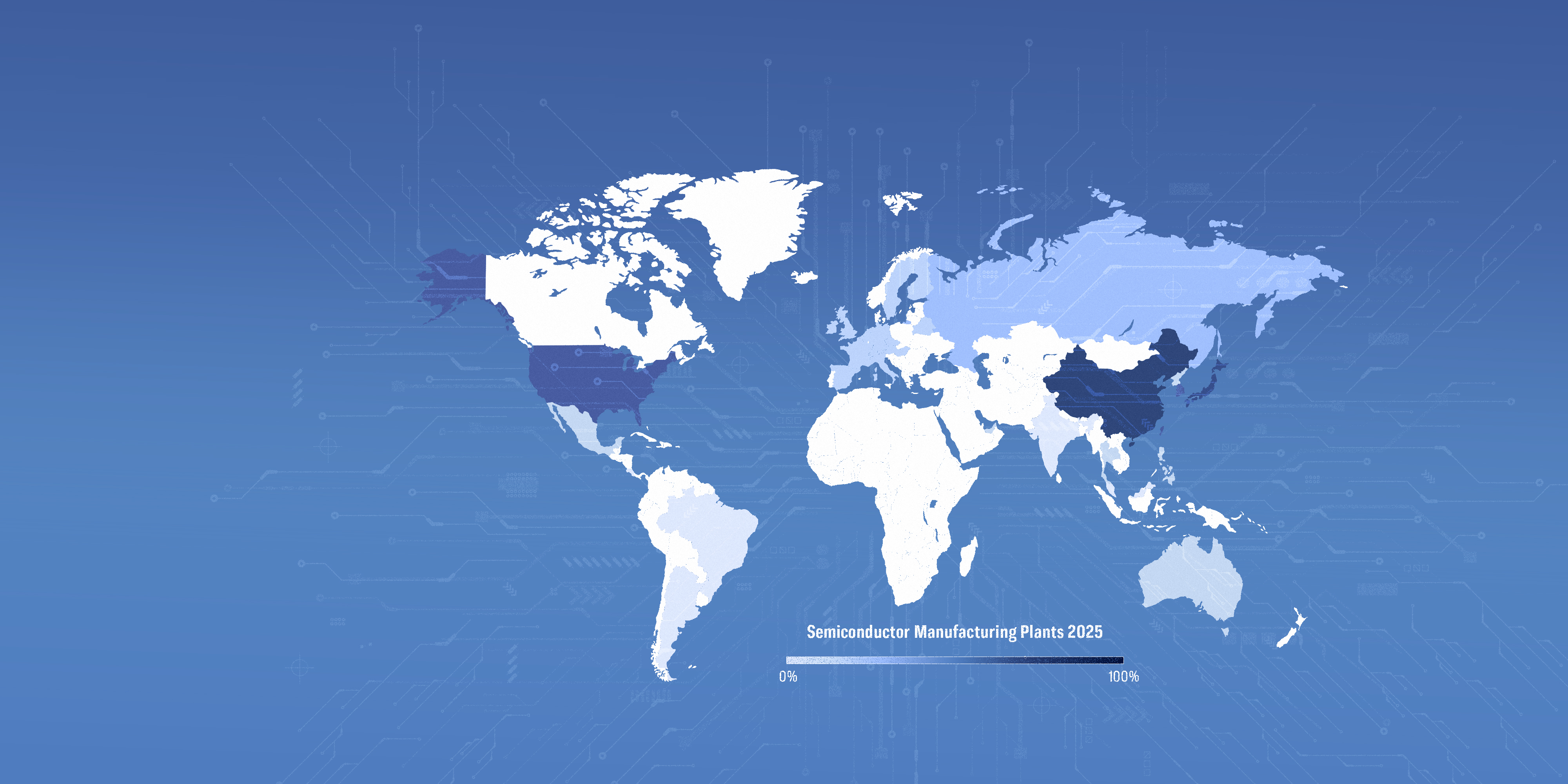

President Donald Trump has ordered an investigation into national security risks posed by the import of semiconductors, the equipment used to build them, and the products that use them.

The public comment period for the investigation ended on May 7, and the Commerce Department will have up to 270 days to offer the president its recommendations on what actions to take to secure the semiconductor supply chain.