News Analysis

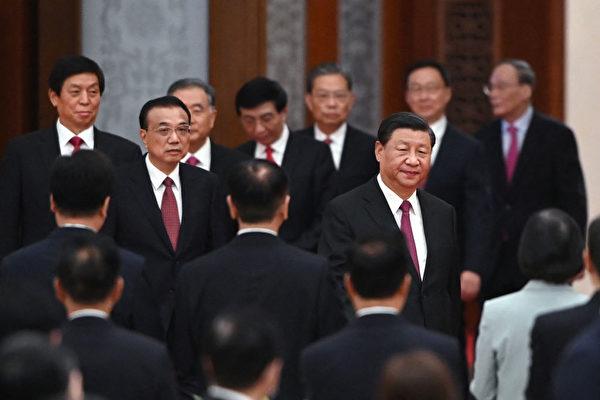

Nearly 100 high-level Chinese officials in the financial sector have been investigated since the beginning of this year, ranging from banks, insurance companies, asset management companies, and financial regulatory agencies. The scope is unprecedented as previous disciplinary campaigns in China mostly targeted a small number of officials who were found suspicious.