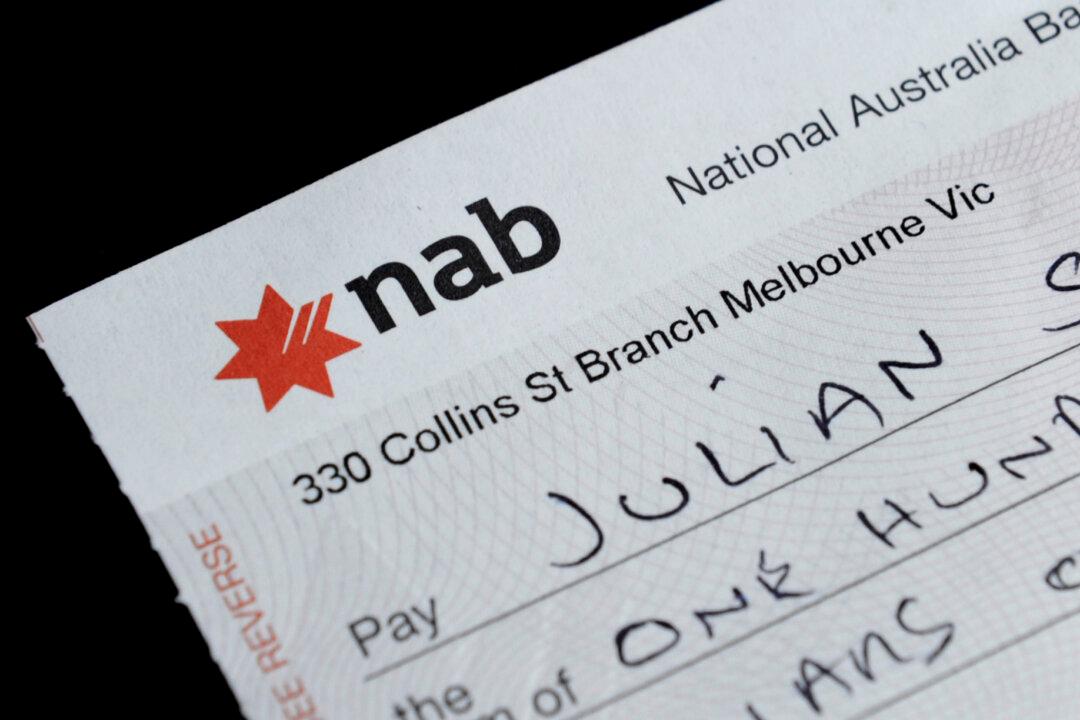

The Australian government has launched a public consultation on the removal of cheques from the country’s payment system.

This comes following an announcement in July that outlined the government’s plan to abolish the paper-based payment system by 2030, with the government completely moving to new forms of payment by the end of 2028.