The Reserve Bank of Australia (RBA) has outlined plans to introduce tokenised money to Australia, including central bank digital currencies (CBDCs).

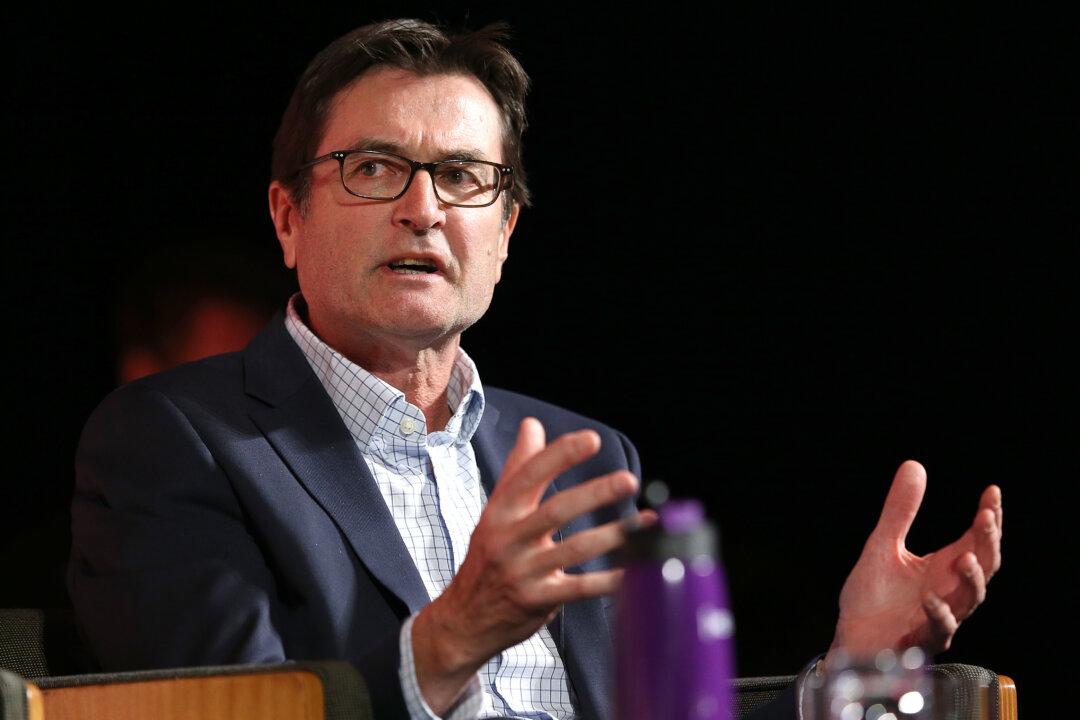

In a speech issued on Monday, the bank’s assistant governor, Brad Jones, cited a key monetary incentive for the transition, claiming a tokenised means of payment will save billions of dollars.