Medium Enterprises Association. He said that no matter how Beijing controls capital flight, people always have opportunities to transfer money out of the country. “For example, if someone needs to transfer money out and someone else needs to transfer money in, then they just hit it off. Both sides have the need, and they can exchange it through intermediaries or other channels.”