Chinese leader Xi Jinping called the President of Sierra Leone, promising to help the small West African country with its fight on the pandemic. He emphasized that the two sides should “expand mutually beneficial cooperation.” Analysts speculate that the move is related to the rich mineral resources in Sierra Leone that China needs.

China is the world’s largest steel producer. However, as the low quality and quantity of domestic iron ore are far from meeting the needs of domestic steel production, 80 percent of the ore is imported, mostly from Australia and Brazil.

Last year, the Australian government called on the international community to launch an independent investigation into the origins of the Chinese Communist Party virus, commonly known as the novel coronavirus. China soon retaliated by starting an invisible trade war between the two countries. To remove its dependence on imports from Australia, Beijing issued an unofficial ban, urging the Chinese steel industry to switch to Brazilian iron ore, despite its relatively low quality.

However, Brazil’s mines encountered extreme rains this year, resulting in reduced shipments and insufficient supply at the iron ore mines. In addition, Brazilian President Jair Bolsonaro hinted on May 5 that the CCP virus may be a biological weapon developed by the CCP.

CCP Grabs Iron Ore in Africa At All Costs

At the end of last year, both Congo and Cameroon withdrew the mining rights of Australia’s Sundance company to the 5.64 billion tons of Mbalam-Nabeba project iron ore that spanned the two countries, and transferred part of the mines to Chinese companies.As early as 2012 and 2014, Sundance signed agreements with the governments of Cameroon and Congo to mine the iron ore. At that time, the company planned to invest $8.7 billion for the constructions of a 360-mile railway and iron ore terminal.

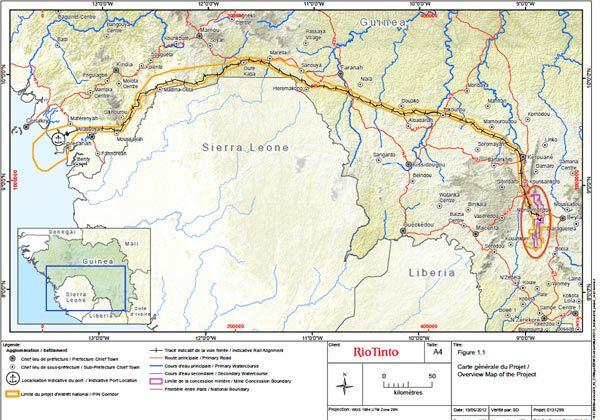

Sierra Leone, located on the west coast of Africa, is rich in iron ore. Chinese companies have been operating there for about 10 years, and restarted a suspended project last year.

China’s state-owned Shandong Iron and Steel Company started operations at Tonkolili iron ore and exported the ore to China in 2011. The export volume peaked in 2014 at 19.03 million tons. After 2017, due to the Ebola virus epidemic and low prices for iron ore, the Tonkolili project was halted. Sierra Leone’s annual iron ore exports to China then plummeted to below 1 million tons in 2018, and to zero in 2020.

Chinese company, Qinghua Investment Co., Ltd., took over the iron ore on Sept. 23, 2020, and resumed operations. The first shipment headed to China on Jan. 29, this year.

In addition, the CCP has invested $14 billion in Guinea to obtain the mining rights of its Simandou mine, a gigantic mine with more than 2.25 billion tons of iron ore reserves that is located in a remote mountainous area. Chinese companies are currently constructing railways in Guinea to prepare for the Simandou project. It is estimated that it will take at least 5-7 years for the mine to start producing.

“China has options in Africa, and even if newly tapped African iron ore deposits take several years and massive injections of capital to develop, this will not deter China, who knows how to play the long game,” the report stated.

Similarly, the China-Africa Trade Research Center, a CCP think tank, emphasized in a report released on April 20, that the CCP has multiple choices in Africa, therefore, “even if the newly invested African iron mines require several years of development and huge sum of capital injection, it will not stop China’s investment.”

Li Yanming, a U.S.-based expert on China issues, told The Epoch Times that Xi Jinping’s personal involvement in talking to leaders of these African countries shows his determination to be rid of China’s dependence on Australia. It also indicates that China’s iron ore imports are in trouble. The CCP hopes that working with these African countries will be an alternative option to save itself from a serious predicament.