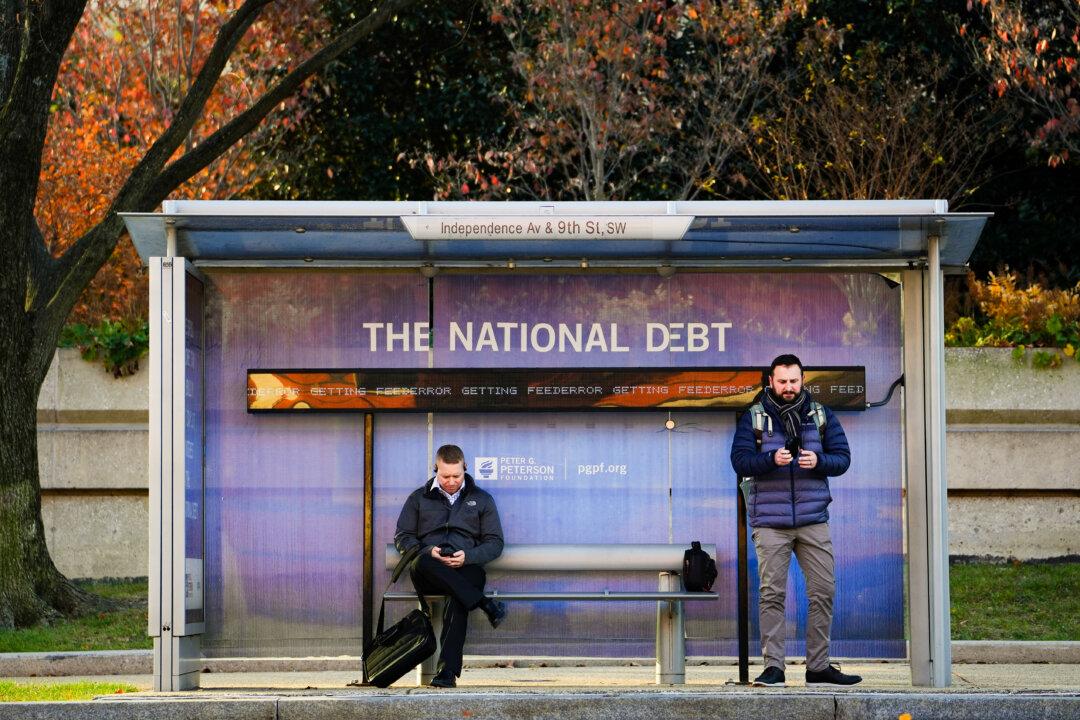

Congress is moving closer to establishing a bipartisan commission to tackle the ballooning $34 trillion national debt.

The Republican-led House Budget Committee voted 22–12 to create a 16-member commission and submit fiscal policy recommendations. The panel would consist of six Republican and six Democratic lawmakers, as well as four outside experts without any voting power.