Canada’s housing market has good reason to be rising despite 4.5 percentage points of Bank of Canada interest rate hikes since March last year. But policy-makers are taking steps to contain risks stemming from the housing market and analysts expect prices to start dropping.

“I’m pretty sure the Bank of Canada is not happy seeing the housing market start to accelerate again, so they might lean on it a little bit,” BMO senior economist Robert Kavcic said in a June 27 interview.

The Teranet-National Bank House Price Index rose 1.6 percent from April to May. This is the third consecutive month of price increases for the index, which fell 7.6 percent from May 2022 to May 2023.

Home prices quickly adjusted to the rate increases, but Kavcic said that after the BoC told Canadians it would be pausing further rate hikes in January, people thought the worst was over and started buying houses again.

“That helped put a floor under the market,” he said.

Lack of housing supply has long been an issue in Canada, and with a skyrocketing population, it supports prices.

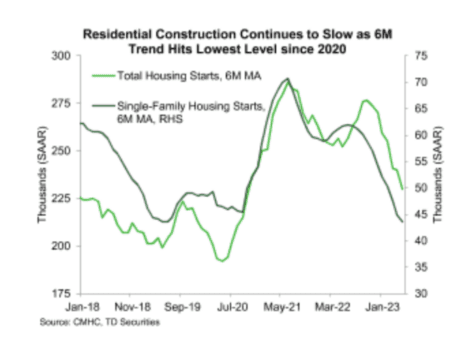

“With domestic housing starts falling to their lowest level in three years in May, there is no reason to believe that the shortage of properties on the market will be resolved any time soon,” National Bank said on June 19.

Analysis from TD on June 19 shows that the six-month trend in housing starts is at the lowest since 2020.

Less Favourable Policy

More rate hikes are likely to slow the pace of home prices rising, said Robert Hogue, RBC assistant chief economist.

“The recovery to date is stronger than we expected,” he said in a June 15 note.

Even as economists expect at least one more rate hike in July, Kavcic says that the housing market has not fully digested the prior rate increases from the BoC in spite of the recent rebound in home prices.

“I would expect that for the housing market to fully reflect everything we’ve done on monetary policy, you have to get to the point where you’ve reached a low in economic output, and you’ve seen the worst of the impact on the labour market,” he said. “And we haven’t really seen any of that yet.”

Robert McLister of MortgageLogic.news also said that the full impact of the BoC’s monetary policy has not been totally absorbed by the housing market, with the key being unemployment’s effect.

“The longer rates stay this high, the more job losses we‘ll see, and the more distressed borrowers will get. A small minority of these distressed borrowers will turn into forced sellers, and that’ll weigh on the market to some degree,” he told The Epoch Times on June 26.