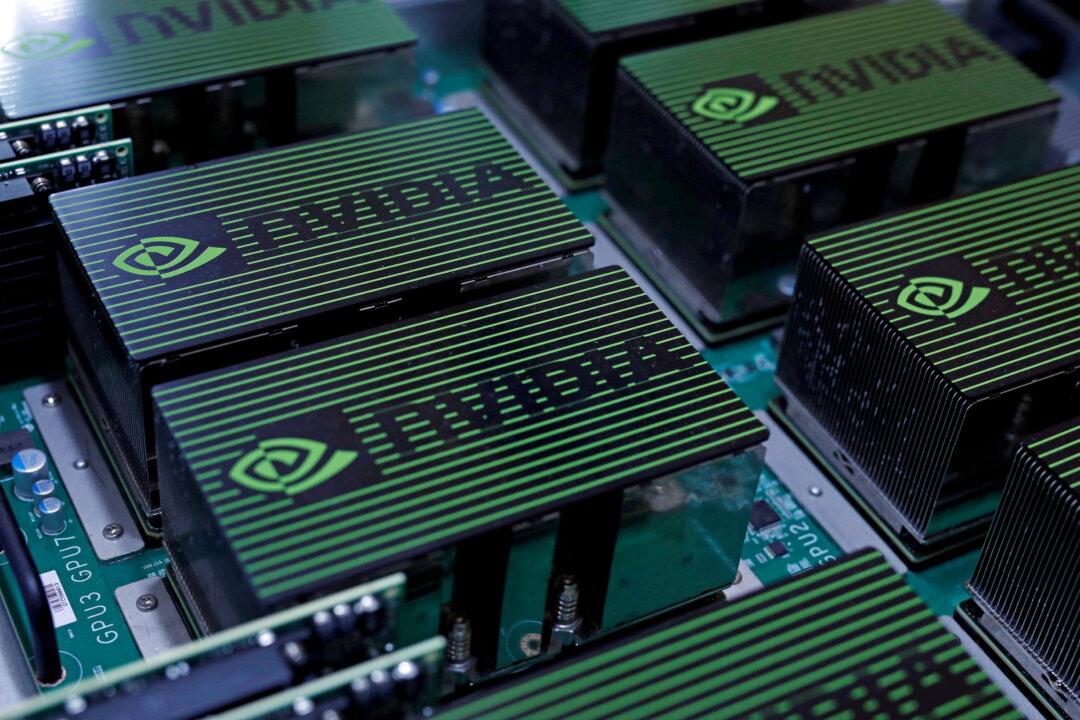

Nvidia Corp. shares were trading lower Monday as many companies in the broader tech sector move lower.

A rise in Treasury yields has put pressure on these stocks.

Nvidia Corp. shares were trading lower Monday as many companies in the broader tech sector move lower.

A rise in Treasury yields has put pressure on these stocks.