A new online platform traces the funds from companies that destroy rainforests in Southeast Asia to the banks around the world that finance them.

The need for banks to adopt socially responsible policies on the environment is a topic of increasing interest in the financial sector. The platform was released on Sept. 6, timed to dovetail with the U.N. Principles for Responsible Investment (PRI) conference in Singapore, which runs Sept. 6–8.

The growing interest in responsible investment is evidenced in the increase of PRI signatories from 100 (representing $6.5 trillion) in 2006 to 1,380 (representing $59 trillion) in 2015. Most of these signatories are in the United States (256) and Europe (696), but some are found in emerging markets, such as Brazil (57) and South Africa (52).

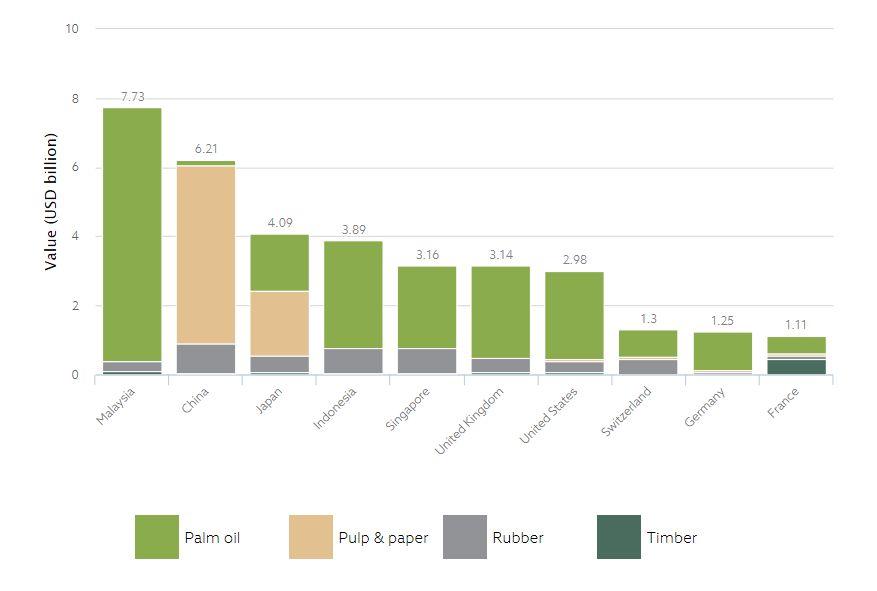

Banks in Asia are the worst offenders for financing deforestation, but U.S. and European banks also contribute to the problem, according to the research that informed the new online tool.

The tool was developed by the Rainforest Action Network (RAN), in collaboration with the nongovernmental organization TuK Indonesia and consultancy firm Profundo. It looks at investments in palm oil, pulp and paper, rubber, and timber companies known for environmental degradation and human rights abuses in Southeast Asia.

Researchers at the University of Maryland determined in 2014 that Indonesia’s rate of deforestation was the highest in the world because of these industries. A study published in August by researchers at Duke University newly identified more than 200 species as being at high risk of extinction due to deforestation in the region.