Summary

- Gold’s historical position as the ultimate store of value no longer applies.

- Rising consumer inflation suggests the Fed has room to tighten monetary policy.

- Rallies in GLD have only generated false breakouts and bull-traps.

For thousands of years, the financial market has viewed gold as the ultimate currency -- and the ultimate store of value. But most of this historical activity has been predicated on the fact that human beings are simple animals. Animals fascinated by shiny things. Trends build on trends, and investors make arguments that what worked before will work again in the future. But this type of mentality can only last for so long, and there are clear reasons to believe that gold’s historical status has run its course.

When we look at the assets that drive gold sentiment, the real area to watch can be found in the SPDR Gold Trust ETF (NYSEARCA:GLD), and its attempts at a rally are still holding below double-digit territory in the last year. The ETF posted declines of nearly 30% last year in a time when most asset classes posted substantial gains. Already this month, we have seen net outflows for the fourth week in a row, at rates not seen since last December. Recent arguments on SA have started warming to that fact that gold-based ETFs will start to melt and I have outlined critical levels for real trades in previous articles. A big reason for this comes from the fact that, on a comparative basis, it is now more expensive to hold onto gold and other precious metals.

Rising Rates and Historical Tendencies

The SPDR Gold Trust ETF has struggled to gain back a small portion of last year’s losses, and most of this activity should be described as profit taking for those that bought in at the lower levels. Those that have based long positions on supportive policies from the Federal Reserve are now facing the “slow taper,” which will ultimately lead to higher interest rates. As this happens, it will be much more difficult to justify exposure in assets with negative carry. In the current environment, it makes much more sense to seek out assets that offer access to dividends and rising corporate earnings. If you are already long assets that track the price of gold, my condolences. But since I don’t understand whatever rationale that preceded your decision, my sympathy is limited.

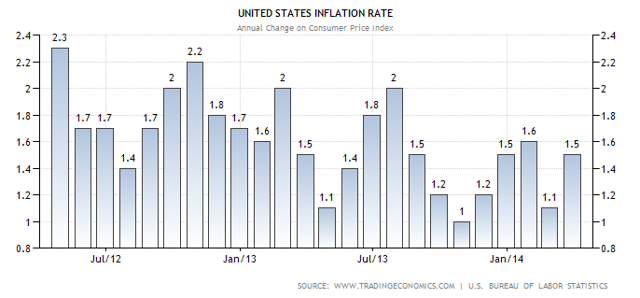

Inflationary Pressures

In March, consumer prices rose in the US rose by 0.2%. This beat the consensus estimates and shows that broader trends are emerging at real levels. When we look at things on an annual basis, the increase is 1.5%. Trend numbers were 1.1% in February. The average consumer might not see these changes as significant. But when we pull-out to the macro view, policy implications are clear. The Fed’s commitment to $55 billion in monthly asset purchases is finite to say the least, and it is time to start preparing for the changes that will be taking place over the next few months. These events will have clearly positive implications for assets like the PowerShares DB US Dollar Index Bullish ETF (NYSEARCA:UUP). For those holding positions in GLD, the scenario is much more pessimistic. It is time to acknowledge that the times are a-changin‘. You better start swimmin’ or you'll sink like a stone.

Chart Perspective: GLD

(chart source: Google Finance)

From a chart perspective, there are some major warning signals in this year’s price action in GLD. The move above the 131 area has proven to be a false breakout and since rallies have gained no real traction, the next historical demand level to watch comes in at 123. A downside break here would signal that the multi-year downtrend from above 1900 marks the real trajectory, and that we are in store for another test of the yearly lows in GLD.a