Commentary

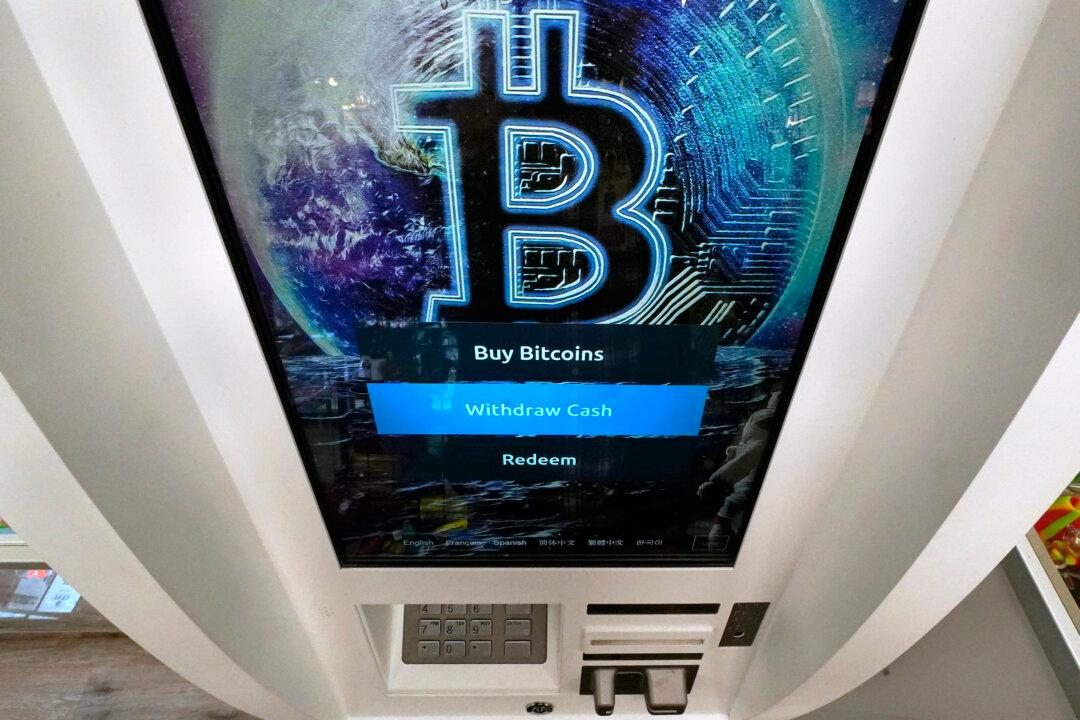

Currently, central banks across the globe are drafting plans to issue their own digital currencies. Some, such as the People’s Bank of China, are already experimenting with such monetary plans. Many don’t realize it, but digital currencies issued by central banks pose the greatest threat to economic and financial freedom we may have ever faced.