Senior cabinet ministers in four countries on Tuesday expressed Canada’s staunch opposition to the proposal for a global tax on financial institutions as a way to prevent another meltdown and subsequent bailout of banks.

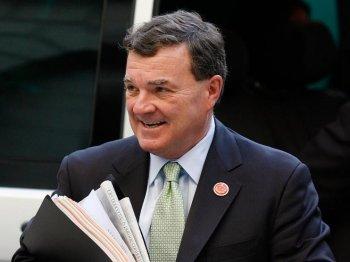

Industry Minister Tony Clement and Foreign Affairs Minister Lawrence Cannon spoke in Ottawa, insisting that it makes no sense to impose a tax on Canada’s banking sector, known to be one of the soundest in the world.

Echoing their stance was Finance Minister Jim Flaherty in Mumbai, Minister for the Asia–Pacific Gateway Stockwell Day in Beijing, and International Trade Minister Peter Van Loan in Washington, D.C.

“Make no mistake, our government is opposed to a global bank tax. This tax would reach into consumers’ pockets and punish our financial institutions, which have taken precautions to avoid turmoil,” Clement told reporters on Parliament Hill.

“We must ensure the transparency of our banking sector, but at the same time we must not unduly burden it with a tax that will put it at a competitive disadvantage to banks in other countries,” Clement said, adding that such a tax would be unfair to consumers, who would “ultimately foot the bill.”

Canada has its own proposal to prevent banks from going bust which, in a conference call from Mumbai, Flaherty said is gaining “some support” among G20 economies.

“We are detailing that proposal now in further correspondence to my G20 colleagues,” he said. “We think this is the way to go.”

Called “embedded contingent capital,” Canada’s alternative to a global tax would give banks a way to convert debt to equity to insure themselves against failure. Superintendent of Financial Institutions Julie Dickson views the proposal as the best of several options being floated to regulate the global financial system.

The idea of a “global financial levy” on banks was first broached last year by former British Prime Minister Gordon Brown. At a conference in London in February, Brown said he hoped for an agreement on a global bank tax at the June G20 summit in Toronto and the G20 meeting in South Korea in November.

Flaherty said that while discussions on financial sector reform would take place at the Toronto G20, a consensus on global banking rules—whatever they may be—are more likely to be reached at the later meeting in Korea.

Canada’s opposition to the global levy is supported by Bank of Canada Governor Mark Carney as well as the six major Canadian banks. Efforts to have the proposal endorsed at a G20 meeting of central bankers and finance ministers in Washington last month failed.

“The bank tax is not going to gain the kind of universal support that perhaps some thought it would obtain,” Flaherty said, adding that the debate is acting as a distraction from the issue of real global financial reform.

Britain, France, Germany, and Italy are in favour of a global bank tax with the support of most of Europe, while Canada, Japan, Brazil, Australia, and others are opposed. It is unclear whether newly elected British PM David Cameron supports it. The United States looks to be for the tax.

In Ottawa, Cannon said that with the G20 approaching, “we wanted to get out in front of it quite frankly and make sure people knew what Canada’s position was.”

“Because we feel we’re not alone on this. We do not feel isolated in this position. There are other countries that we feel share the same position, so we want to exercise some global leadership.”

Meanwhile, Axel Weber, a member of the European Central Bank’s governing council and head of the Deutsche Bundesbank, suggested that it’s impossible to keep banks from going under and that world leaders should drop efforts to prevent it.

“It is neither possible nor desirable to prevent the collapse of individual financial institutions,” Weber said, according to Reuters.

Banks should avail of the current favourable conditions to “strengthen their risk capacity and build adequate capital buffers,” Weber said.

Industry Minister Tony Clement and Foreign Affairs Minister Lawrence Cannon spoke in Ottawa, insisting that it makes no sense to impose a tax on Canada’s banking sector, known to be one of the soundest in the world.

Echoing their stance was Finance Minister Jim Flaherty in Mumbai, Minister for the Asia–Pacific Gateway Stockwell Day in Beijing, and International Trade Minister Peter Van Loan in Washington, D.C.

“Make no mistake, our government is opposed to a global bank tax. This tax would reach into consumers’ pockets and punish our financial institutions, which have taken precautions to avoid turmoil,” Clement told reporters on Parliament Hill.

“We must ensure the transparency of our banking sector, but at the same time we must not unduly burden it with a tax that will put it at a competitive disadvantage to banks in other countries,” Clement said, adding that such a tax would be unfair to consumers, who would “ultimately foot the bill.”

Canada has its own proposal to prevent banks from going bust which, in a conference call from Mumbai, Flaherty said is gaining “some support” among G20 economies.

“We are detailing that proposal now in further correspondence to my G20 colleagues,” he said. “We think this is the way to go.”

Called “embedded contingent capital,” Canada’s alternative to a global tax would give banks a way to convert debt to equity to insure themselves against failure. Superintendent of Financial Institutions Julie Dickson views the proposal as the best of several options being floated to regulate the global financial system.

The idea of a “global financial levy” on banks was first broached last year by former British Prime Minister Gordon Brown. At a conference in London in February, Brown said he hoped for an agreement on a global bank tax at the June G20 summit in Toronto and the G20 meeting in South Korea in November.

Flaherty said that while discussions on financial sector reform would take place at the Toronto G20, a consensus on global banking rules—whatever they may be—are more likely to be reached at the later meeting in Korea.

Canada’s opposition to the global levy is supported by Bank of Canada Governor Mark Carney as well as the six major Canadian banks. Efforts to have the proposal endorsed at a G20 meeting of central bankers and finance ministers in Washington last month failed.

“The bank tax is not going to gain the kind of universal support that perhaps some thought it would obtain,” Flaherty said, adding that the debate is acting as a distraction from the issue of real global financial reform.

Britain, France, Germany, and Italy are in favour of a global bank tax with the support of most of Europe, while Canada, Japan, Brazil, Australia, and others are opposed. It is unclear whether newly elected British PM David Cameron supports it. The United States looks to be for the tax.

In Ottawa, Cannon said that with the G20 approaching, “we wanted to get out in front of it quite frankly and make sure people knew what Canada’s position was.”

“Because we feel we’re not alone on this. We do not feel isolated in this position. There are other countries that we feel share the same position, so we want to exercise some global leadership.”

Meanwhile, Axel Weber, a member of the European Central Bank’s governing council and head of the Deutsche Bundesbank, suggested that it’s impossible to keep banks from going under and that world leaders should drop efforts to prevent it.

“It is neither possible nor desirable to prevent the collapse of individual financial institutions,” Weber said, according to Reuters.

Banks should avail of the current favourable conditions to “strengthen their risk capacity and build adequate capital buffers,” Weber said.