The Bank of Canada and U.S. Federal Reserve are used to being questioned about how they set interest rates to govern the economy. With the two central banks chomping at the bit to raise rates while inflation sputters, many question what the inflation target should be and if a policy error is being made.

The central banks’ primary mandate is to ensure a low and stable level of inflation. One can make a good argument that they’ve achieved this in aggregate.

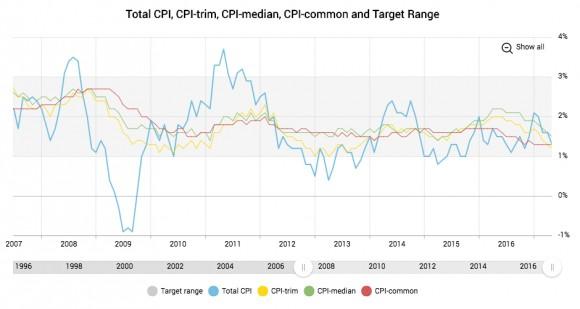

The latest inflation reading in Canada showed the consumer price index (CPI) rose just 1.3 percent, down from 1.6 percent a month earlier. The Bank of Canada’s three measures of core inflation, which exclude volatile items, average 1.33 percent.

Inflation in Canada Courtesy Bank of Canada website