WASHINGTON—A government proposal to phase out ownership of mortgage giants Fannie Mae and Freddie Mac has brought to the fore Americans’ dream of home ownership and how to preserve it within private markets.

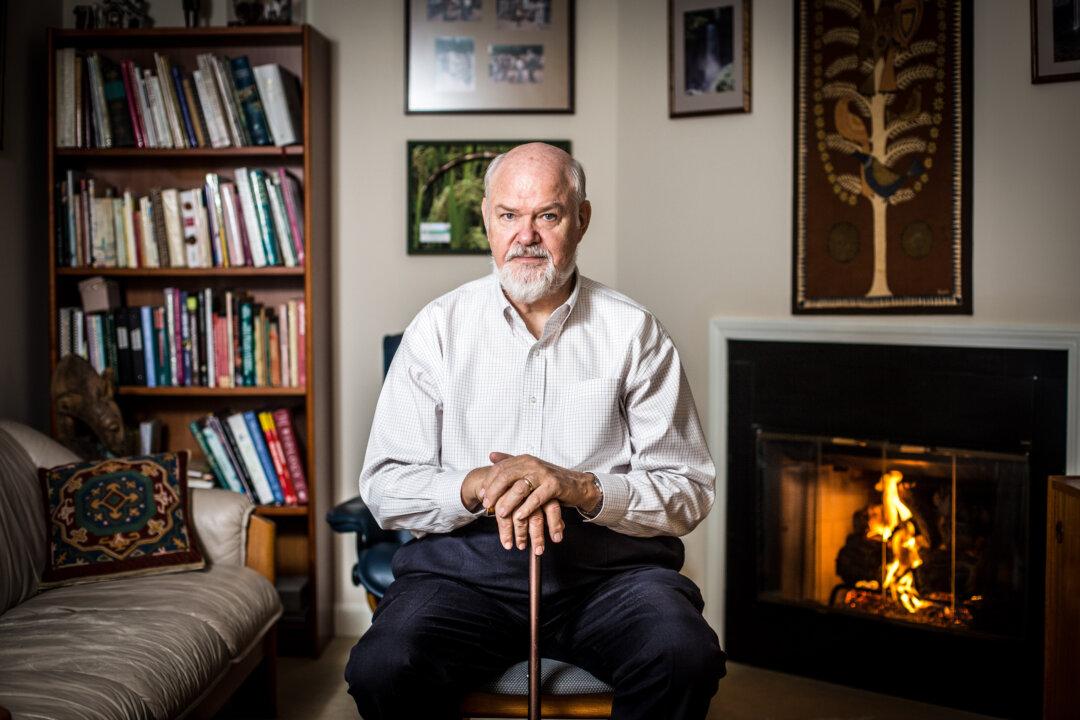

“I really believe that home ownership is part of the American dream for a lot people, and I believe that you have to start from that place, but it’s got to be sustainable. That dream can become a nightmare if it is unsustainable,” said Jared Bernstein, economic adviser to Vice President Joe Biden, and also the executive director of the Middle Class Task Force.

As the housing bubble crash of 2008 showed, “it can become a slide out of the middle class as much as a ladder into it,” Bernstein said on Thursday in a discussion with the Atlantic and National Journal.

The senior economist’s comments reflect the views of a white paper released in February outlining the government’s position on housing market reform. “Reforming America’s Housing Finance Market” was released by the Department of Treasury and HUD.

“The housing finance system must be reformed. It is the vital link to sustainable home ownership and rental options for millions of Americans, and it is central to our nation’s economy,” states the paper.

The administration’s proposal centers on gradually winding down and eliminating the Federal National Mortgage Association (Fannie Mae) and the Federal Home Loan Mortgage Corporation (Freddie Mac).

“I really believe that home ownership is part of the American dream for a lot people, and I believe that you have to start from that place, but it’s got to be sustainable. That dream can become a nightmare if it is unsustainable,” said Jared Bernstein, economic adviser to Vice President Joe Biden, and also the executive director of the Middle Class Task Force.

As the housing bubble crash of 2008 showed, “it can become a slide out of the middle class as much as a ladder into it,” Bernstein said on Thursday in a discussion with the Atlantic and National Journal.

The senior economist’s comments reflect the views of a white paper released in February outlining the government’s position on housing market reform. “Reforming America’s Housing Finance Market” was released by the Department of Treasury and HUD.

“The housing finance system must be reformed. It is the vital link to sustainable home ownership and rental options for millions of Americans, and it is central to our nation’s economy,” states the paper.

The administration’s proposal centers on gradually winding down and eliminating the Federal National Mortgage Association (Fannie Mae) and the Federal Home Loan Mortgage Corporation (Freddie Mac).