The Future Fund—Australia’s sovereign wealth fund—must remain in its current independently-managed form, as opposed to liquidated to fuel more government spending on net zero, according to the free market think tank, the Centre for Independent Studies (CIS).

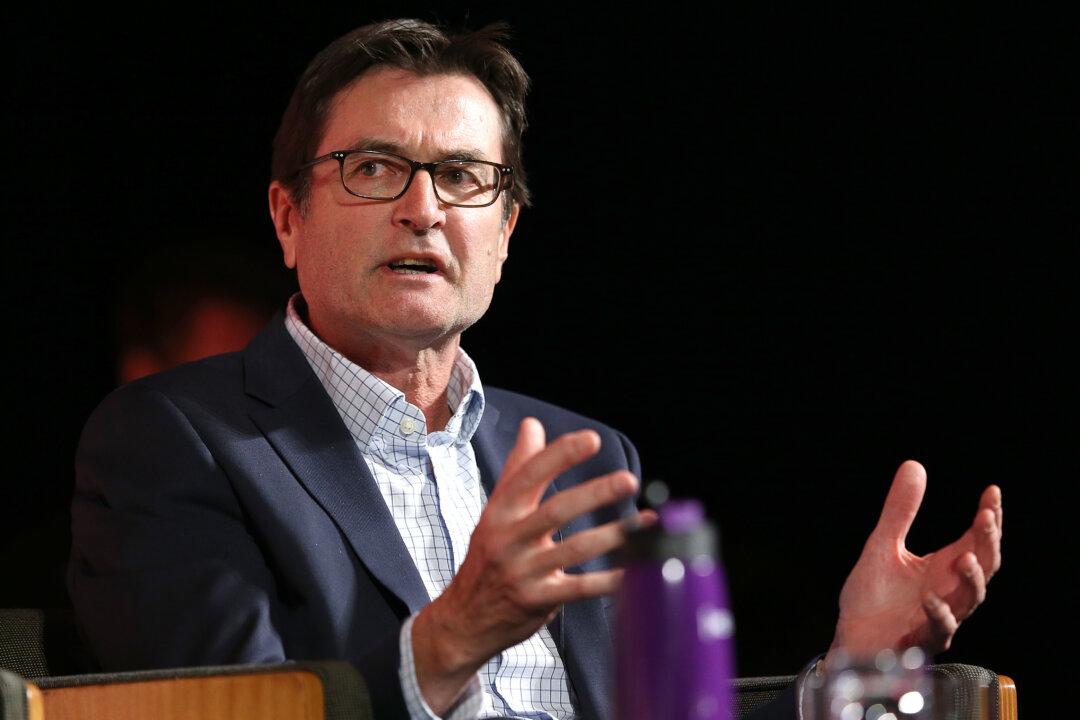

On Jan. 30, the CIS released a publication written by David Murray— one of The Future Fund’s inaugural chairmen—in which Mr. Murray argues that the fund should be protected from being sold by politicians looking to fund their “pet projects.”