Attorneys general from 23 states issued a letter to 28 insurance companies on May 15 requesting information regarding possible violations by the insurers of U.S. antitrust laws.

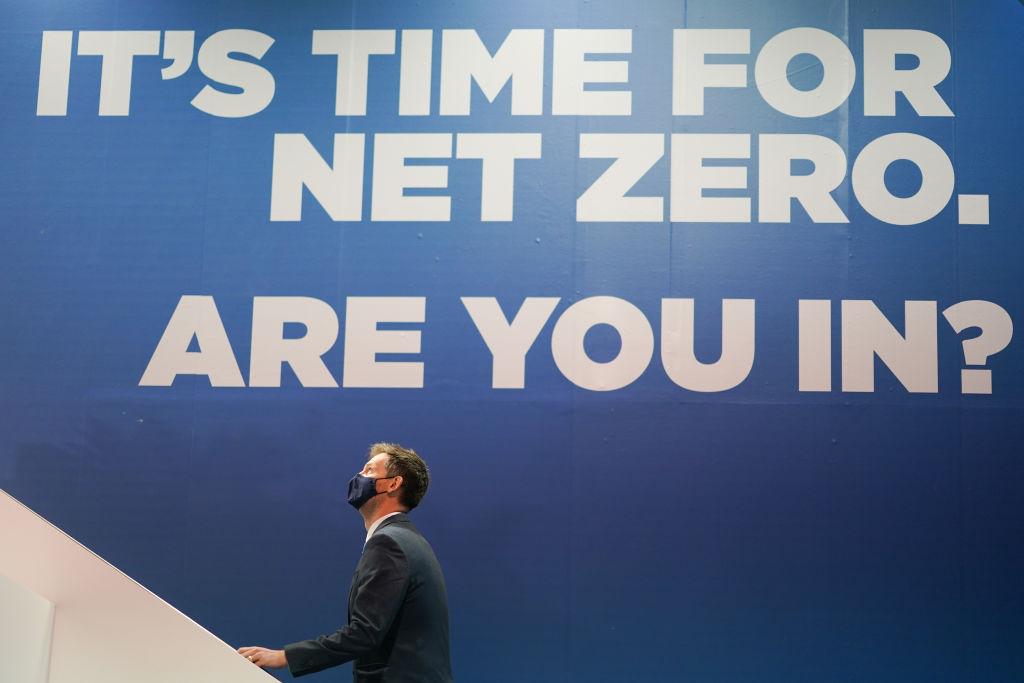

In what could be the first step towards an antitrust lawsuit, the state AGs requested that the insurance companies provide details on their membership in climate associations like the Net Zero Insurance Alliance (NZIA) and the Net Zero Asset Owner Alliance (NZAOA), two United Nations-sponsored clubs whose members pledge to act in unison to transition global energy markets away from fossil fuels. The effort was led by Louisiana AG Jeff Landry and Utah AG Sean Reyes.