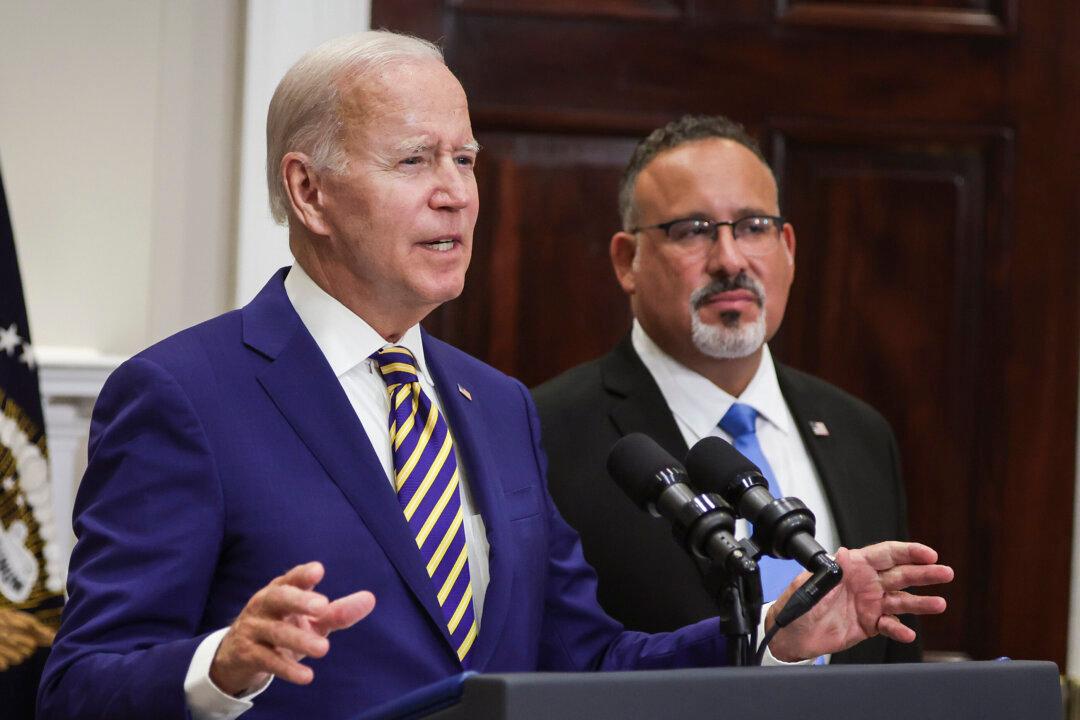

Senate Democrats are trying to codify President Joe Biden’s latest federal student loan forgiveness plan and protect it from being overturned under future administrations.

President Biden’s program, dubbed SAVE, has enrolled over 7.7 million people since it launched in August. Like the existing income-driven repayment (IDR) option it replaces, SAVE can provide an affordable monthly payment based on income and family size before the eventual discharge of the remaining balance.