NEW YORK—Federal authorities on Wednesday said that they charged seven men—including hedge fund managers and stock analysts—for a massive insider-trading scheme, believed to be the biggest ever for New York.

The FBI arrested seven people in total—four on Wednesday and three previously charged—involved with running an insider-trading scheme that defrauded up to $78 million.

The U.S. Securities and Exchange Commission (SEC) said that traders at hedge funds Diamondback Capital Management LLC and Level Global Investors LP obtained illicit insider, nonpublic information regarding technology giants Dell, Inc. and Nvidia Corp.

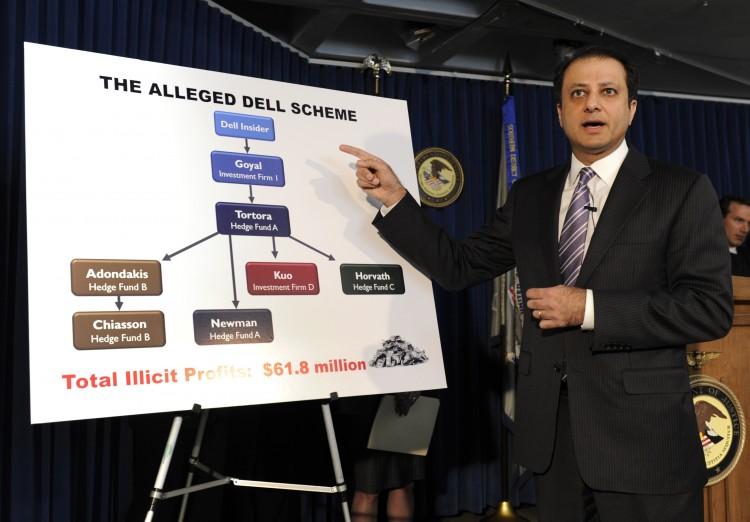

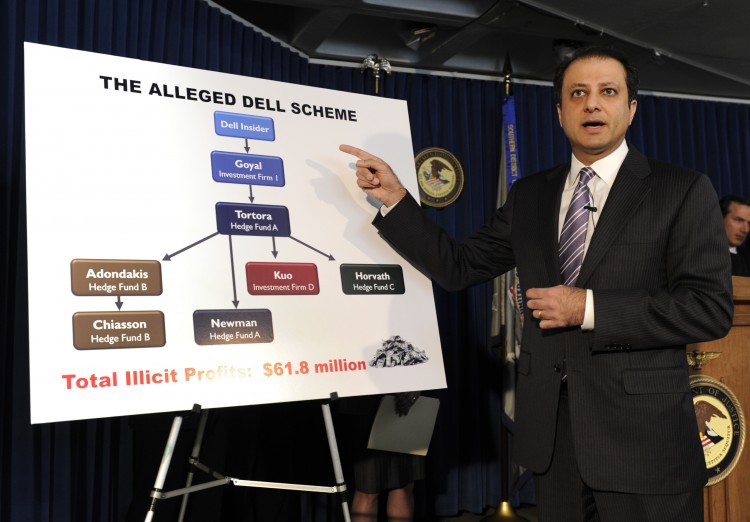

Insider information obtained for Dell netted the accomplices almost $62 million in illegal profits, the SEC alleges. A Dell employee tipped a former Dell employee before the earnings announcement. The former employee then gave the information to several friends who worked in the investments industry.

The trades involving shares of Nvidia yielded profits of more than $15.7 million.

“These are sophisticated players who built a corrupt network to systematically and methodically obtain and exploit illegal inside information again and again at the expense of law-abiding investors and the integrity of the markets,” said Robert Khuzami, Director of the SEC’s Division of Enforcement, in a statement.

“They show that insider trading activity in recent times has, indeed, been rampant and routine and that this criminal behavior was known, encouraged, and exploited by authority figures in several investment funds,” U.S. Attorney Preet Bharara said at a press conference in New York.

Experts say that the complexity and profits garnered by this insider trading ring rivals the one headed by Raj Rajaratnam, the convicted former head of the Galleon Group. Rajaratnam is currently serving an 11-year sentence.

The FBI called the case “Operation Perfect Hedge.” This week, Diamondback sent a letter to investors explaining that the hedge fund was fully cooperating with authorities, and that the allegations are “an important step towards putting this matter behind us,” according to a Reuters report.

The defendants are Anthony Chiasson, co-founder of Level Global; Todd Newman, a trader at Diamondback in Boston; Jesse Tortora, also of Diamondback; hedge fund analyst Jon Horvath of Sigma Capital Management; former Dell employee Sandeep “Sandy” Goyal; Danny Kuo, a trader at Whittier Trust in South Pasedena, Calif.; and Spyridon “Sam” Adondakis, an analyst at Level Global.

The SEC also charged Diamondback Capital and Level Global in addition to the aforementioned individuals.

According to the FBI, investigations are still ongoing, and more individuals may be charged as their roles are uncovered.