Canada’s Superintendent of Financial Institutions announced Thursday that the stress test rate for mortgage applications will remain the same after his annual review.

The minimum qualifying rate (MQR), also known as the stress test, will remain at whichever is greater—the mortgage contract rate plus a 2 percent buffer, or 5.25 percent. So, if a mortgage contract rate is 6.45 percent—the current prime rate in Canada—lenders regulated by the government must ensure borrowers could pay their bills at a rate of 8.45 percent.

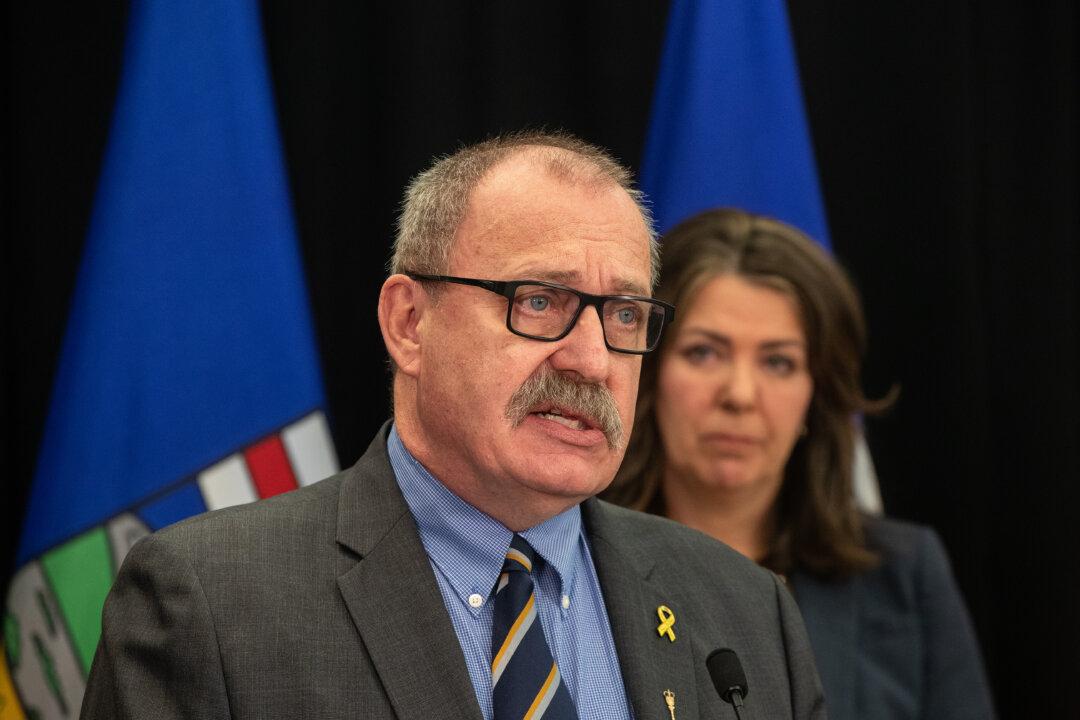

At the announcement, Superintendent Peter Routledge was asked by a reporter if he thought this might drive borrowers to alternative lenders. That could mean higher interest rates for them and greater risk.

Routledge replied: “We’re really looking at risks to the financial institutions that we regulate, ultimately with the aim of protecting borrowers and creditors and their interests and rights.”

He added, “The specific risk that we’re looking at when it comes to the MQR and the impact on borrowers is really, obviously, the impact of the potential for increasing interest rates, also of course, unexpected expenses and shocks to their income.”

On Jan. 23, The Office of the Superintendent of Financial Institutions (OSFI) will launch a broad policy review of its Guideline B-20, its guidance on residential mortgage and underwriting practices. Routledge said the length of this process “will be measured in months rather than weeks.” OSFI will invite input from stakeholders on its current Guideline B-20. Then it will make proposed changes and open those changes up to feedback again before finalizing them.

He said this review will not specifically look at changing the MQR. In theory, OSFI could change the MQR at any time, he said. But it is likely only to change, if at all, after the next annual review.

When setting the MQR, he said, his office considers macroeconomic factors, the housing and mortgage market, the financial institutions it regulates and their risk profiles, and a range of plausible scenarios.

The current rate was set last December, and OSFI said in a release at the time, “In an environment characterized by increased household indebtedness and low interest rates, it is essential that lenders test their borrowers to ensure that mortgages can continue to be paid during more adverse conditions.” Interest rates were less than half what they are now.

OSFI’s statement on Thursday’s announcement said: “In an environment characterized by rising mortgage interest rates, sustained high inflation and potential risks to borrower income, it is prudent that lenders continue to test borrowers for adverse conditions.”