Weeks ago China released a bunch of economic figures for June and the second quarter. Despite beating expectations, most series continue to show a downtrend after the unusual rebound due to exceptionally low base effect in the first quarter. While countries of BRICS belong to the same class, India, Brazil, Russia, and South Africa had first-quarter GDP growth rates at only 1.64 percent, 0.95 percent, –0.7 percent, and –3.2 percent respectively. Yet China’s was an unbelievably high 18.3 percent. It was funny that none of the stock markets reacted to that.

The even funnier thing was the fixed assets ex rural year-to-date year-on-year (YTD, YoY) growth; the June number was +12.6 percent. What an outstanding number widely admired in the local media. However, guys with clear minds found that the assets levels for June 2020 and June 2021 were 28.16 and 25.59 respectively, both YTD in trillion Yuan. One does not need a calculator to figure out that this is a YoY decline. This is a big joke to the world, really. Alright, there must be a revision to either figure, but who wants to dig it out from their release?

Had the economy been really good, the People’s Bank of China (PBoC) would not have to ease the monetary policy by cutting the required reserve ratio (RRR) comprehensively. India and Russia are having the latest inflation at 6 percent+ while Brazil 8 percent+, China’s is declining from 1.3 percent to 1.1 percent despite the producers inflation is near 9 percent. If these numbers were not fake, the story behind would be a very weak aggregate demand, or an incredibly low inflation figure was created to justify the RRR cut. In either case, this reveals a very problematic economy.

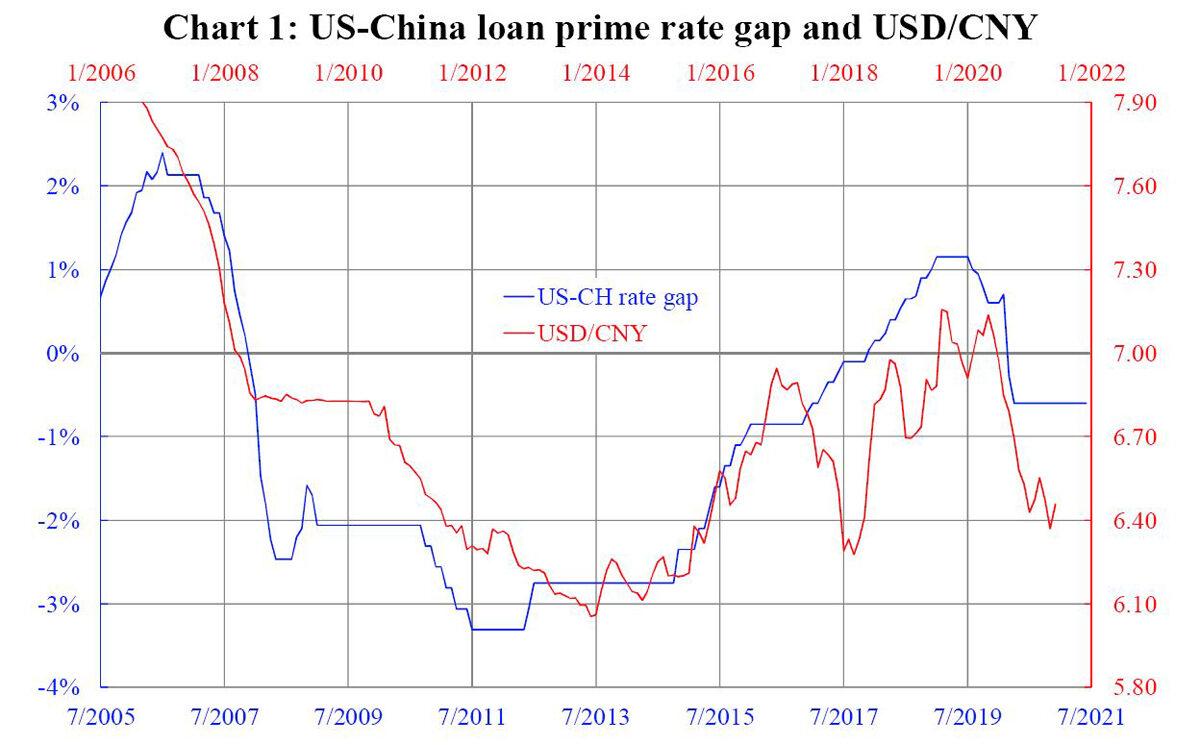

Previously PBoC left the loan prime rates (LPRs) unchanged for both one and five-year tenors. Some market analysts had anticipated PBoC to cut-rate in line with RRR cut, but in fact not. The reason is simple under interest rate parity. The United States also has a loan prime rate given by the Federal Reserve. Chart 1 computes the difference between U.S. and China loan prime rates, which is then compared with the corresponding pair of exchange rate USD/CNY. The parity is somehow illustrated with the interest rate gap leading the exchange rate by half a year.

In order to maintain a stable exchange rate or equivalently no unilateral net flows between two places, a stable interest rate gap is needed. This means if the Fed is not altering its interest rate, PBoC will not have much room to do so. However, the macros are different in that the China economy is weakening (have a look at the PMIs and you will see) while the rest of the world is improving. Similar contrasts are also found by comparing inflation and stock market performance between the two. Thus, China does need some accommodative policies.

A strict cut of interest rate by the PBoC will obviously lead to imminent outflow pressure. So they can only ease on quantity (RRR) rather than on price (interest rate). This means banks can lend more rather than lend cheap. However, experience shows RRR cuts were mostly futile because borrowing incentive was not altered given price of funds unchanged. Similarly, banks had no extra incentive to supply more funds without a change in their pricing. The above is easily derived from simple economic theories, just now evidence proves it.

What could they do in case the rest of the world is hiking interest rates? They would likely follow it partially than completely, given corporate defaults have been rising when rates are low. Yet the widening interest rate gap means the exchange rate will have depreciation pressure. This is exactly in line with the official tone where Yuan could go weak from 6.40.

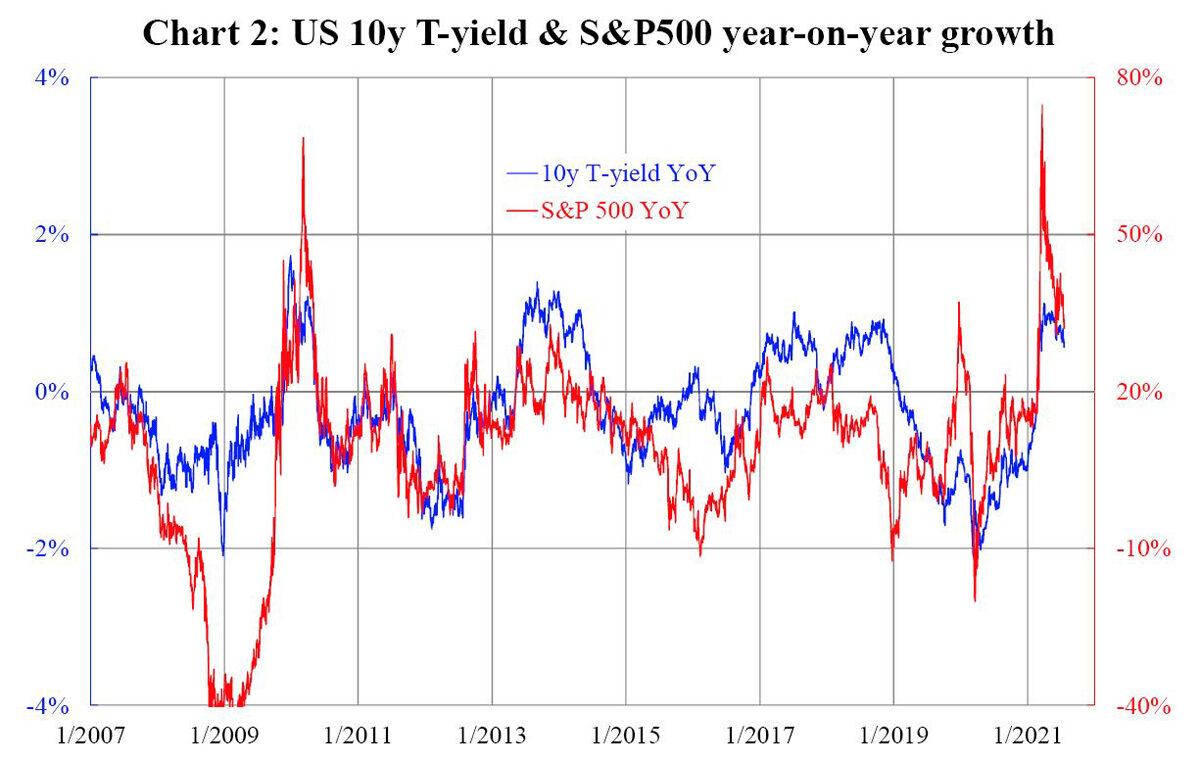

This week, the U.S. market has been getting volatile with a stocktaking roller coaster especially on the Asian side. U.S. 10-year Treasury yield has set back for over 50 basis points from the peak in end-March. This is generally a bad omen for the risk-on assets ahead. As is seen from Chart 2, long-tenor Treasury yield YoY change has been highly positively correlated with the U.S. stock index YoY change despite short-term discrepancies. Were the 10-year yield approaching 1 percent, overall risk appetite will certainly worsen for a long while.

This week the Asian market slumped for the infighting between the Chinese government and the entrepreneurs. Foreign investors will find investing in China have infighting risks on top of the traditional policy risks. This could be just the beginning where many more sectors will be “rectified.” Given all these, funds have been flowing from the East to the West so that Asian stocks plummeting while the United States is breaking record highs. Such trend is likely to last for some time probably until the end of the third quarter, and sectoral rotation will become geographical rotation.