Asia’s biggest shipping firm, China Cosco Holdings, suffered the biggest interim net loss of a mainland-listed company ever despite a stabilizing global shipping market.

The Hong Kong-listed shipping giant, formerly known as China Ocean Shipping Co. (Cosco), reported a net loss of 7.2 billion yuan (US$1.1 billion) for the first six months of 2016, compared to profits of 1.97 billion yuan in the same period one year ago.

The state-owned company blamed the loss on lower demand for container shipping services and one-time charges related to the February merger between Cosco and China Shipping Group. Of the total deficit, 2.4 billion yuan were related to sales of subsidiaries—at a loss—in connection with the consolidation.

The massive six-month loss is the biggest of any listed Chinese company since A-shares were introduced in 1990.

Industry-Wide Slump

The entire dry bulk shipping industry had been mired in a years-long slump.

The dry bulk market has been experiencing disequilibrium between supply and demand. Expecting continued emerging markets growth—especially from China—a large number of ships were ordered prior to the 2008 global financial crisis.

Due to the high backlog and slow shipbuilding process, by the time the ships were finally delivered into service years later, the Chinese economy had slowed considerably and its demand for iron ore, coal, and lumber waned. The excessive supply of ship capacity and lower imports from China drove down the price and volume of global shipping.

Market Rebalancing

In recent months, the dry bulk market has rebounded somewhat and while experts offer divergent views, the consensus is that the market has been stabilizing on a convergence of supply and demand.

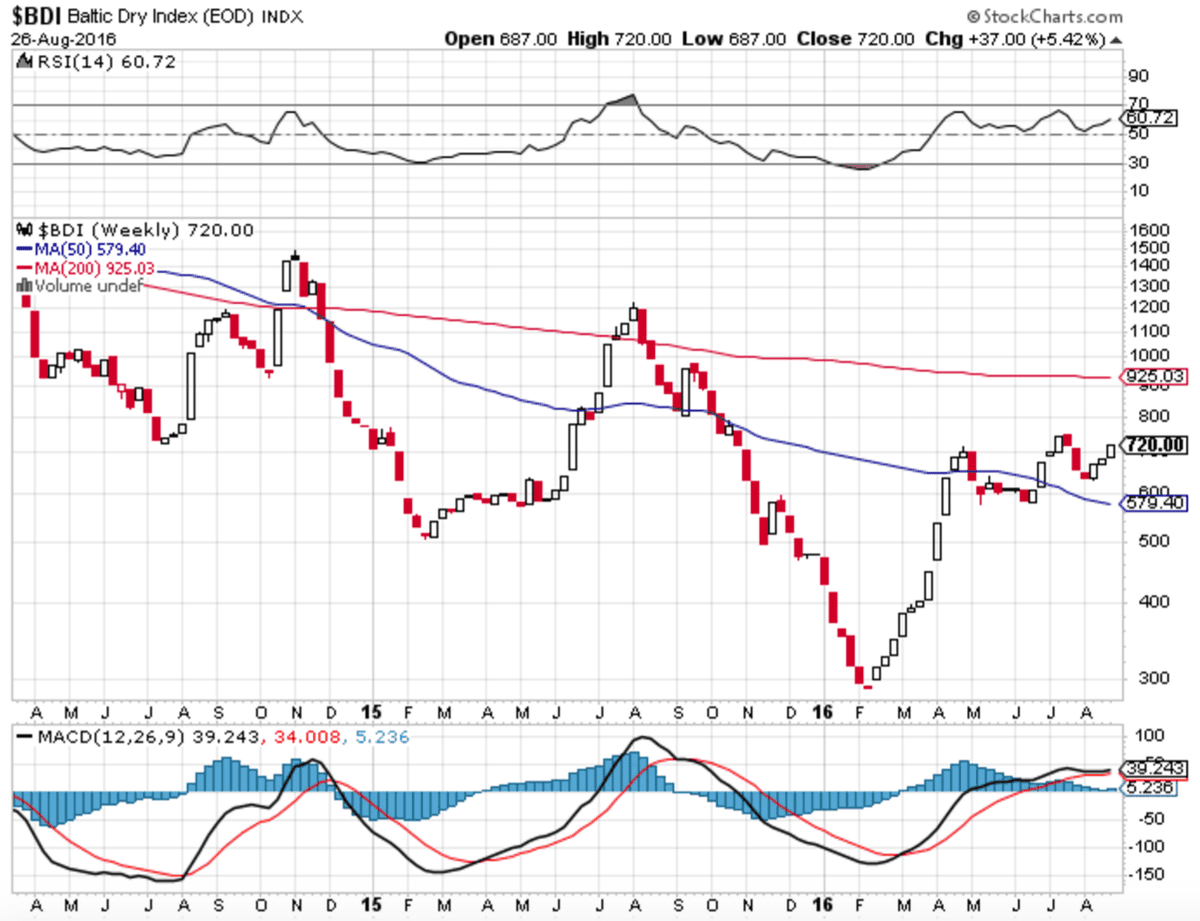

The Baltic Dry Index, a composite of the Baltic Capesize, Supramax, Panamax, and Handysize indices, is a commonly used benchmark for prices of shipping bulk commodities. After reaching a low in February, the index has rebounded in recent months.

On the supply side, capacity is being trimmed as deliveries of new ships and orders of shipbuilding have slowed. “Ship-owners opted to delete 2.8 percent of total dry bulk capacity and 2.5 percent of Handysize capacity rather than continue to operate their older or poorly designed ships in such depressed trading conditions,” according to Pacific Basin Shipping, a leading Hong Kong-based operator of shipping vessels.

“For the first time since the 1980s, we observed a meaningful number of vessels withdrawn from the market for short-term idling or longer-term lay-up.” In other words, vessel operators are scrapping ships and cutting shipping capacity.

On the demand side, growing Chinese imports for both iron ore and coal is a favorable—although temporary—development in the industry. Pacific Basin reported increased iron ore exports, especially from Brazil, as well as growth in Chinese steel exports and bauxite and copper concentrates imports.

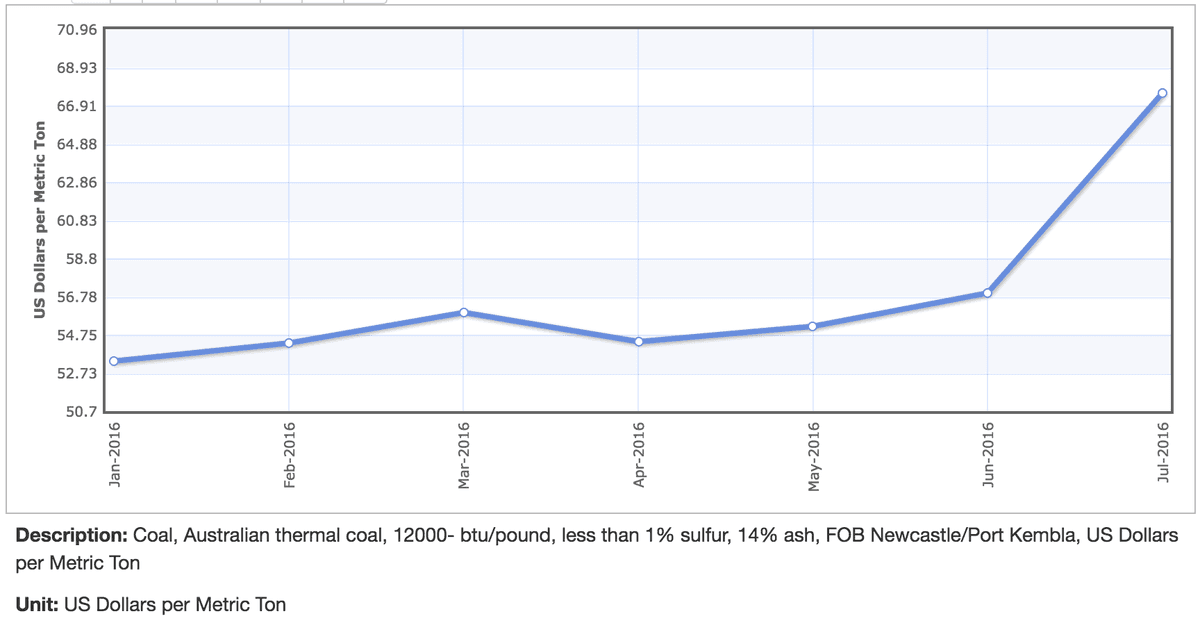

The Chinese Communist regime has been steadily cutting domestic coal production. Beijing announced in February plans to eliminate more than 500 million metric tons of annual coal output by 2020. Those cuts are already underway, and if such targets are met, almost 15 percent of its current coal production capacity will be slashed.

Despite mandates from Beijing, certain regions have been slow to decrease coal dependency. This created a temporary gap in domestic production versus consumption of coal, a gap currently filled by foreign imports.

Reflecting increased demand from China, Newcastle Thermal Coal, an Asian-Australia coal price benchmark, is up around 27 percent year-to-date.

But the positive developments could just be skin-deep. While bulk shipping rates are climbing, decreasing activity capacity could mean profits at shipping firms would remain flat-to-down this year, taking into consideration unused capacity. Drewry, a maritime consulting firm, forecast total losses of more than $5 billion for the industry as a whole this year.

On the ground in China, iron ore is piling up. Stocks of iron ore are burgeoning at the Chinese ports, despite stronger steel margins and production in China.

A source with a major Western iron ore trading company told industry publication Hellenic Shipping News, “It is getting pretty difficult to sell our port [ore] stocks.”