SPECIAL COVERAGE

Read More

Read More

Supreme Court Seems Open to Allowing Some Presidential Immunity, May Delay Trump Trial

Justices wrestled with how to define a president’s ‘official’ versus ‘private’ acts. A decision may delay President Trump’s trial, which would hand him a win.

Supreme Court Seems Open to Allowing Some Presidential Immunity, May Delay Trump Trial

Justices wrestled with how to define a president’s ‘official’ versus ‘private’ acts. A decision may delay President Trump’s trial, which would hand him a win.

Top Premium Reads

Top Stories

Most Read

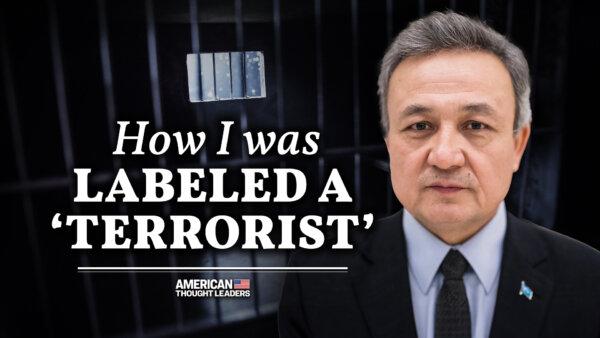

A Peaceful Appeal for Freedom 25 Years Ago Still Echoes Today

About 10,000 people congregated in Beijing on a spring day in 1999, in the largest protest in China’s recent history—known as the April 25 appeal.

Southwest Pulling out of 4 Airports Due to First Quarter Loss, Boeing Problems

The loss was worse than expected.

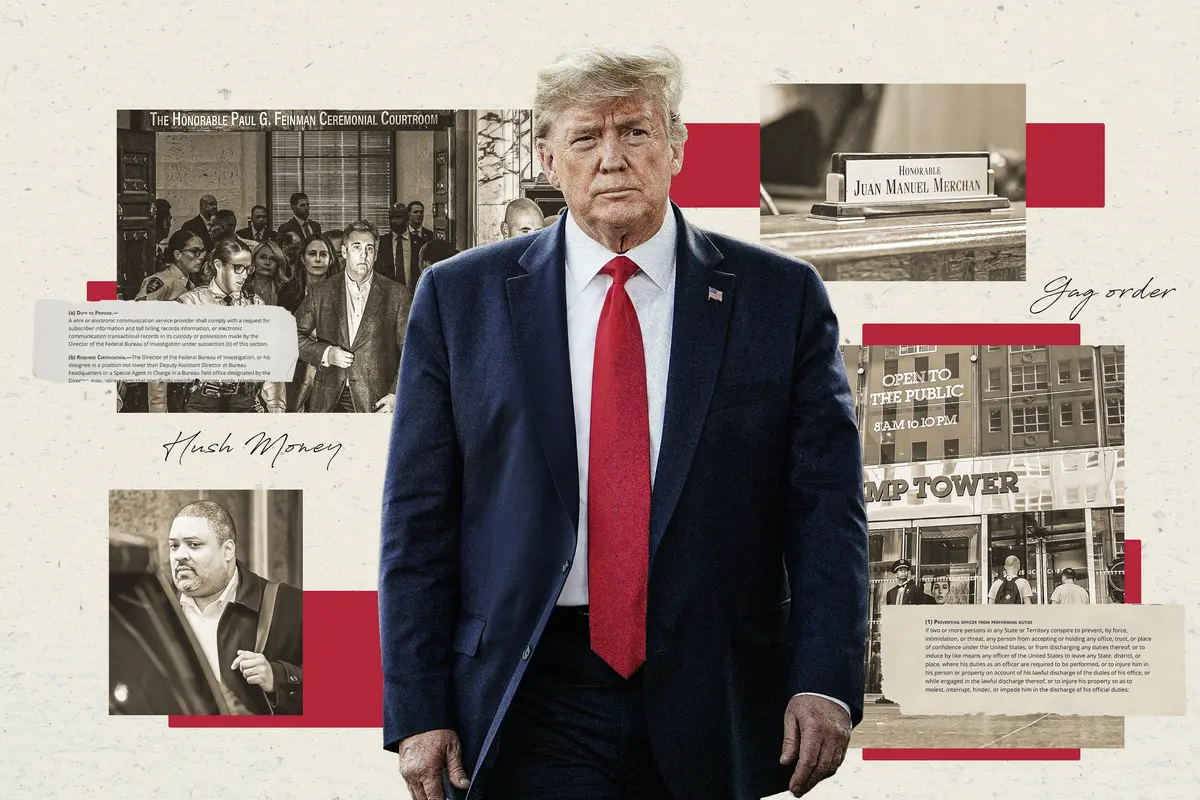

Manhattan DA Accused of Politically Motivated Prosecution in Trump Trial: House Report

‘Bragg’s politically motivated prosecution of President Trump threatens to destroy this notion of blind justice,’ the committee alleges.

Pentagon Moving Ahead With Plans to Pull US Troops From Niger, Draw Down in Chad

While working to expel Western forces that have previously been stationed in the country, Niger’s junta government has begun to form partnerships with Russia.

Key Takeaways From Trump’s Supreme Court Immunity Appeal

A Trump attorney argued that presidents will be hamstrung in office and open to extortion if they are not guaranteed immunity for official acts.

FCC Reinstates Net Neutrality Rule, Upending Trump-Era Decision

The net neutrality rules were first implemented by the FCC under Obama, but the commission reversed course during President Donald Trump’s administration

Indo-Pacific Spending Bill Puts $8 Billion Toward Countering Communist China

‘It’s no secret Communist China is eyeing an invasion of Taiwan, and [Chinese leader] Xi is watching the United States closely,’ said Rep. Bob Latta.

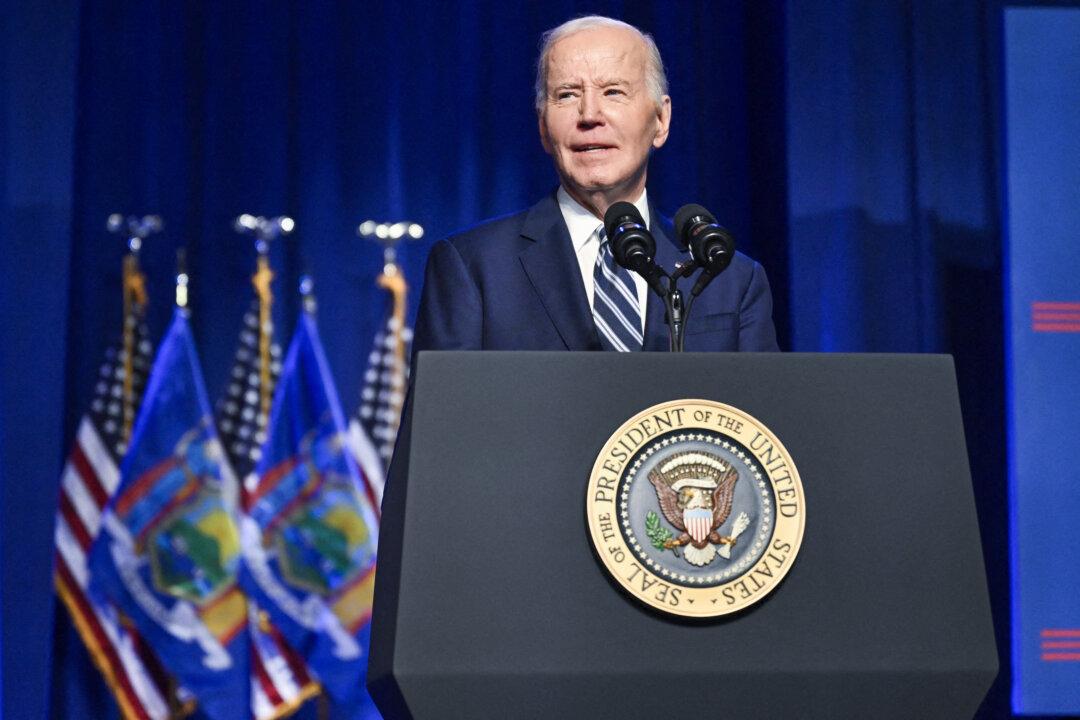

Biden Awards Micron $6 Billion to Boost Chip Production in US

President Biden hailed the investment during a speech in Syracuse, New York, calling it “a big deal.”

JPMorgan CEO Issues Dire Warning About Biden Admininistration’s ‘Huge’ Deficit Spending

‘Deficits which basically aren’t going to go away as far as the eye can see,’ JPMorgan CEO Jamie Dimon said, while warning of stagflation.

Biden Admin Finalizes New Rules to Restrain Fossil Fuel Power Plant Carbon Emissions

The rules include a proposal to implement hydrogen co-firing and carbon capture and sequestration/storage technologies in power plants.

Editors' Picks

Judge Unseals Documents Showing FBI Discussed ‘Loose Surveillance’ of Trump’s Plane

A large tranche of documents were unsealed by Judge Aileen Cannon on Monday, revealing the FBI’s code name for the probe.

Trump’s Request for New Trial Denied in E. Jean Carroll Case

President Trump’s attorneys argued that the outcome of the trial was ‘infected’ by the judge’s errors.

Justice Alito Questions Whether Prosecuting Presidents Would Undermine the Government

His comment was made as U.S. Supreme Court heard arguments in former President Trump’s immunity case.

Judge Shoots Down Effort to Identify FBI, Undercover Police on Jan. 6

U.S. District Judge Rudolph Contreras agreed with prosecutors that material sought by defendant William Pope “is irrelevant and immaterial.”

Mahler’s ‘Resurrection’ Symphony: Answering Nihilism

Mahler’s “Resurrection” Symphony is the musical equivalent of “Hamlet.” What led to its creation?

Mahler’s ‘Resurrection’ Symphony: Answering Nihilism

Mahler’s “Resurrection” Symphony is the musical equivalent of “Hamlet.” What led to its creation?

Epoch Readers’ Stories

A History Of The American Nation

A patriotic poem by Ted Schneider

Of Cars and Kids

Why should our kids have to settle for a Trabant, or a Pyonghwa, education when they could have a BMW?

A Nation Divided

Poem by an American Patriot

What Is Going on Here?

There are two major things plants need to survive and continue generating our life saving oxygen. The first is CO2, and the second is sunshine.

Inspired Stories

Empower the World with Your Story: Share Love, Inspiration, and Hope with Millions

Special Coverage

Special Coverage

Starting Antihypertensive Medications Associated With Higher Risk of Falls, Fractures

When first initiated, blood pressure-lowering drugs pose an increased risk of falls for residents living in health care facilities, a new study shows.

Starting Antihypertensive Medications Associated With Higher Risk of Falls, Fractures

When first initiated, blood pressure-lowering drugs pose an increased risk of falls for residents living in health care facilities, a new study shows.

Art Awakens the Soul in Evelyn Waugh’s ‘Brideshead Revisited’

The 1945 novel traces the young man’s path from self-indulgence to a discovery of deeper meaning.

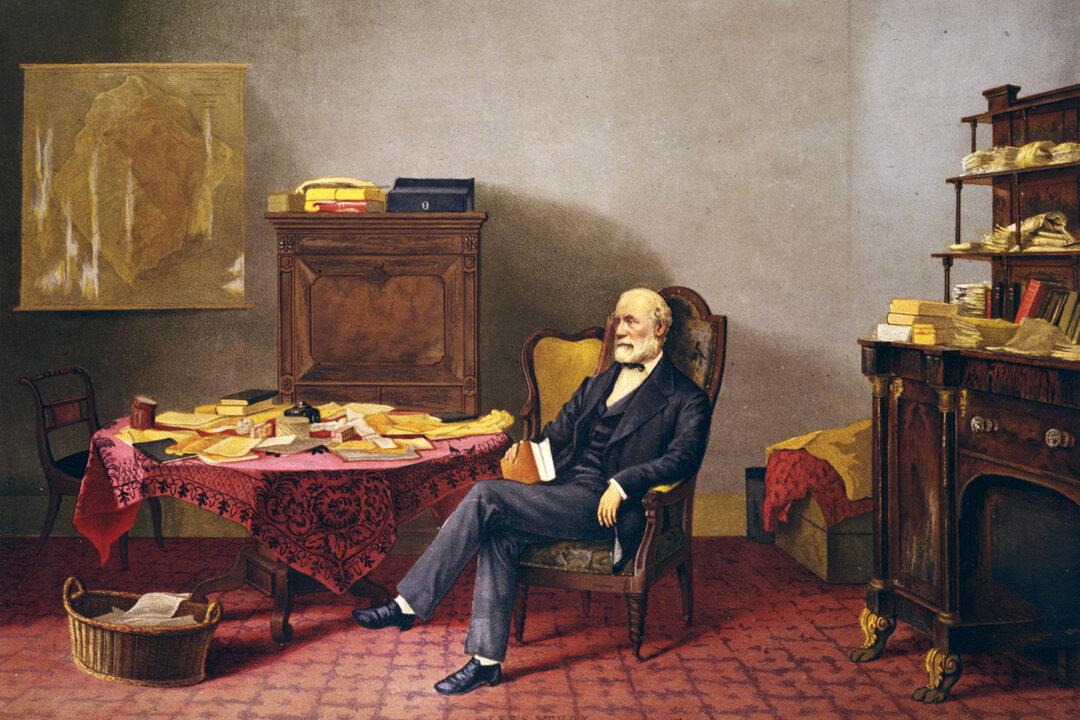

The Two Reputations of Robert E. Lee

While those in the past saw Lee’s stellar qualities, today, some cannot see that he was a man defined, like all of us, by his time.

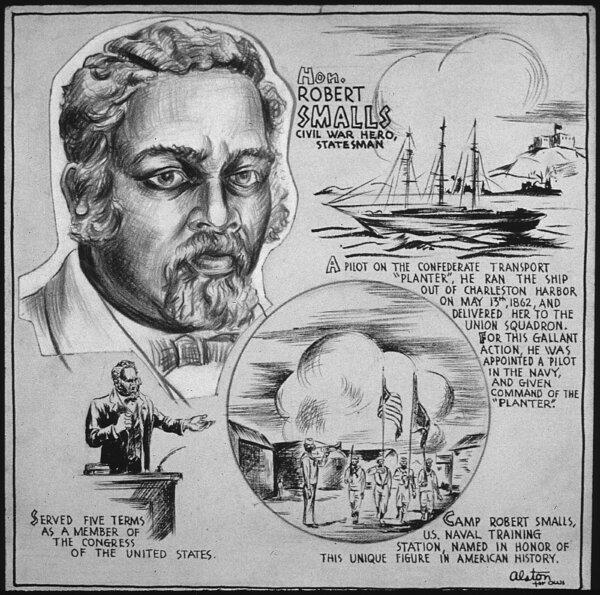

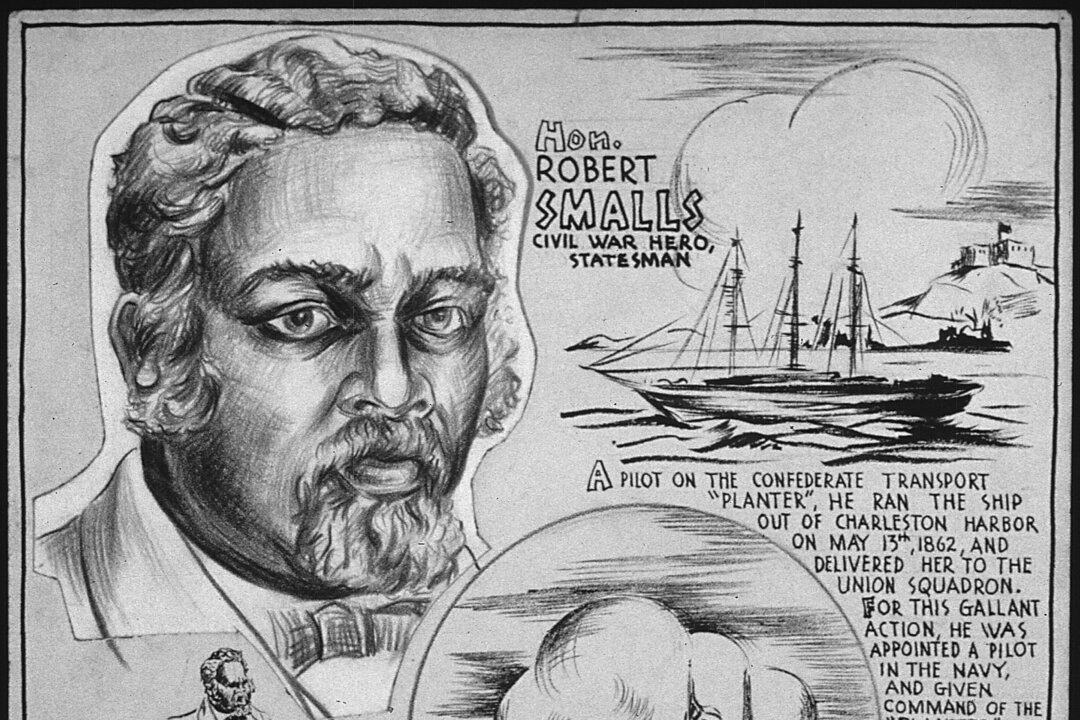

Robert Smalls: Navy Captain and Reconstruction-Era Politician

This former slave would not let anything stop him on the road to freedom.

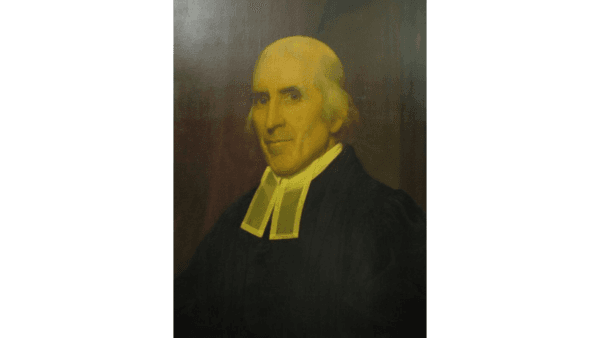

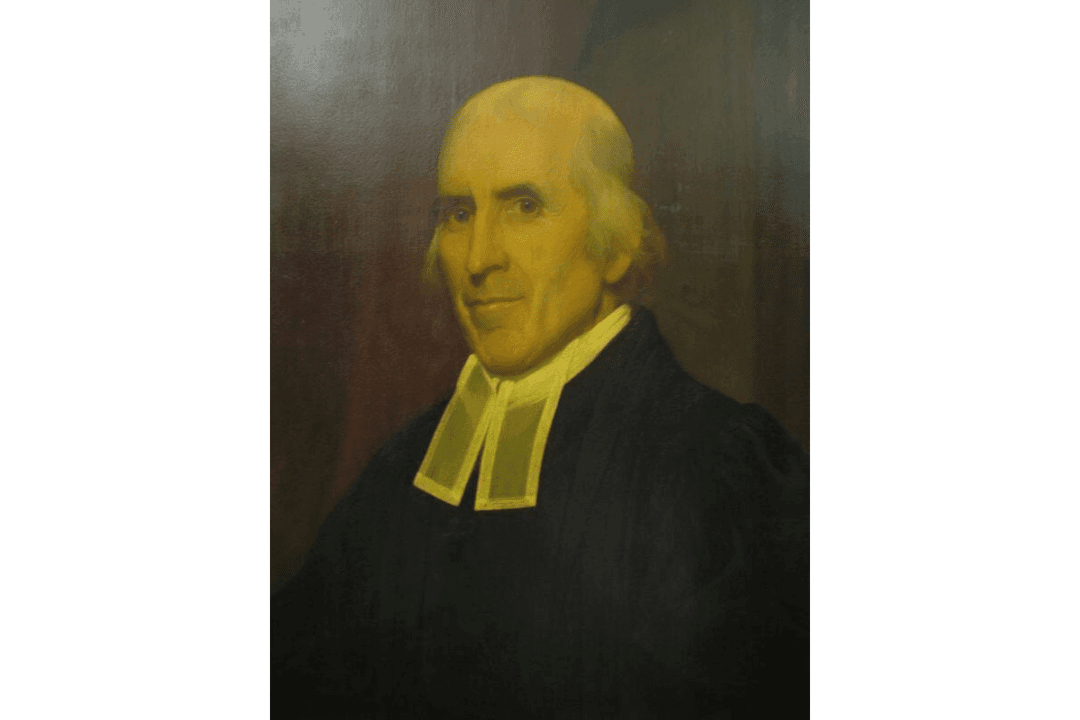

Jedidiah Morse: Father of American Geography

In this installment of ‘Profiles in History,’ we meet a minister who possessed a keen interest in geography and a concern about Christian liberalism.

White Fish With Lemon Butter Sauce

This White Fish with Lemon Butter Sauce is one of the most delicious yet simple ways to enjoy fish for dinner.

Taking the Kids: To the Smithsonian Museums

The Smithsonian Institution is the world’s largest museum, education and research complex.

Airbnb Rentals Could Be Harder to Come by in Hawaii. Here’s Why and When That Might Happen

New bills will give counties the power to limit short-term rentals amidst housing shortages.

These Texas Airports Have Flight Cancellation Rates That Place Them Among the Highest in the Country, Study Finds

Airports across the country have made the list with New York and New Jersery placing in the top 3.

Taking the Kids: To the Smithsonian Museums

The Smithsonian Institution is the world’s largest museum, education and research complex.

![[LIVE 4/26 at 10:30AM ET] New Push Started for Global Digital Currencies](/_next/image?url=https%3A%2F%2Fimg.theepochtimes.com%2Fassets%2Fuploads%2F2024%2F04%2F19%2Fid5633115-0426-600x338.jpg&w=1200&q=75)