News Analysis

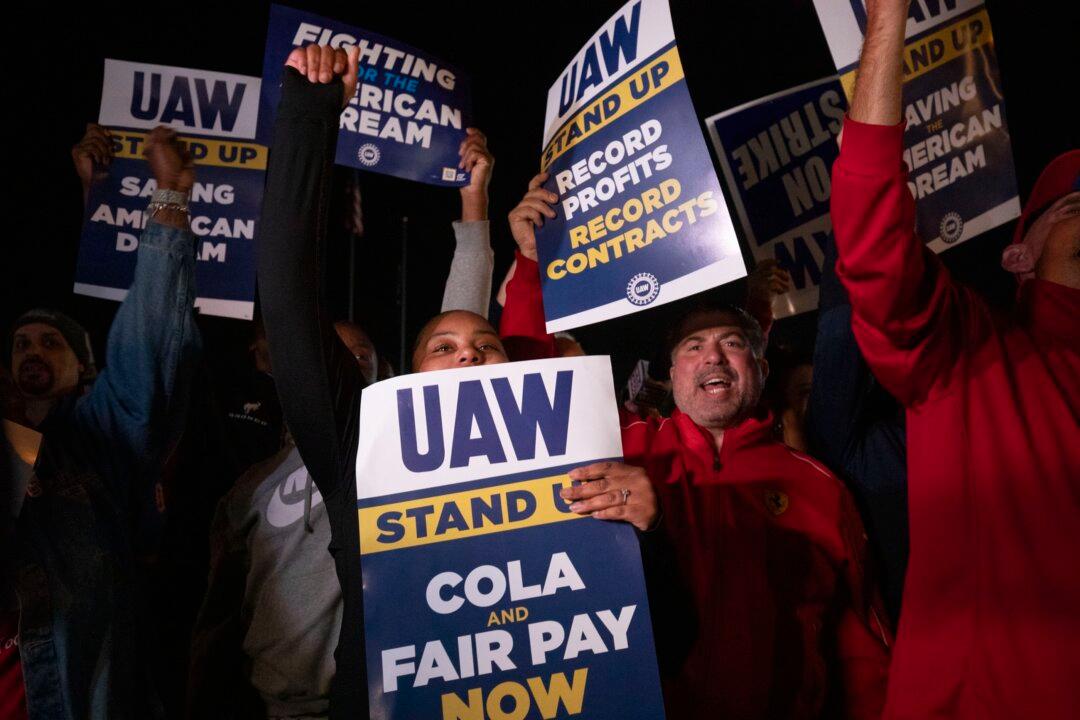

The United Auto Workers (UAW) strike against the Big Three automakers—Ford, General Motors, and Stellantis—may affect the broader U.S. economy in the coming months, experts warn.

The United Auto Workers (UAW) strike against the Big Three automakers—Ford, General Motors, and Stellantis—may affect the broader U.S. economy in the coming months, experts warn.