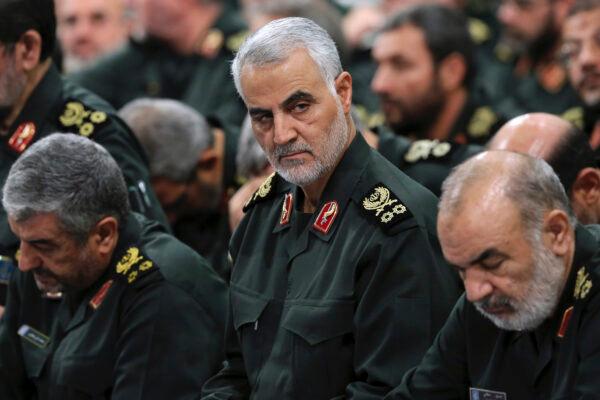

The cost of insuring against a potential debt default by Saudi Arabia has soared by over 16 percent since the killing by a U.S. drone of Iranian commander Qassem Soleimani.

International bonds issued by Saudi Arabia and its state oil giant Aramco were yielding around 10 basis points more on the long end of the curve when compared to their levels before the strike.

The price of Saudi credit default swaps, also known as their “spread,” was at 64 basis points early on Monday, up from 55 bps on Jan. 2, according to IHS Markit, via Reuters.

“The main channels of credit transmission would be the immediate effect of the shock to exports and fiscal revenue should hydrocarbon production capacity be impaired significantly and durably,” it said.

President Donald Trump ordered a strike last week against Soleimani, the architect of Tehran’s overseas military operations, including ones targeting Americans. The Iranian general was killed early on Jan. 3 by a drone-fired missile that struck his convoy at Baghdad’s airport.

Before the attack, the U.S. intelligence community said it had reason to believe that Soleimani was involved in “late stage” planning to strike Americans in multiple countries.

Iranian officials responded to the strike by threatening to retaliate.

Gulf Stocks Tumble Amid Rising Tensions

Stocks in the Persian Gulf plunged in trading on Jan. 5, with shares of oil giant Saudi Aramco falling 1.7 percent to their lowest level since listing last month in a record initial public offering.The Kuwaiti index, the best performer in the region in 2019, fell almost 4.1 percent, while Saudi stocks plunged 2.2 percent.

“A U.S.-Iran war could shave 0.5 percentage points or more off global GDP, mainly due to a collapse in Iran’s economy, but also due to the impact from a surge in oil prices,” Jason Tuvey, senior emerging markets economist at Capital Economics, said in a note last week.

‘Circle of Violence’

The killing of Soleimani came following months of attacks by Iran-backed militias on U.S. forces in Iraq.“We cannot promise that we have broken the circle of violence,” a senior State Department official told reporters on Jan. 3. “What I can say from my experience with Qassem Soleimani is, it is less likely that we will see this now than it was before, and if we do see an increase in violence, it probably will not be as devilishly ingenious.”

Experts and others familiar with the situation told The Epoch Times that Iran Supreme Leader Ali Khamenei is unlikely to order attacks on U.S. assets while the nation is mourning Soleimani.

“Khamenei is unlikely to go to war during the coming days, as he’s scheduled to pray over Soleimani on Monday at Tehran University,” said Sam Bazzi, Middle East expert and founder of Hezbollah Watch.

That’s an umbrella grouping of paramilitary forces, mostly Iran-backed Shi’ite militias that were formally integrated into Iraq’s armed forces amid efforts to defeat the ISIS terrorist group.