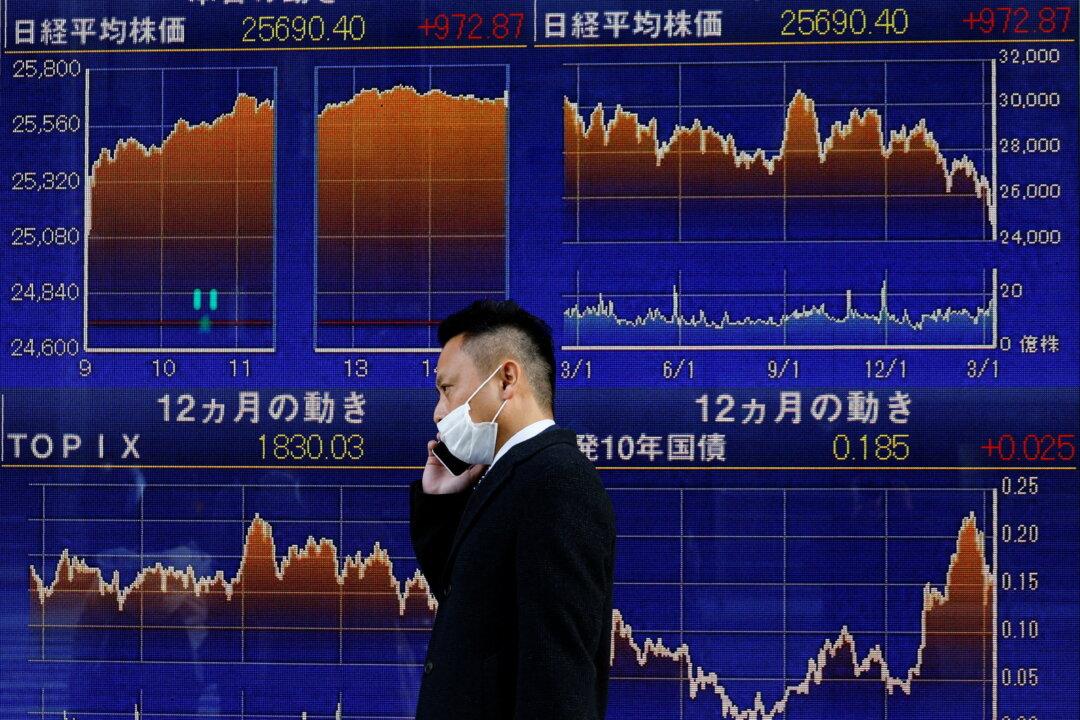

LONDON/TOKYO—Europe’s stock markets consolidated strong gains made in Asia on Thursday, after China signalled more support for its spluttering economy and the Federal Reserve had pressed ahead with the first U.S. interest rate rise in more than three years.

Traders remained gripped by the devastating war in Ukraine, but with hopes of possible a peace deal faint but alive, they were also watching to see if the Bank of England raises UK interest rates again later too.