The Dodd-Frank Wall Street Reform and Consumer Protection Act, passed in the wake of the 2008 financial crisis, requires U.S. agencies to start regulating a market that has been until now largely left unregulated.

The derivatives markets, which were created by U.S. institutions beginning in the early 1980s, were widely seen as a major cause of the credit crash that brought the globe to its knees, decimating individuals’ savings and investments.

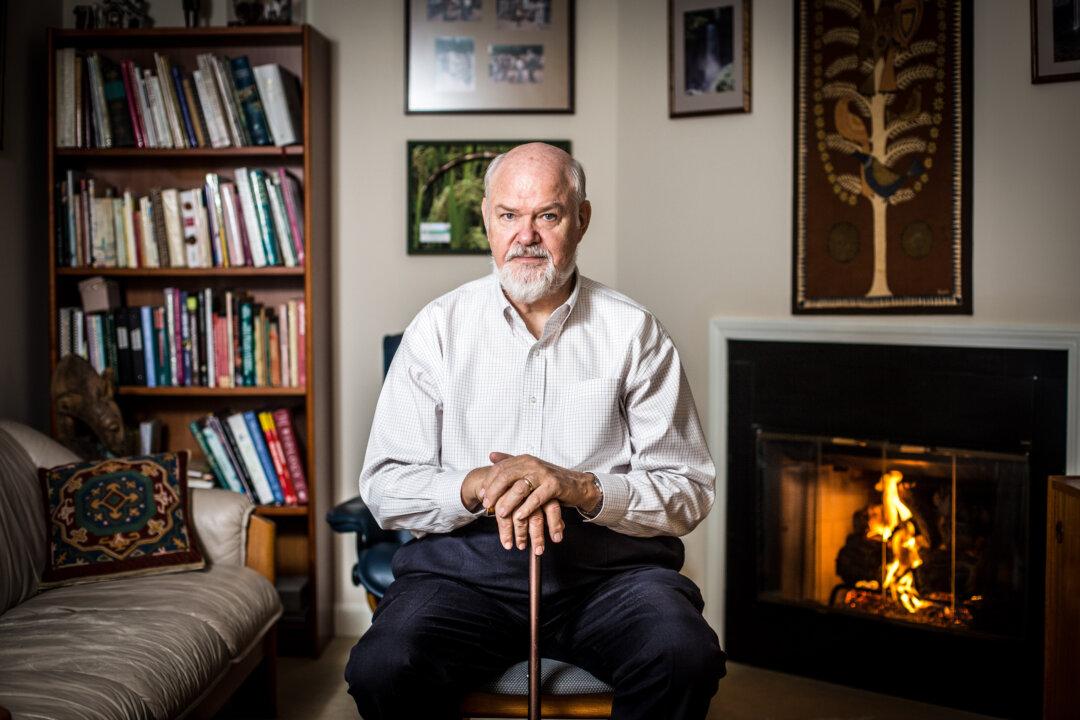

“Swaps added leverage to the financial system with more risk being backed up by less capital...swaps—initially developed to help manage and lower risk—actually concentrated and heightened risk in the economy and to the public,” said Gary Gensler, Chairman of the Commodity Futures Trading Commission (CFTC).

Mr. Gensler was speaking at a hearing before the House Committee on Financial Services last week. The CFTC is the main regulatory agency now responsible for the derivatives markets.

An environment of deregulation, fueled by the ongoing success of stock markets for many years, had led Congress into blindly trusting in the sophistication of large financial institutions.

Few believed or predicted the kind of major, systemic collapse that happened, because nobody really knew the extent of what was on the books. Institutions did not know what kind of risk other banks were carrying, nor the extent of the trading that led the banks to be so interconnected.

The same year lawmakers passed Dodd-Frank, G20 leaders unanimously agreed to a framework for the regulation of derivatives markets on a global scale.

They agreed to use central clearing houses and exchanges to trade derivatives, and to require higher levels of capital to back the largest trades.

G20 leaders set an ambitious deadline, the end of 2012, for the completion of all legislation, rule-making and implementation of the reforms.

Today, as U.S. agencies work through the fine details of various rules, of the other G20 countries, until now only Japan has enacted over-the-counter “OTC” derivatives reform legislation.

While legislation is being considered in the European Union, it has not been passed. According to the SEC, other countries are completely lagging behind, making it challenging to coordinate with other jurisdictions.

Dodd-Frank requires the Securities and Exchange Commission (SEC) and the Commodities and Futures Trading Commission (CFTC) to “consult and coordinate” with foreign regulatory authorities in order to promote consistent global regulation.

Other nations’ failure to move forward with their own process makes it difficult for the agencies to ensure adequate dialogue.

The dissimilar schedules pose a major concern for corporations, asset managers, and financial institutions. Many have expressed fears that differing policies and time schedules across jurisdictions will affect the competitiveness of U.S. institutions in the short-term.

They are asking for a global synchronization of rule-making. This would mean more delay here at home.

Ranking member of the House Financial Services Committee, and co-author of Dodd-Frank, Mr. Barney Frank (D-Mass), said recently that the goal of the proposed reforms is to improve the soundness of the financial system while allowing it to remain competitive.

The way he sees it, reducing profitability a little is okay, as long as it doesn’t interfere with the ability of the banking sector to extend capital.

“The simple fact of the reduction of profitability from some very profitable institutions with some very well paid executives is not a problem,” Mr. Frank said at a hearing last week.

“Whether banks make a profit is not a matter for public policy,” he added.

Committee Chairman Spencer Baucus (R-Alabama), said at the hearing that the 2,300-page Dodd-Frank law represents the most ambitious set of changes in financial services regulation since the Great Depression.

While acknowledging the benefits of managing risk with government rules, Baucus said his fear is that it will push industry and jobs out of the country.

“At a time when each new release of government data seems to underscore the sensitivity of our economic recovery, it is fair to ask Treasury and other agencies...whether they have carefully considered the cumulative effect ... the tsunami of regulatory mandates unleashed by Dodd-Frank is having on the real economy.”

In response to Baucus’ inquires, the panel acknowledged industry and congressional concerns, but said they were moving forward nonetheless.

Last week, the CFTC announced that they would delay the implementation of certain derivatives regulations for an additional six months past the original July 16 deadline to allow more time for global cooperation and consensus building.

Over 200 other rules, governing issues such as data management, margin requirements, transparency, and standards for business conduct are set to go into effect on time.

The derivatives markets, which were created by U.S. institutions beginning in the early 1980s, were widely seen as a major cause of the credit crash that brought the globe to its knees, decimating individuals’ savings and investments.

“Swaps added leverage to the financial system with more risk being backed up by less capital...swaps—initially developed to help manage and lower risk—actually concentrated and heightened risk in the economy and to the public,” said Gary Gensler, Chairman of the Commodity Futures Trading Commission (CFTC).

Mr. Gensler was speaking at a hearing before the House Committee on Financial Services last week. The CFTC is the main regulatory agency now responsible for the derivatives markets.

An environment of deregulation, fueled by the ongoing success of stock markets for many years, had led Congress into blindly trusting in the sophistication of large financial institutions.

Few believed or predicted the kind of major, systemic collapse that happened, because nobody really knew the extent of what was on the books. Institutions did not know what kind of risk other banks were carrying, nor the extent of the trading that led the banks to be so interconnected.

The same year lawmakers passed Dodd-Frank, G20 leaders unanimously agreed to a framework for the regulation of derivatives markets on a global scale.

They agreed to use central clearing houses and exchanges to trade derivatives, and to require higher levels of capital to back the largest trades.

G20 leaders set an ambitious deadline, the end of 2012, for the completion of all legislation, rule-making and implementation of the reforms.

Today, as U.S. agencies work through the fine details of various rules, of the other G20 countries, until now only Japan has enacted over-the-counter “OTC” derivatives reform legislation.

While legislation is being considered in the European Union, it has not been passed. According to the SEC, other countries are completely lagging behind, making it challenging to coordinate with other jurisdictions.

Dodd-Frank requires the Securities and Exchange Commission (SEC) and the Commodities and Futures Trading Commission (CFTC) to “consult and coordinate” with foreign regulatory authorities in order to promote consistent global regulation.

Other nations’ failure to move forward with their own process makes it difficult for the agencies to ensure adequate dialogue.

The dissimilar schedules pose a major concern for corporations, asset managers, and financial institutions. Many have expressed fears that differing policies and time schedules across jurisdictions will affect the competitiveness of U.S. institutions in the short-term.

They are asking for a global synchronization of rule-making. This would mean more delay here at home.

Ranking member of the House Financial Services Committee, and co-author of Dodd-Frank, Mr. Barney Frank (D-Mass), said recently that the goal of the proposed reforms is to improve the soundness of the financial system while allowing it to remain competitive.

The way he sees it, reducing profitability a little is okay, as long as it doesn’t interfere with the ability of the banking sector to extend capital.

“The simple fact of the reduction of profitability from some very profitable institutions with some very well paid executives is not a problem,” Mr. Frank said at a hearing last week.

“Whether banks make a profit is not a matter for public policy,” he added.

Committee Chairman Spencer Baucus (R-Alabama), said at the hearing that the 2,300-page Dodd-Frank law represents the most ambitious set of changes in financial services regulation since the Great Depression.

While acknowledging the benefits of managing risk with government rules, Baucus said his fear is that it will push industry and jobs out of the country.

“At a time when each new release of government data seems to underscore the sensitivity of our economic recovery, it is fair to ask Treasury and other agencies...whether they have carefully considered the cumulative effect ... the tsunami of regulatory mandates unleashed by Dodd-Frank is having on the real economy.”

In response to Baucus’ inquires, the panel acknowledged industry and congressional concerns, but said they were moving forward nonetheless.

Last week, the CFTC announced that they would delay the implementation of certain derivatives regulations for an additional six months past the original July 16 deadline to allow more time for global cooperation and consensus building.

Over 200 other rules, governing issues such as data management, margin requirements, transparency, and standards for business conduct are set to go into effect on time.